In a new weekly update for PV -MagazineOpis, a Dow Jones company, offers a quick look at the most important trends in the global PV industry.

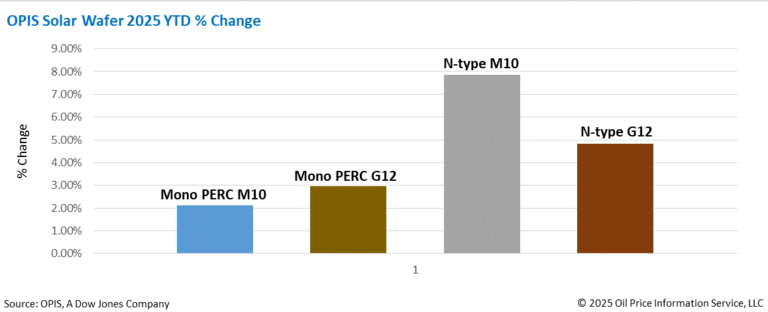

FOB China prices for G12 waffles remained stable this week, with mono Perc G12 Wafers priced at $ 0.208 per PC and N-type G12 waffles for $ 0.196/PC. M10 waffle prices, on the other hand, saw a rise, in which Mono Perc M10 waffles rises to $ 0.145/PC and N-type M10 waffles that reached $ 0.151/PC, which reflects an increase from the week to week of 0.69% and 1.34%.

The price increase of waffles is mainly powered by an increase in domestic solar installation projects in China, resulting in a limited availability of export. The increased purchasing activity, supported by two new solar energy policy to come into effect in May and June, has been extended to the wafers segment, which stimulates the wafers demand considerably. Reports indicate a temporary, light offer, in which certain celf manufacturers are actively involved with large wafer suppliers to secure the offered obligations.

Although the current price trend is expected to remain stable in the second quarter, sources from the industry warned that the implementation of the aforementioned new solar energy policy could dampen the demand for the end user to photovoltaic products in the third quarter, so that the renewed pressure on the Waferprijs is exerted.

On the product side, a market participant observed an increase in the production of Mono Perc Wafer, so that this trend was attributed to patent-related challenges that influence the production of Topcon and BC cells. These challenges have made the production of mono perc cells an alternative with a lower risk.

A company in Cambodia is said to be set up on the worldwide market to launch a 2 GW Ingot production facility in May. This facility currently has a 2 GW Wafer-Slicing factory, which, according to trade sources, depends on Ingots from China.

In the meantime, a Chinese manufacturer who has recently founded a new 3 GW-Wafer-Slicing factory in Laos is for challenges in securing customers. After the inclusion of one of his factories in China on the American non-travailability-compliant entity list in January, some customers switched to competitors to reduce the export risks for the American market.

The Indian Ministry of New and Renewable Energie (MNRE) has tightened the rules for domestic content requirement (DCR), which limits the use of imported diffuse waffles (blue waffles) in locally manufactured solar photo photovoltaic cells, according to a notification of 11 March.

Sources from the industry showed that the import of the Blue Wafer from India is mainly from overseas celf manufacturers instead of waffle producers, because diffuse waffles are considered partially manufactured solar cells. The policy is intended to reduce dependence on semi-processed imports by encouraging Indian manufacturers to invest in texture and diffusion equipment for internal cell production. However, one source warned that, although limiting the import of the uncoloured wafer can lead to increased diffuse wafer input, scaling up domestic diffusion options will take time.

Opis, a Dow Jones company, offers energy prices, news, data and analysis of gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmental products. It acquired price determination of data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content