The Regional Voluntary Carbon Market Company (RVCMC) has announced its partnership with Xpansiv, a leading provider of market infrastructure in the global energy transition. The aim is to facilitate the technological backbone for RVCMC’s upcoming carbon credit exchange in Saudi Arabia. It will start later this year.

RVCMC and Xpansiv pave the way to sustainable trade

Founded in October 2022, RVCMC was founded by the Public Investment Fund (PIF) and the Saudi Tadawul Group Holding Company. PIF has an 80% stake in the company, while Tadawul Group owns the remaining 20% stake.

With a shared vision, RVCMC is rapidly and ambitiously building a credible voluntary carbon market with global significance. Central to its mission is prioritizing high-quality carbon credits and proactive climate action.

RVCMC is at the forefront of developing an ecosystem that includes several components essential for effective climate mitigation. This ecosystem includes the following financial instruments and services:

- An investment fund dedicated to financing climate mitigation projects,

- A tailor-made exchange for carbon credit trading, and

- Advisory services focused on helping organizations navigate the complexities of decarbonization.

The decision to engage Xpansiv stems from RVCMC’s commitment to providing traders with an institutional-quality infrastructure, ensuring fast and secure transactions.

Xpansiv, known for operating CBL, the world’s largest carbon credit marketplace, will equip the new exchange with its open-access market infrastructure. This includes a fully automated same-day settlement platform and portfolio management system, both seamlessly integrated with leading global registries.

RVCMC will impose strict criteria for the exchange to list only carbon credit projects with high integrity. They are all validated by independent standard setters, strengthening the global energy transition.

Contracts will be carefully drafted to align with industry best practice, incorporating a gradual transition to carbon removal initiatives.

Driving climate action: the role of RVCMC in global carbon markets

To achieve the goals of the Paris Agreement and achieve global net-zero greenhouse gas emissions goals, emerging markets and developing countries need an annual investment of $2.4 trillion in climate action by 2030.

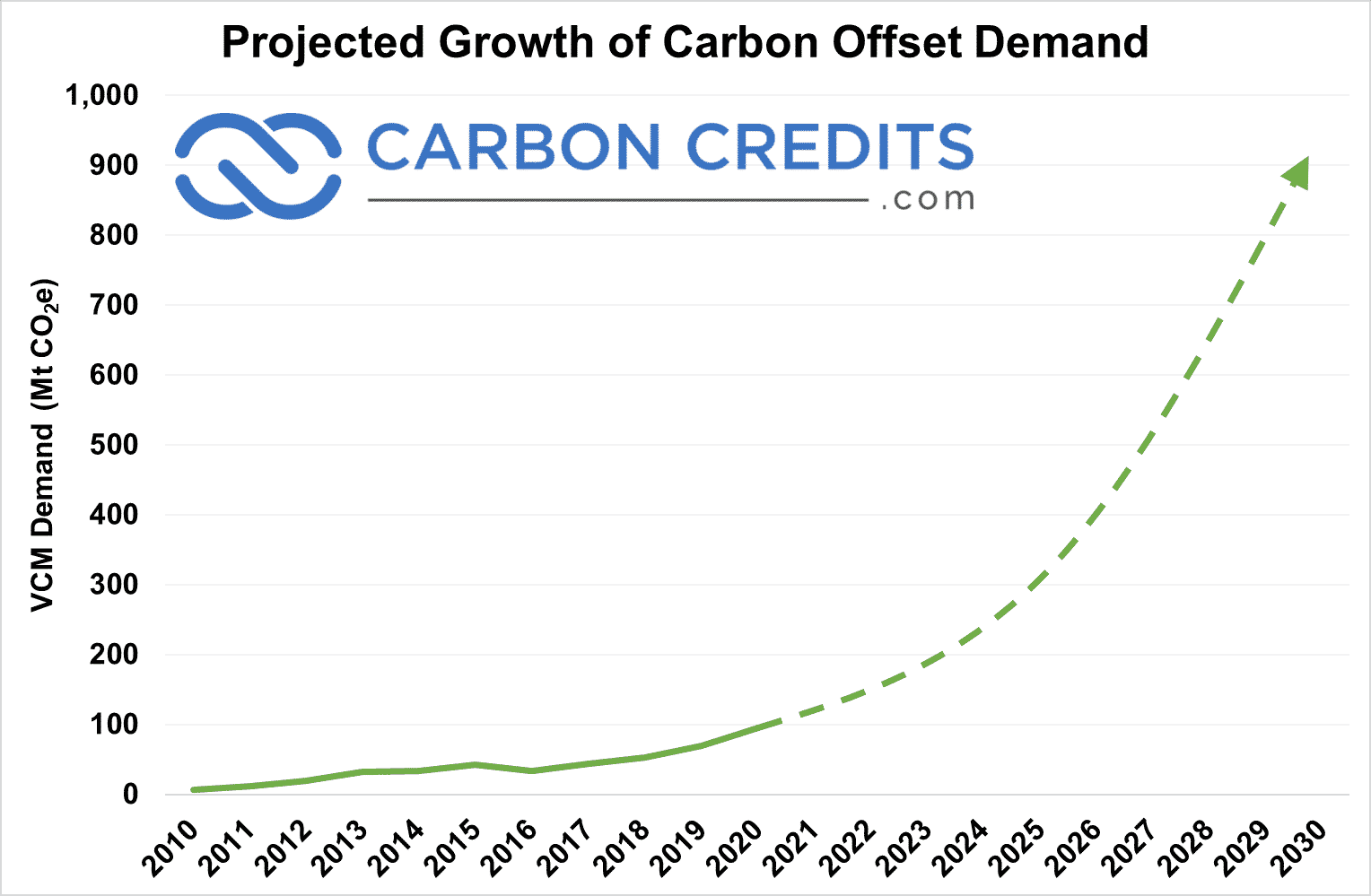

The global VCM, which is expected to reach $3 billion by the end of 2024, plays a crucial role in bridging this financing gap. Projections indicate that the market could grow to $100 billion by 2030, underscoring its importance in advancing climate mitigation efforts.

RVCMC’s previous voluntary carbon credit auctions have significantly boosted demand in the region. They saw sales of 1.4 million tons in 2022 and 2.2 million tons in 2023,

The upcoming launch of the new RVCMC exchange will help strengthen carbon credit trading in Saudi Arabia and beyond.

Such a development is in line with the Kingdom’s commitment to combating climate change, as set out in the Saudi Green Initiative and Vision 2030. This initiative aims to target climate finance to regions where it is most urgently needed. It tackles climate problems sustainably in three ways: reducing emissions, expanding forestation and protecting land and sea areas.

Riham ElGizy, CEO of RVCMC, highlighted the importance of a carbon credit trading exchange in achieving their goal of being one of the largest VCMs in the world by 2030. He further added:

“Our work with Xpansiv will help us build the infrastructure the market needs for a thriving, transparent and increasingly liquid market, one that can maximize the role of carbon offsets in tackling climate change in the Global South.”

Xpansiv CEO John Melby echoed this sentiment, saying:

“We look forward to supporting the company’s mission to develop a marketplace that will channel carbon finance at scale, which is essential to achieving the global energy transition at an accelerated pace.”

Xpansiv is leading the way in advancing the world’s energy transition through its robust market infrastructure. The company’s Platform Solutions group operates the largest spot exchange for environmental goods, including carbon credits and renewable energy certificates.

Xpansiv Registry and Energy Solutions is the leading provider of registry infrastructure for the energy, energy and environmental markets. In addition, Xpansiv Managed Solutions is also the largest independent platform for managing and selling renewable solar credits in North America.

With a shared vision of advancing high-quality carbon credits and proactive climate action, RVCMC and Xpansiv commit to advancing a transparent, liquid market that accelerates the global energy transition. As the world moves toward achieving net-zero emissions, initiatives like the RVCMC exchange play a critical role in mobilizing investments and driving impactful climate mitigation efforts.