In a new weekly update for PV -MagazineOpis, a Dow Jones company, offers a quick look at the most important trends in the global PV industry.

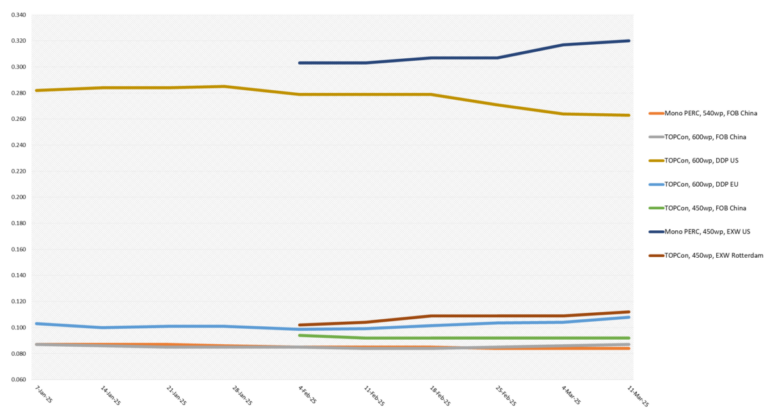

China: The Chinese Modulemmarker (CMM), the OPIS Benchmark Assessment for Topcon 600 W modules from China, Reden 1.16% to $ 0.087/W free-on-board (FOB) China, with higher price indications between $ 0.082 and $ 0.090/W. FOB China Mono Perc -module prices remained stable at $ 0.085/W with indications between $ 0.081 and $ 0.088/W.

Q2 2025 Loads rose 1.16% to $ 0.087/W, with higher values between $ 0.082 and $ 0.090/W, while the second half of 2025 charging prices were stabel at $ 0.086/W, with indications between $ 0.085 and $ 0.090. Q1 2026 Prices decreased 1.15% to $ 0.086/W, amidst weaker indications from $ 0.082 to $ 0.090/W, while modules for the second quarter 2026 were rated at $ 0.085/W.

FOB China Topcon 450 W modules for spot load were rated stably at $ 0.092/W, with price indications between $ 0.086 and $ 0.100/W.

The recent increase in module prices is powered by the expectations of an installation that is brought to the first half of the second quarter of 2025, after two important changes announced in the sun policy by the National Development and Reform Commission (NDRC). The first policy, with effect from 30 April, requires that industrial and commercial users give priority to self -consumption of their generated electricity, whereby some surplus was introduced in the grid but not complete. The second policy, with effect from 1 June, is obliged that new solar projects on the market are adopted on the market on the market, while existing and current projects will retain their guaranteed rates.

Sources from the industry suggest that this policy can have a greater impact on distributed PV projects, instead of large-scale solar developments, due to the strict implementation period lines.

Europe: DDP Europe Topcon 600 W -module prices rose by 1% on the week to € 0.100 ($ 0.11)/W, with indications between a low point of € 0.095/W and a high of € 0.108/W for level 1 panels.

EXW Rotterdam (Western Europe) Topcon 450W module prices, on the other hand, fell by 0.96% and were reported at the average price of € 0.103/W with indications between a low point of € 0.095/W and a high point of € 0.110/W for level 1 panels.

According to buyers sources, some manufacturers have increased the prices, while others have kept stable. Trade sources told OPIs that large developers with large volumes and framework agreements were the least influenced by the last price increase, while buyers with smaller volumes were left against the steepest increase. “Large portfolio developers also have more flexibility in accepting a delay of a few months in the deliveries module. FOB April prices, for example, are drastically higher than FOB June prices, “said a trader.

Meanwhile, sector Federation Solarpower Europe has launched the “International Solar Manufacturing Initiative” (ISMI), supported by eight EU -Zonne -Zonne manufacturers. ISMI tries to expand the global demand for European solar products and at the same time revitalize the production base of EU production of the EU. In contrast to the Net-Zero Industry Act (NZIA), which promotes EU-made PV materials for regional installations, ISMI uses an external approach, causing their consumption to be encouraged in international markets.

United States: The spot price for Topcon 600 W Modules DDP US was rated this week at $ 0.263/W, with 0.38% compared to last week, while the spot price for Mono Perc 450 W -modules Exw increased by 0.63% to $ 0.319/W.

On a future-oriented basis, OPIS assesses the costs of Topcon modules in the first quarter of 2026 at $ 0.276/W, and Mono Perc modules in the same period at $ 0.266/W.

Market sources remain prices for Utility -scale Topcon -Modules DDP US from Laos and Indonesia between $ 0.21 and $ 0.24/w. According to buyers sources, Mono Perc modules have been assembled in the US with imported cells currently priced between the high $ 0.20s/W and low $ 0.30s/W, while a distributor source quoted a quotation of $ 0.27/W for mono perc-modules assembled by the US.

Opis, a Dow Jones company, offers energy prices, news, data and analysis of gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmental products. It acquired price determination of data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content