The carbon offset credit market is currently facing a resurgence of criticism as more than 80 nonprofits come together to oppose their use in climate strategies. These activists argue that carbon offsets undermine real efforts to reduce greenhouse gas emissions and are calling for their complete exclusion from climate regulations and guidelines.

Carbon credits, also called offsets, have been used as a tool to reduce carbon dioxide emissions by allowing companies and governments to invest in projects that supposedly reduce or remove emissions elsewhere. This practice gained traction as part of efforts to reach net-zero emissions targets.

Through this mechanism, entities can offset their emissions by financing projects such as reforestation or renewable energy initiatives.

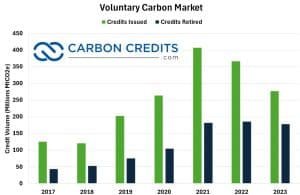

In 2023, the total volume of carbon offsets used (stopped) by entities to offset their carbon emissions was approximately 180 million MtCO2e.

However, critics argue that carbon offsets do not contribute to real emissions reductions. Instead, they argue that offsets allow industries and countries with high emissions to continue polluting while outsourcing the responsibility for emissions reductions to other regions or sectors.

This approach, they argue, undermines the urgency and effectiveness of direct emissions reductions needed to combat climate change.

Joint statement against carbon offsets

In a significant collective effort, leading organizations including CustomerEarth, ShareAction, Oxfam, Amnesty InternationalAnd Green Peace have issued a joint statement condemning carbon offsets. They argue that relying on offsets distracts from the critical need to curb emissions at source. They further claimed that it is failing to mobilize sufficient financial resources for climate action, especially in developing countries.

The statement emphasizes that voluntary and regulatory frameworks for climate transition planning must exclude offsets. It challenges the idea that offsets can serve as a substitute for real emissions reductions.

Controversies and challenges

The debate on carbon offsets has intensified amid efforts to revive and normalize their use within climate finance frameworks.

Recently, a controversial move by the Science Based Targets initiative (SBTi) to endorse the use of credits to offset supply chain emissions has drawn criticism. Critics argue that such endorsements undermine the credibility of emissions reduction targets by allowing companies to offset their largest sources of emissions rather than eliminating them.

In addition, concerns remain about the reliability and accountability of carbon credits. Some studies have revealed significant quality problems, including exaggerated claims about the environmental benefits of offset projects.

Government and institutional responses

Despite the criticism, some governments, including the United States, have supported the integration of carbon credits into climate finance strategies. The federal government recently approved the use of these credits as a legitimate tool for achieving climate goals. This move signals a difference in global perspectives on their role in emissions reduction strategies.

Additionally, leading environmental organizations such as Conservation International, the Environmental Defense Fund, and the Nature Conservancy have supported the SBTi’s proposal to expand the use of carbon credits.

These organizations argue that well-regulated and transparent carbon markets can play a complementary role in financing emissions reduction projects, especially in sectors and regions where direct reductions are difficult or costly to achieve.

Criticism of the effectiveness of carbon credits

Critics argue that carbon offset credits send misleading signals about the true costs and efforts required for effective climate action. In addition, there are concerns that reliance on carbon credits could discourage investments in transformative technologies and infrastructure needed for sustainable development.

They specifically noted that:

“Carbon credits send a misleading signal about the efforts needed to pursue climate action, and they undermine carbon prices by misrepresenting the existence of ultra-cheap reduction options around the world.”

What the data shows about the use of carbon offsets

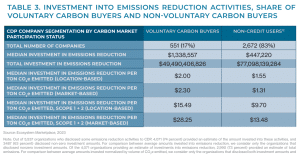

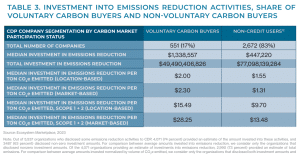

On the other side of the debate, industry reports show that companies, especially large ones, that use carbon credits to offset their carbon footprint are likely to achieve more in reducing their emissions.

As shown below, data from the research from Ecosystem Marketplacethe use of voluntary carbon credits (offsets) has achieved these results:

- Companies in the voluntary carbon market are 1.8x It is more likely that we will be actively decarbonizing the economy year after year.

- They are 1.3x are more likely to have supplier engagement strategies that involve employees and customers in climate action.

- The average voluntary credit buyer invests 3x increase efforts to reduce emissions across their value chain, including the consumption of renewable energy and RECs.

- Voluntary carbon buyers are 3.4x It is more likely that they have adopted science-based climate targets.

- They are 1.2x They are more likely to have oversight of their climate transition plans.

- Companies in this market are 3x They are more likely to include Scope 3 emissions in their climate targets, despite the challenges associated with controlling these emissions.

The debate around carbon offset credits underlines broader challenges in global climate policy and the financial sector.

While critics argue that offset mechanisms divert attention and resources from vital emissions reduction efforts, proponents argue that well-regulated carbon markets can mobilize capital for climate projects and facilitate emissions reductions.