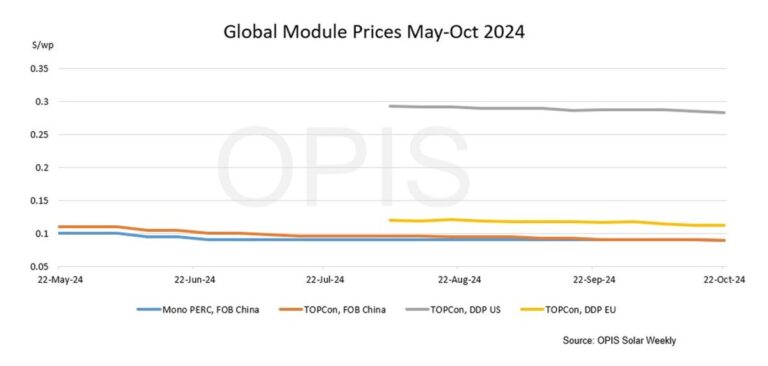

In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

The Chinese Module Marker (CMM), the OPIS benchmark rating for TOPCon modules from China, fell to $0.089/W Free-On-Board (FOB) China, amid weaker indications between $0.085 and $0.099/W FOB. Tier 1 manufacturers are currently filling orders for the first quarter of 2025, with some suppliers offering aggressive pricing for next year, according to a Southeast Asian buyer. Another market source noted that spot indications have also weakened as manufacturers try to clear inventories before the end of this year.

According to market sources, TOPCon modules for delivery in Q4 2024 in Southeast Asia would cost around $0.090/W on a cost, insurance and freight (CIF) basis. Meanwhile, TOPCon modules for delivery in the first half of 2025 were slightly discounted, to a high of $0.080/W CIF Southeast Asia.

In the Chinese domestic market, TOPCon module prices fell as market indications pushed prices down 2.19% week-on-week to CNY0.716 ($0.10)/W. Similarly, prices for mono-PERC modules decreased by 2.25% to CNY 0.694/W. The weaker sentiment is mainly attributed to bearish prices from large-scale tenders, which have put pressure on spot prices in the domestic market.

The China Photovoltaic Industry Association (CPIA) recently released its October cost estimate for photovoltaic modules, setting the production cost for N-type M10 bifacial modules, including tax, at CNY 0.68/W. The move is aimed at curbing below-cost bidding, which has hit the sector.

In Europe, TOPCon module prices remained stable week after week. OPIS estimated the average price at €0.103 ($0.11)/W, with indications ranging between a low of €0.085/W and a high of €0.120/W.

TOPCon panel prices for European imports have fallen by an average of €0.01/W this month as many suppliers continue to devalue their inventories to boost sales, sources said. Market watchers also reported continued flat demand in the housing sector, complex authorization processes and uncertainty about longer-term economic conditions. Brokers estimate current inventory levels in Western Europe at around 20 GW.

According to numerous buy-side sources, the US market is quiet. As November approaches, most customers are looking toward their 2025 needs and awaiting the results of the US presidential election in early November and the AD/CVD survey in late November.

Earlier this year, prices were expected to rise now that AD/CVD research is running at full speed, but oversupply and supplies subject to the December utilization deadline continue to have a dampening effect in the short term. One source said a supplier that owns tens of MWs of modules is floating prices between $0.18/W and $0.24/W.

A source that produces modules in both the US and Southeast Asia is offering TOPCon modules DDP US for approximately $0.25/W “plus or minus 10%” for all of 2025, regardless of where they are assembled. The US modules would use cells produced in Asia and therefore have a negligible percentage of domestic content. The source said: “The market doesn’t let us differentiate (between origins)… so right now we just want to make deals.” “It’s a tough environment,” she added.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content