In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

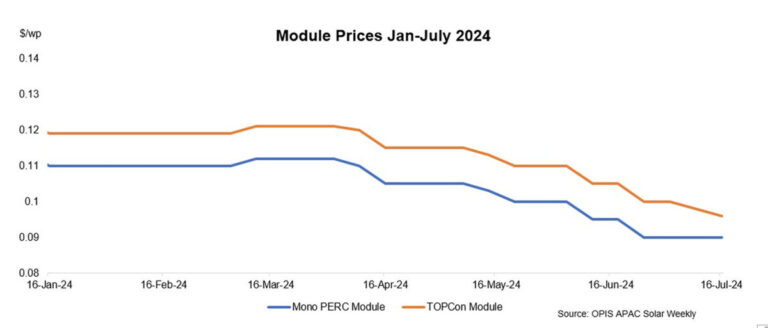

Prices on the module market were rated stable to soft for the second week in a row. The Chinese Module Marker (CMM), the OPIS benchmark rating for TOPCon modules from China, was assessed at $0.096/W, down from $0.002/W due to the discussions heard, while prices for Mono PERC modules remained stable were assessed at $0.090/W versus the previous week.

The TOPCon market was quite ‘chaotic’ during the week through Tuesday, with prices in a wide range. Some Tier 1 module manufacturers continued to offer loads at $0.100/W FOB China, while lower offers from Tier 2 and Tier 3 module sellers had appeared at $0.085/W FOB China. These low prices ‘disrupted’ the market and gave the wrong impression that regular TOPCon prices had fallen so low quickly in a short time, a market source said.

Market participants surveyed by OPIS expected further declines in TOPCon prices in the coming weeks as module manufacturers compete to win new orders and clear inventories. Although module makers are already burning cash and there is a limit to how much lower prices can fall, Tier 1 players are in a better cash flow situation compared to the smaller players in the market. However, several major players have already announced losses in the first half of the year and if this vicious cycle of non-stop price war continues, the industry will see market consolidation very soon, an industry source said.

Business has slowed significantly as buyers requested smaller freight volumes than before, and sales performance was dismal this quarter, a module seller said. Sales forecasts for the third quarter were also bearish as module prices were expected to fall further with no market recovery in sight, the seller added.

The spread between TOPCon and Mono PERC prices is starting to narrow. Not surprisingly, Mono PERC prices are slightly lower or comparable to TOPCon prices, as module manufacturers sell based on their Mono PERC inventory levels, a market source said. OPIS heard the majority of discussions on Mono PERC at $0.090/W FOB China, although a few vendors held offers at $0.093-0.095/W FOB China.

In the Chinese market, the Ministry of Industry and Information Technology (MIIT) has published proposals to solicit public opinion on the “Regulatory Conditions for the Photovoltaic Manufacturing Industry (2024 Edition)” and “Administrative Measures for the Announcement of the Photovoltaic Manufacturing Industry industry (2024 edition)” on July 9.

One of the proposals was to increase the minimum capital ratio for new construction and expansion of photovoltaic production projects to 30%, compared to 20% previously for the production of wafers, cells and modules. One of the other proposals is for MIIT to guide photovoltaic companies in reducing photovoltaic production projects that simply increase production capacity.

A market veteran OPIS spoke to expressed skepticism that such measures would limit production expansions and restore the balance between supply and demand in the Chinese market, as capacity expansion plans are announced almost every day. Any positive impact from these measures would take at least two to three quarters from the implementation date before improvements would be visible, the veteran added.

OPIS rated the forward pricing curve for U.S.-delivered, duty-paid (DDP) mono-PERC modules lower this week, indicating softer market values. Prices for PERC modules scheduled for delivery in the fourth quarter averaged $0.291/W, ranging from $0.240-0.365/W on a DDP US basis, while prices for 2025 delivery averaged $0.315-0.319/W, ranging between $0.270/W and $0.365/W DDP US.

One producer noted that demand has weakened due to uncertainty surrounding U.S. tariff policy, while more competitively priced freights are emerging from Southeast Asian countries such as Indonesia and Laos. The potential tariffs are expected to impact delivery schedules, and freight volatility remains a concern for buyers. Trade sources said TOPCon modules for spot loading from Indonesia and Laos cost $0.24/W to $0.28/W on a DDP US basis.

In response to potential tariff complications, there has been an increase in shipments of Indian modules to the US as buyers are cautious about purchasing from Southeast Asia. According to an industry source, module shipments from India to the US reached about 1 GW in May, accounting for about 20% of US module imports. The source noted that India previously represented a smaller share of US module imports before May. Moreover, the source reported a 10-15% decline in imports of modules from Southeast Asia in May compared to March and April.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content