In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

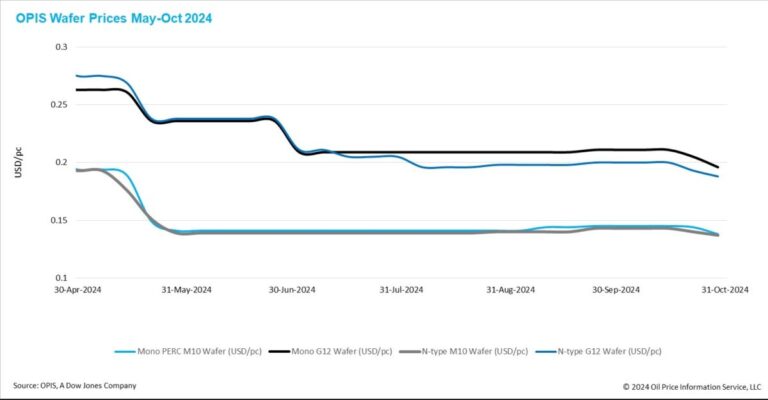

Waffle prices in FOB China fell across the board for the second week in a row. Prices for Mono PERC M10 and n-type M10 wafers were reported at $0.138/pc and $0.137/pc, representing a weekly decline of 4.17% and 2.14% respectively. Similarly, prices for Mono PERC G12 and n-type G12 wafers fell to $0.196/pc and $0.188/pc, representing a decline of 4.39% and 2.59% compared to the previous week.

Tier-1 wafer manufacturers have been advocating and leading price increases over the past two months despite challenging market conditions, with some success. However, due to recent market developments, they have gradually lost control over price developments.

Slow downstream demand – particularly declining demand for 182mm and 183mm wafers – has resulted in a recovery in total wafer inventory, which now reaches 4 to 5 billion units, or about 35-40 GW. This increase indicates that the cycle of clearing excess inventories in the wafer market has extended again, prolonging the challenging conditions in this segment.

In response, major manufacturers have initiated price cuts and inventory sales in an urgent attempt to recoup money. Sources report that some n-type M10 wafers are now available on the market for as low as CNY 1/pc ($0.124/pc), indicating a likely downward trend in wafer prices in the near future.

In the fourth quarter, wafer makers are expected to face significant pressure, controlling costs through wage cuts and layoffs while reducing inventories by cutting business rates and lowering prices. A Tier-1 wafer producer, previously known for maintaining high operating rates as a core strategy, has reportedly cut its rate to below 40%, with expectations of this dropping further to 30% in November – making it even falls below some Tier 2 manufacturers.

Sources indicate that most wafer companies are likely to see their corporate rates fall to an average of around 30% this quarter. Additionally, wafer producers have received negative attention recently due to sharp production declines. Public records show multiple lawsuits were filed in October alone over labor disputes and compensation issues within the industry.

The US market, on the other hand, has seen favorable policy developments for local solar energy production. Last week, the U.S. Treasury Department clarified that solar ingots and wafers qualify as semiconductor manufacturing, making them eligible for the 25% Advanced Manufacturing Investment Credit. Sources suggest this credit could be combined with other incentives, including tax credits from the Inflation Reduction Act.

In addition, the Treasury Department released final regulations for the 45X Advanced Manufacturing Production Tax Credit, which will allow manufacturers to claim deductions based on annual sales of eligible products. With a set rate of $12/m2 for wafers – which requires the use of US-made billets to qualify – industry insiders see this as a crucial measure to support investment security for new projects in the US.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content