In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

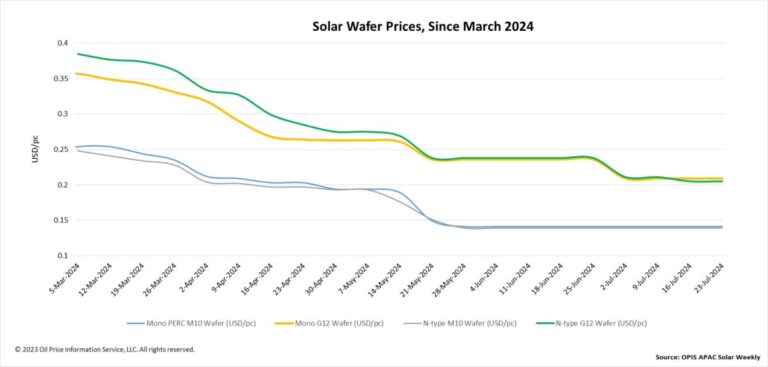

FOB Chinese waffle prices have remained stable across the board this week. Prices for mono PERC M10 and n-type M10 wafers remained stable at $0.141/pc and $0.139/pc, respectively. Similarly, prices for Mono PERC G12 and nN-type G12 wafers remained unchanged at $0.209/pc and 0.205/pc, respectively, compared to the previous week.

Although there are reports that n-type M10 wafer prices could increase due to the switch in China’s domestic wafer production lines from fully square 182mm x 182mm wafers to 182mm x 183.75mm rectangular wafers and 182mm x 210mm, the actual transaction prices have remained unchanged apart from increased offers from a few companies.

“Given the sluggish demand in the downstream and the losses incurred by downstream companies, it is impossible to expect them to accept increases in upstream material costs,” said a market source.

In contrast, prices of 210mm n-type wafer sets, including the 210mm x 210mm full square wafers and 182mm x 210mm rectangular wafers, have fallen twice in the past month, according to OPIS data. Industry insiders attribute this to a shift in production capacity from the 182mm set to the 210mm set, leading to increased inventory of the latter.

“As market share grows beyond a certain size, inventory rises and prices fall, which is what the 210mm wafer set is currently experiencing,” said one market observer.

According to OPIS market research, the majority of wafer production rates in the Chinese domestic market are at 50% or lower, with the exception of a Tier-1 wafer producer and one large specialty wafer producer that maintains a production rate of more than 90%.

“Some integrated manufacturers who have stopped internal wafer production due to low market prices are now sourcing most of their waffles from these two producers,” said an industry participant.

A leading Chinese wafer manufacturer announced last week that it will set up a 20 GW ingot and wafer capacity in Saudi Arabia. According to an insider, construction is expected to begin this year, with completion and operations planned for 2026.

High gross margins on U.S. module prices are currently the only significant source of potential profitability for supply chain manufacturers, according to a market veteran. He notes that this wafer project is expected to target the US market in the future, potentially sourcing polysilicon from the three existing companies. global polysilicon suppliers, the polysilicon factories in Oman and the UAE that have yet to produce, and Chinese regions that meet traceability standards.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content