In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

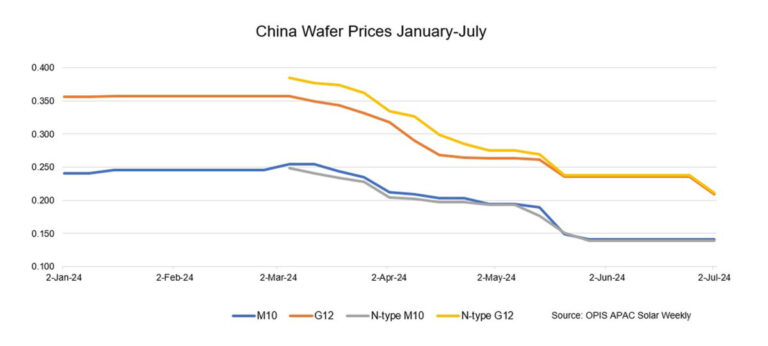

FOB China prices for M10 wafers have remained stable for the fifth week in a row. Prices for mono PERC M10 and n-type M10 wafers remained constant at $0.141 per unit (pc) and $0.139/pc, respectively.

FOB China prices for G12 wafers have fallen further this week. Prices for Mono PERC G12 and N-type G12 wafers fell to $0.209/pc and $0.211/pc respectively, representing a week-on-week decline of 11.44% and 11.34% compared to the previous week.

According to a wafer manufacturer that continues to maintain a high operating rate of 90%, cash flow and cost management – which here includes the company’s management and marketing costs in addition to production costs – are critical determinants of the viability of upstream polysilicon and wafers. businesses.

Industry insiders widely acknowledge that China’s waffle market has reached saturation, with the next phase requiring a wait for excess production capacity to disappear. On the contrary, the establishment and growth of wafer production capacity outside China is progressing vigorously.

A Chinese manufacturer promoting a waffle production project in the Middle East plans to start production within two years, with an initial focus on meeting local demand, a company source said. Their secondary goal is to penetrate the US market, with plans to target the European market should entry into the US market prove challenging, the source added.

In addition, a European manufacturer, which halted wafer production last year, recently announced plans to build a 5 GW ingot and wafer plant in the US. Construction will begin in late 2024, pending final approvals, according to a source familiar with the matter. necessary permits and incentive agreements. Production of blocks and wafers is expected to begin in 2026.

“We also plan to bring wafer production back to Europe, provided there are sufficient attractive policy frameworks to support the solar industry,” the source added. He further noted that the company is actively lobbying European policymakers to recognize the strategic importance of developing a solar energy value chain, and advocating for the implementation of appropriate incentives and protective measures.

In terms of product technology, the current solar energy market is booming, impacting the operations and performance of wafer manufacturers. A major wafer manufacturer noted that the cost of wafers delivered to heterojunction (HJT) cell customers may be slightly higher compared to the cost used in other technology-driven cells.

The solar market has transitioned from an era driven primarily by advances in wafer technology to one in which cell technology plays a central role, according to a source from an HJT cell maker.

Popular content

One market observer agrees with this view, but believes that future technology trends will in turn have a significant impact on wafer makers. The industry is currently evaluating several technologies, including back contact (BC), tunnel oxide passivating contacts (TOPCon), HJT and perovskite, to determine which will become prominent. One wafer manufacturer is clearly focused on BC technology, having recently acquired a specialist company in BC technology, while another is focusing on larger wafer sizes. The question remains whether the market for larger modules, which are mainly used in utility-scale projects, will perform well this year.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.