Developers continued to take advantage of the Inflation Reduction Act in the second quarter by adding large-scale solar projects in the United States at a record pace.

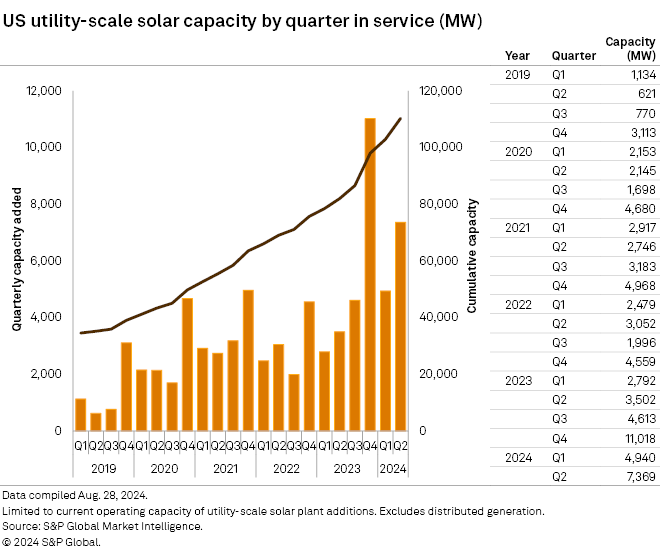

7,369 MW of solar power was installed in the quarter, up 49% from the first quarter, according to data from S&P Global Market Intelligence. U.S. installed solar capacity has grown 34% since the second quarter of 2023, with more than 110,000 MW of projects now in operation.

Developers plan to add more than 40,292 MW of solar this year, with 3,727 MW announced, 14,548 MW in early development, 1,473 MW in advanced development and 20,543 MW under construction. According to data from Market Intelligence, nearly 233,000 MW of additional solar capacity is under development in the US through 2028.

However, licensing and interconnection issues remain obstacles for projects.

“There is a situation in America where solar energy, all renewable energy, but especially solar energy is difficult to develop, especially small solar fields are even more difficult. You need economies of scale,” Nick Cohen, CEO of Doral Renewables, told S&P Global Commodity Insights. Cohen added that due to the slow interconnections, “a lot of projects are being built… at the same time, demand has never been higher… so you have a situation where there is not enough supply and demand is skyrocketing.”

Doral Renewables has 1,300 MW of solar under construction in the US at a multi-phase project in Indiana. Cohen added that tariffs have also created uncertainty, delays and price escalations.

“There’s a lot of cost escalation happening because of the geopolitical tensions,” Cohen said. “We are seeing higher prices for power purchase agreements. And ultimately that ends up on the taxpayer.”

As a result, energy prices are rising and there has been a consolidation of developers, he said. Cohen added that the tariffs forced Doral Renewables, which focuses development on agricultural land, to switch to less efficient panels that require more land.

Woody Rubin, chief development officer of AES Corp.’s U.S. renewable energy business, told S&P Global Commodity Insights that managing the supply chain is a competitive advantage.

“We have virtually all of our major equipment in the country for projects coming online this year and expect to have most of the solar panels we need through 2026 before tariffs could potentially apply,” Rubin said. “We have weathered these currents of uncertainty before, by adapting our supply chain, and we are finding ways to meet our commitments to our projects and our customers.”

As the U.S. continues to add more solar energy, according to a report from consulting firm McKinsey & Co. An additional 61 GW is needed to achieve its objectives.

“However, the nature of solar installations is such that the pipelines can indeed emerge in time,” McKinsey added.

The ten largest projects completed in the second quarter of 2024 had a total added value of 3,062 MW; seven of the projects are in Texas.

Hecate Energy and its investor, Spanish oil company Repsol SA, completed two projects: the 570 MW Hecate Energy Frye Solar Project in Texas and the 400 MW Highland Solar Farm in Ohio. Amazon.com Inc. has contracted for the majority of the Frye plant’s production.

Ørsted A/S, better known as an offshore wind energy developer, completed two solar projects in the second quarter: the 300 MW Eleven Mile Solar Center in Arizona and the 250 MW Sparta Solar Plant (Helena Energy Center) in Texas. Ørsted has secured $680 million in tax financing from JP Morgan for these two solar-plus-storage projects. Meta Platforms Inc. will purchase the production of the Eleven Mile Solar Center.

The two projects announced in the second quarter would add just over 200 MW of additional capacity.

According to Market Intelligence data, there are more than 300 projects in advanced development or under construction, with the largest number in Texas.

Market Intelligence considers a project to be under construction when construction activity has begun; Site preparation is not eligible. Projects in advanced development must meet two of five criteria: financing is in place; power purchase agreements are signed; equipment is secured; required permits have been approved; or a contractor has joined the project. A project is in early development after permitting has begun. An announced project must be included in an interconnection queue with an accompanying public announcement or permit action.

News item from S&P Global