In a new weekly update for PV magazineOpis, a Dow Jones company, gives a brief overview of the most important price trends in the global PV industry.

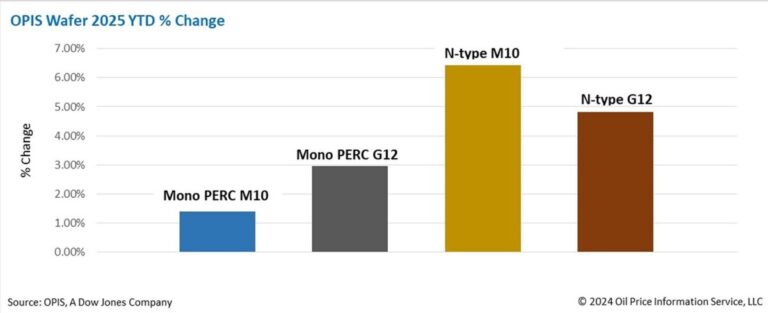

The prices for Mono Perc waffles in China remained stable this week, with the prices for Mono Perc M10 and G12 waffles respectively $ 0.144 each and $ 0.208/piece amounted to. In the meantime, the FOB China prices for N-type M10 and G12 waffles had a slight increase and reached $ 0.149/PC and $ 0.196/PC respectively, which reflects a growth of 2.05% and 1.55% compared to the previous week .

Since the beginning of 2025, the prices of N-Type Wafers have risen for three consecutive weeks as a result of production omissions and lower stock levels. Large -scale production cuts by wafer companies Since the third quarter of 2024, the market stock has effectively reduced to approximately two weeks of production, considerably lower than the stock levels of polysilicium and modules.

These developments have led to wafer companies to have increased their company rates since the beginning of January, with the general average now being above 50%. As a result, the production of waffles is expected to be around 46 GW in January, an increase of 5.5% compared to the 43.61 GW in October 2024.

The sustainability of the price increase for Wafers depends on a possible revival of transaction prices for solar cells, participants from the sector notice. They also warn that the operational speed of Wafers will be crucial in the coming weeks. A significant increase in company rates as a result of higher prices could cause the risk that prices will fall after the Chinese New Year, because the current enormous production capacity can quickly drive the stock levels back to high levels.

Another recent trend on the Chinese market is the slow sale of rectangular G12R waffles (182 mm x 210 mm), causing the prices to fall. Sources attribute this to the rapid performance of this size in both the upstream and the downstream segments, which surpasses their adoption by end users. As a result, an oversupply of this specification has developed before it could gain popularity as a mainstream product.

Last week, the US Department of Interior Security expanded its prohibition list of entities based in China with four bar and waf manufacturers, including a subsidiary of a prominent manufacturer of integrated solar energy. The action was taken because it was established that these entities involve polysilicon from regions in China that do not meet the traceability requirements.

Insiders are generally convinced that this American decision will in theory support the increased demand for global polys silicon, although its impact has not yet been fully realized. It is also expected that this will further hinder the export of Chinese Wafers and the modules derived from these wafer suppliers to the US. Now that these manufacturers are excluded from the American export market, reduced competition can stabilize or even increase prices for wafers and modules in the US. is in line with earlier market expectations and reflects the strategic intention of the US to implement energy -related policy aimed at minimizing dependence on components related to China.

This week, the US Department of Finance has updated the SAFE Harbor tables and introduced new standard cost percentages for components to take into account the premium customers who will pay for waffles made in the US, with the aim of stimulating the domestic production of waffles. The bonus is seen as a “direct addition” to the 45X Advanced Manufacturing Production Tax Credit. Although the inclusion of wafers in the guideline is considered considerable, players from the sector remain sector about their impact on purchasing activities or plans for the production of Wafers in the US.

Opis, a Dow Jones company, offers energy prices, news, data and analyzes about gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly raw materials. It acquired assets in 2022 with price data from Singapore Solar Exchange and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author PV magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content