JinkoSolar has begun converting its production to n-type tunnel oxide passivated contact products (TOPCon) to stay competitive, says Frank Niendorf, the company’s general manager for Europe. He predicts that several market players in the value chain will soon exit the market.

The installation market for private PV roof systems in Germany is currently undergoing consolidation, with a global market shock due to the threat of overcapacity. Frank Niendorf, general manager Europe at JinkoSolar, said this shakeout will impact the solar industry, especially second-tier manufacturers, and could trigger shifts among major Chinese photovoltaic manufacturers.

“The consolidation is unlikely to spare second-tier manufacturers and will also lead to shifts among the very large photovoltaic manufacturers from China,” Niendorf said in a recent interview with pv magazine.

The industry is competing for sales markets, with module prices falling below production costs in some segments, Niendorf said. This price pressure is reflected in the financial reports of module manufacturers. JinkoSolar, the last major Chinese photovoltaic manufacturer still listed on the Nasdaq stock exchange, recently reported positive quarterly results for the first quarter of 2024.

JinkoSolar’s balance sheet shows that sales of solar panels, cells and wafers increased by more than 50% to almost 22 GW, although revenue was down 1.2% year-on-year at $3.19 billion. The company still managed to post a net profit of $84.4 million.

This performance positions JinkoSolar better than many of its domestic competitors, which are no longer listed on the Nasdaq and publish their financial forecasts on the Chinese stock exchanges. Recent figures from other major PV manufacturers indicate heavy losses. Longi Solar, for example, expects a net loss of at least $660.2 million for the first half of this year – a significant decline from last year’s profit due to falling prices and inventory write-downs. Similarly, JA Solar expects a loss of up to $166 million in the first half of the year, attributing this to increased competition and continued price declines.

“Companies with less than 100 gigawatts of vertically integrated PV capacity have little chance”

Many medium and smaller PV manufacturers in China are currently facing intense competitive pressure. Niendorf said companies with less than 100 GW of vertically integrated PV capacity have little chance of surviving in the market. He noted that global production capacity is about 1.3 TW, while demand is only about 500 GW to 600 GW. He said he did not expect the market to match production capabilities anytime soon, especially as many manufacturers continue to expand. He predicted that “consolidation will come.”

Niendorf also noted that JinkoSolar management has long recognized the shift from passivated emitter and back contact (PERC) to TOPCon technology. The company has largely completed the transition to n-type TOPCon products, saving it the burden of converting production lines in the current market situation.

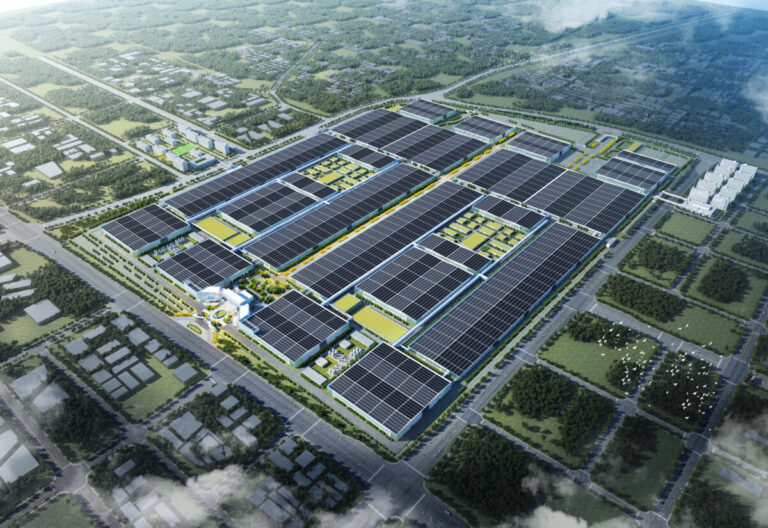

According to Niendorf, JinkoSolar expects to sell 100 GW to 110 GW of products this year – mainly solar panels, but also cells and wafers. It is expected that almost 90% of this turnover will consist of n-type solar panels. By the end of the year, JinkoSolar aims to have a production capacity of 120 GW for wafers, 110 GW for solar cells and 130 GW for solar panels. The company also targeted an efficiency of 26.5% for its n-type solar cells in mass production.

JinkoSolar continues to develop PV technology despite challenging times, while also exploring new business areas. The company sees energy storage as an important opportunity. Last year it introduced a home storage system at Intersolar Europe and this year expanded its offering to include storage solutions for commercial and large-scale systems.

“Storage is the next big thing now,” says Niendorf. He expects that the storage sector has the potential to become as big as the module sector in the long term. In any case, it will be a new important pillar for JinkoSolar.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.