Martin Schachinger, founder of pvXchange.com, says November’s 8% price drop for solar panels could mark the end of ongoing declines as market signals point to a possible recovery.

The sharp drop in solar panel prices in November could mark the end of the ongoing decline as the market shows signs of recovery.

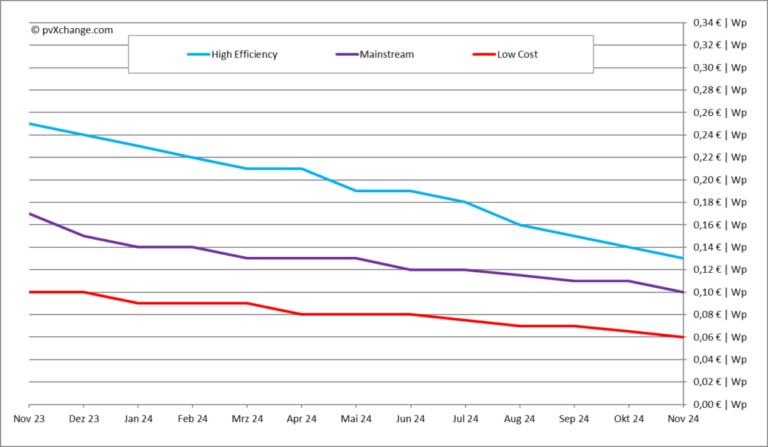

Prices fell by an average of 8% across all technologies, putting pressure on margins even on recently purchased modules. This decline was due to subdued demand, year-end stock clearance campaigns and distress sales due to insolvency.

Some modules are now selling for less than $0.06/W, but experts warn against low-quality and no-name products, citing operational risks and unreliable warranties from second- and third-tier Chinese manufacturers.

The downward trend appears to be reversing. China’s export tax credit on solar panels, long set at 13%, fell to 9% on December 1, causing exporters’ costs to rise 4%. This change could increase module prices by $0.03/W to $0.05/W.

More importantly, manufacturers are cutting production to create an artificial supply shortage. Capacity cuts in China, reduced exports and factory closures over the winter aim to restore profitability. This strategy, if effective, could transform the market into a seller’s market where suppliers dictate prices.

How quickly this strategy succeeds depends on the size of the existing stock in Europe. An adequate supply could limit the impact of production cuts, especially for regular modules. Premium products, such as high-efficiency bifacial glass-glass modules, may experience sharper price increases, widening the gap between mainstream and high-efficiency offerings. Budget modules may still be available at bargain prices.

Market players are trading cautiously, with some cancellations reversed for excess goods and securing supplies. Projects with solid pipelines hedge against future shortages by purchasing now. Depletion of inventories at the end of the year could cause the price increases that suppliers anticipate. Even modest stimulus measures such as small tax changes can trigger such a shift.

About the author: Martin Schachinger studied electrical engineering and has been active in the field of photovoltaics and renewable energy for almost 30 years. In 2004, he founded the online trading platform pvXchange.com. The company has standard components in stock for new installations and solar panels and inverters that are no longer produced.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content