Today, the U.S. Department of the Treasury and the Internal Revenue Service (IRS) announced that applications will open at 9:00 a.m. ET on May 28, 2024 for the 2024 program year of the Section 48(e) Bonus Credit Program for Low-Income Communities. ) of the Internal Revenue Code. All applications submitted within the first 30 days before 11:59 PM ET on June 27 will be treated as if they were submitted on the same date and time. This ensures that all applicants, regardless of size or resources, have an equal opportunity to participate. After the initial 30-day period, DOE will continue to accept applications on a rolling basis.

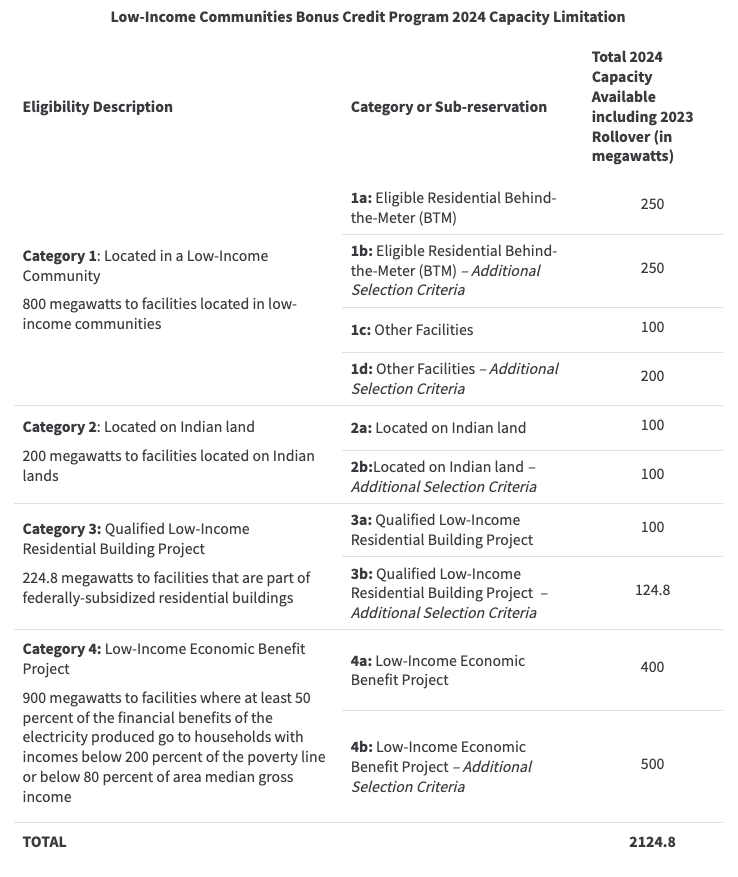

The Treasury Department and the IRS also announced that approximately 325 MW of available capacity will be transferred to the 2024 program year. This will add to the annual capacity of 1.8 GW for a total of more than 2.1 GW of available capacity in 2024 to spur additional investment and advance President Biden’s Investing in America Agenda by lowering energy costs for Americans and investing in good-paying clean energy jobs. in low-income communities and to support small business growth.

During the initial 30-day application period in 2023, the program received more than 46,000 applications, representing more than 8 GW of generation capacity.

To provide information about the application process prior to the opening of the application, the Ministry of Finance and the Ministry of Energy will send a webinar open to the public on the application process for the 2024 program year on May 16, 2024 at 1:00 PM ET. Potential applicants can register for the webinar here. Additional guidance, including the 2024 revenue process, final regulations, and program resources to help applicants prepare their submissions, is available at DOE program home page.

This provision of President Biden’s Inflation Reduction Act provides a 10 or 20 percentage point boost to the investment tax credit for qualified solar or wind installations in low-income communities, and is already providing a huge boost to the construction of clean energy facilities in communities across the country. , encouraging new market entrants, benefiting Americans who have suffered adverse health or environmental impacts and lacked economic opportunity, and reducing energy and related housing costs for families.

“This groundbreaking incentive to invest in low-income communities, created by President Biden’s Inflation Reduction Act, will create jobs and opportunity while lowering energy costs for long-underinvested communities,” said the U.S. Deputy Secretary of State Finance Wally Adeyemo. “In the first year of the program, we saw skyrocketing demand for solar and wind energy investments, and we expect this momentum to continue as President Biden’s economic agenda ensures that all Americans benefit from clean energy growth economy.”

The Bonus Credit Program for Low-Income Communities annually allocates 1.8 GW of available capacity through competitive application to four categories of qualified solar or wind facilities with a maximum output of less than 5 MW. Under the final regulations, a minimum of 50% of the capacity limit in each category or sub-reservation will be made available to facilities that meet additional selection criteria. Including the 324.8 MW of available capacity announced today that will be rolled over, the IRS will allocate the total capacity for the 2024 program year as follows:

News item from the Ministry of Finance