The market for silicon solar panels has become somewhat uniform. After decades of R&D, manufacturers determined that PERC (passivated emitter back contact) technology would be the fundamental building block for all silicon solar panels. To go beyond that central design, manufacturers can expand to HJT (heterojunction technology) or TOPCon (tunnel oxide passivated contact). HJT’s more complex formulation, which adds thin films of amorphous silicon to the mix, has led most of the industry to adopt the TOPCon path, which only requires adding a single oxide layer to PERC cells.

It’s hard to stand out in the crowded TOPCon market, so it’s only natural to hear calls about patent infringement. While patent claims are common in every industry, these TOPCon patent battles should not be ignored as everyday business actions. Who owns which solar panel process could reshape the domestic manufacturing landscape and has already seen companies pivot to this volatile market.

TOPCon was introduced added to the industry in 2013 by the Fraunhofer Institute for Solar Energy Systems in Germany and has been used by mainstream Chinese manufacturers since at least 2019 before becoming globally dominant in the past two years. Test laboratory Kiwa PVEL assesses hundreds of solar panels for its annual PV Module Reliability Scorecard and found 2023 to be TOPCon’s breakthrough moment. Only one TOPCon module was offered for testing in 2022, before jumping to 37 modules in 2023. In 2024, 160 TOPCon models were tested.

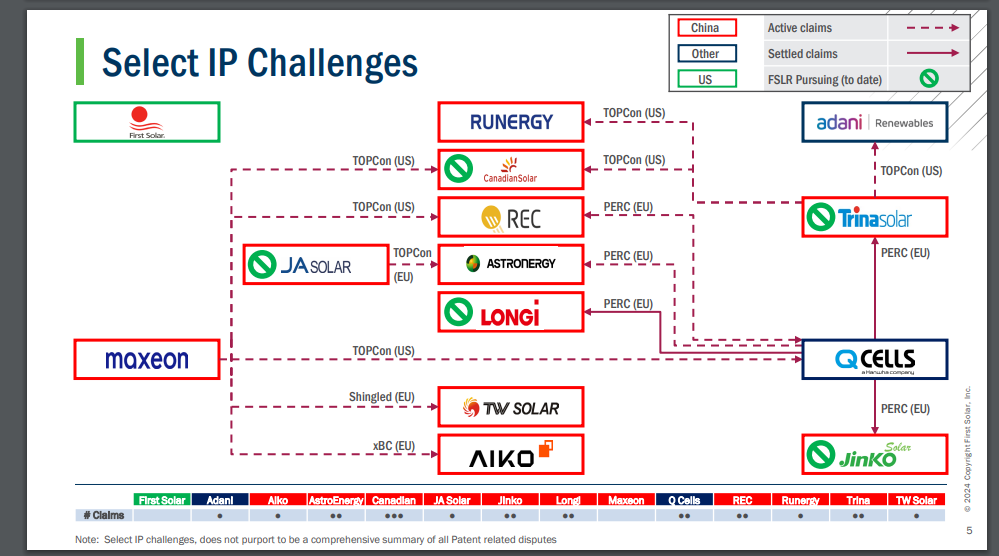

Maxeon was the first to delve into TOPCon patent infringement claims, filing separate complaints against Canadian Solar and both REC and Qcells earlier this year. Maxeon owns three patents related to TOPCon technology, which were initially granted to SunPower and transferred to Maxeon in 2022.

“Maxeon has a strong legacy in the development of solar cell technology and is leading the development and commercialization of tunnel oxide passivated contacts,” said Marc Robinson, associate general counsel for Maxeon. “Years before the nickname ‘TOPCon’ was used in the industry to describe a tunnel oxide passivated contact-based solar cell, our scientists and engineers had developed several ways to implement TOPCon technology in both back-contact and front-contact solar cells. .”

Then came Trina Solar’s filings, first against Runergy and Adani, before also claiming patent infringement against Canadian Solar. Trina escalated matters by requesting that the U.S. International Trade Commission conduct a full investigation of the three companies under Sec. 337 of the Tariff Act of 1930, which would direct U.S. Customs to prevent infringing imports from entering the United States. Trina could only get a Sec. 337 investigation request because it was considered a U.S. manufacturer in need of protection. But in November, Trina sold its Texas factory to FREYR, and the U.S. government is now reconsidering Trina’s claims of protecting its domestic market. (Additionally, Trina just withdrew her Sec. 337 complaint against Canadian Solar and notified Adani of its subsidiary Mundra Solar PV.)

A slide from a recent First Solar earnings report illustrating the various patent challenges in the solar industry.

But that’s not all: a manufacturer of non-silicon solar panels is also joining the battle for silicon patents. First Solar, which makes thin-film solar panels that don’t use silicon, also has TOPCon patents. America’s largest solar panel maker secured the patents through its 2013 acquisition of silicon cell start-up TetraSun. First Solar said it still retains the TOPCon-related patents until 2030 and is investigating several silicon solar panel manufacturers for possible infringement. The company has not yet filed any official complaints against its fellow manufacturers in the US, but First Solar will go after the dominant silicon technology if it believes it has merit.

These threats have direct consequences for newcomers to the American solar panel market. New manufacturer Solarix said it will make HJT panels in Virginia to avoid stepping on TOPCon landmines.

“There are many variants of TOPCon that have been patented by many companies. We knew that at some point there would be an infringement of the TOPCon patent [allegations],” said Carlos Class, CEO of Solarix. “These companies that developed their production lines here to use TOPCon in their modules are now putting a moratorium on their 2025 production plans for domestic content.”

In November, Toyo and VSUN announced plans to set up a solar panel assembly plant in Houston. A few weeks later, JinkoSolar filed TOPCon patent infringement claims against the two companies and their subsidiaries. Construction plans continue, but a positive finding of infringement could halt their domestic production. The same can be said for all companies that encounter problems. A 2020 patent infringement lawsuit between Solaria and Canadian Solar was ultimately settled, blocking Canadian Solar from selling shingles in the U.S. market for seven years. Whether the long list of hopeful American manufacturers gets off the ground could depend on who owns which TOPCon patent.