Withdrawing carbon credits can be a powerful tool for individuals and companies to offset their carbon emissions and contribute to a greener future. By withdrawing these credits, we can ensure that the emissions reductions achieved are permanent and not double-counted, creating a more transparent and effective carbon market.

This approach not only helps combat climate change, but also encourages the development of sustainable practices and technologies.

If you want to know how the process works, this article explains everything you need to know about carbon credit retirement. Let’s start by explaining how these credits work.

Understanding how carbon credits work

Carbon credits are tradable certificates that give entities the right to emit one tonne of CO2 or its equivalent. They are generated by projects that reduce or remove CO22 from the atmosphere, such as planting trees.

The credits serve as a permit, with which the holder can neutralize his emissions. In this way, they function like renewable energy certificates (RECs), which are also a market-based instrument that certifies that the holder owns one megawatt-hour of electricity from a clean energy source.

Essentially, RECs are a type of carbon credit, among many others. These credits come in two main categories: compliance and voluntary markets.

In voluntary carbon markets, carbon credits are also called offsets. Emitters voluntarily purchased them to offset their greenhouse gas emissions.

In the compliance markets, companies’ emissions are ‘capped’. If they exceed that limit, they will be fined or be able to purchase carbon credits corresponding to the amount of excess emissions.

The life cycle of a carbon credit

The withdrawal of carbon credits involves a series of stages. But let’s focus on the last three crucial steps that guarantee the integrity of the credits, the process of trading them and what it means to retire them.

The verification process is critical to ensuring the accuracy, transparency and integrity of reported project data. Verifiers must confirm that a project meets the carbon program eligibility criteria. They validate project monitoring data collection according to program requirements and verify the accuracy of emissions reduction calculations based on approved methodologies.

Once a project has completed the verification processes, it is eligible for registration within the program. In other words, the credits they generate are now available for trading.

Carbon credit trading has become very popular among individuals and organizations today and various carbon exchanges started to emerge. This is happening for a simple reason: reducing greenhouse gas emissions is a global initiative and the carbon market offers great opportunities for entities looking to reduce their emissions.

You can buy or trade carbon credits for retirement purposes through various platforms. There are a number of online carbon credit marketplaces and spot exchanges to choose from.

Here are the top four carbon exchanges this 2024 you can consider. You can also try popular marketplaces like that Sales team launched or that of Alcove.

Finally, let’s get to the end goal of carbon credit trading: retirement.

The pension process explained

Retirement with carbon credits also means their death.

A carbon credit is terminated once its benefit has occurred. That means it has been used and the carbon benefit it represents has been claimed by the entity that purchased it.

If you wish to withdraw your carbon credits, you must ensure that they are removed from the market and marked as ‘retired’ in any documents or records. The retired credits may only serve their emissions reduction goal once to avoid double counting.

Please note that retirement does not occur until after the impact has occurred. This means that the withdrawal of your carbon credits depends on the type of credit you purchase.

If you have purchased ex-post carbon credits, you can withdraw them immediately after your purchase. You can then immediately receive proof of pension.

For ex-ante and pre-purchase carbon credits, withdrawals do not happen immediately after you purchase them. That’s because their impact hasn’t happened yet and their retirement should happen in the future. You need to know when the timeline comes from the seller or the marketplace where you are purchasing the credits. It could take months or even years depending on the specific project you are investing in.

Impact and benefits of withdrawing Carbon Credits

By purchasing carbon credits, entities help finance efforts that support decarbonization elsewhere. These initiatives often deliver positive benefits for the environment and local communities. More importantly, each credit withdrawn helps quantify the true environmental impacts of those projects.

When it comes to the impact of withdrawing carbon credits on investors, whether individuals or companies, this has two main consequences.

First and foremost, it ensures the integrity and effectiveness of emission reduction projects. It prevents double counting or reuse of the credits by multiple entities. This further ensures transparency and accountability in carbon markets.

In effect, carbon credit retirement builds confidence among companies about the impact of their purchases or investments.

Secondly, withdrawing carbon credits helps build a good reputation and increase the brand value of your company. Take for example the case of large companies supporting various CO2 reduction projects.

Major technology companies like Microsoft and Apple have invested millions in carbon offsets through projects that reduce or store CO2 from the atmosphere.

As they do so, they tackle not only their emissions, but also their business sustainability.

The role of carbon credits in corporate sustainability

So, how do carbon credits become the new currency? ESG investing to comply with environmental obligations and sustainable entrepreneurship?

In the US the currency of the kingdom is dollars, while in the EU it is the euro. In the ESG world that is the carbon credit. Carbon credits have a small place in companies’ ESG targets.

But as more companies pledge to reach net zero, these credits are also gaining momentum among ESG investing to accelerate carbon emissions reductions. And reducing emissions has now become a crucial part of corporate and environmental responsibility to help fight climate change.

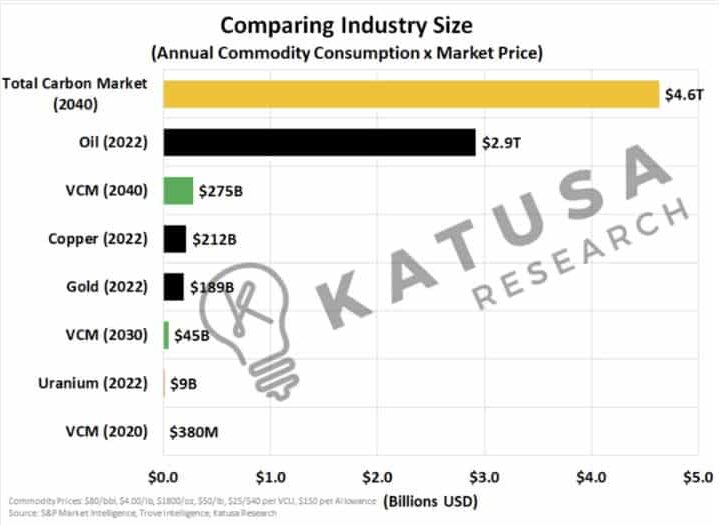

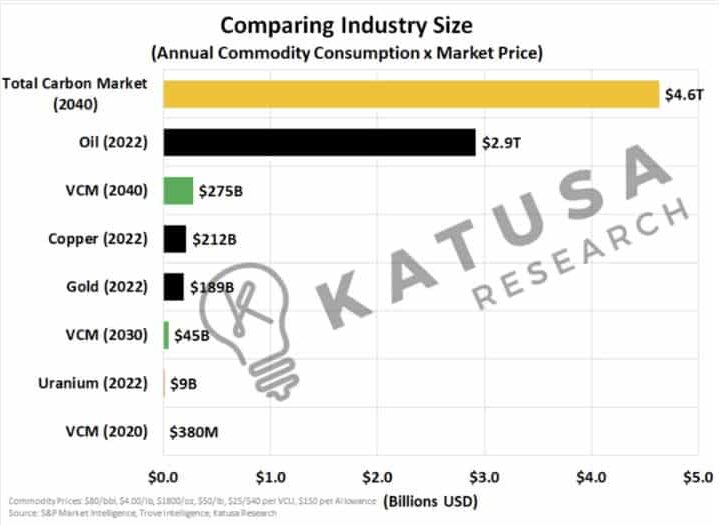

Companies use carbon credits to achieve their net zero, carbon neutrality or carbon negative targets. Research agencies estimate that the carbon market will grow as much as 30x faster by 2030. If that happens, the market will be as big as the NASDAQ stock market by the end of the decade.

According to the independent company Katusa researchthe total carbon market (compliance and voluntary) could be on par with the oil market.

Burning fossil fuels releases carbon dioxide, which contributes to climate change. Different business climate goals mean different things.

Achieving carbon neutrality means balancing the CO2 emitted and removed. Everyday actions such as driving emit CO2, but walking or using renewable energy sources can reduce these CO2 emissions. Carbon credit offsets finance carbon removal projects.

Carbon negative goes beyond neutrality and removes more CO2 than emitted. Microsoft, for example, is aiming for carbon negativity by 2030, pledging to eliminate all emissions since its founding. H&M and Ikea are also pursuing “climate positive” efforts, similar to carbon negativity efforts. Their strategies include sustainability investments and reduced emissions.

Carbon Credit Pension Best Practices

Now that you know how carbon credits work, the importance of withdrawing them, and the processes involved, there’s one more thing to keep in mind. What are the best practices to follow when withdrawing carbon credits?

We summarize them in two essential points: selecting the right carbon credit projects and transparent retirement reporting.

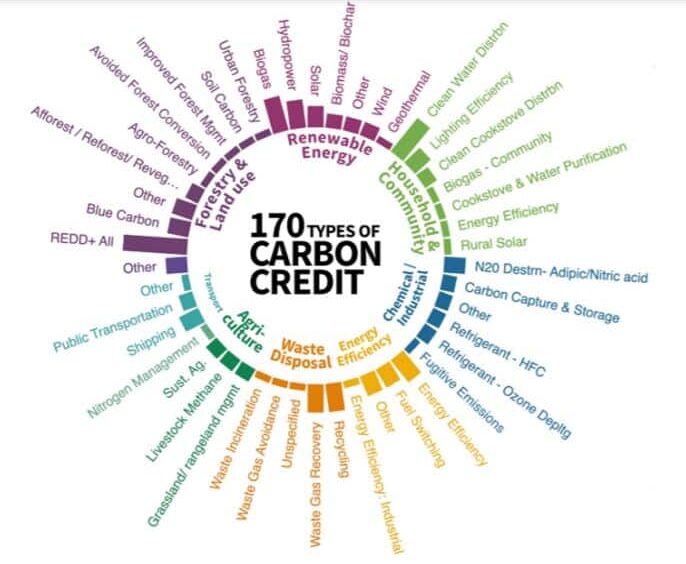

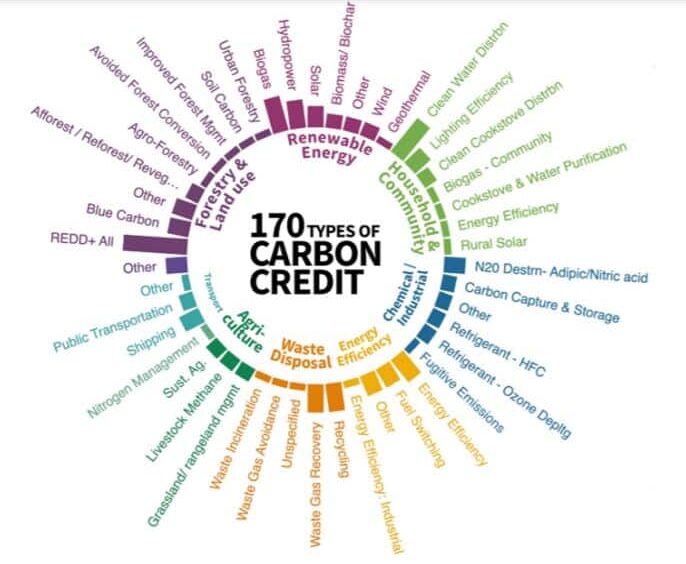

As mentioned earlier, there are numerous projects that generate carbon credits. There are more than 170 according to the Ecosystem marketplace report.

So, you should choose the ones that suit your purpose very well. If you like nature-based initiatives, you can choose from the various forestry and land use projects, for example REDD+. But if you are in the energy sector, you may want to opt for renewable energy, such as supporting solar or wind energy projects.

Regardless of your choice, make sure you are aware of the existing standards and methodologies for that project. This is critical so that your investment in carbon credits counts by actually reducing emissions. This means that you must be transparent in reporting your pension.

Transparency is one of the biggest concerns currently facing the carbon market. Questions were raised about the effectiveness of carbon projects in delivering on their emissions reduction promises. This caused a rapid decline in voluntary prices for carbon credits, especially nature-based offsets.

Yet current and future innovations in carbon credit markets show that they are here to stay and will continue to play an important role in reducing greenhouse gas emissions.

The future of carbon credits

Recent innovations, such as the launch of insurance products that protect carbon credits, indicate that the market is moving in the right direction. Application integration such as the case between Alcove and Shopify is another important market development that addresses transparency in credit write-offs.

The use of blockchain technology is also considered a solution to make it easier to track the retirement of carbon credits. Add to this the major players entering the market to further increase transparency in tracking the life cycle of each loan. For example, the NASDAQ stock exchange launched an innovative technology to revolutionize the industry.

Nasdaq’s new approach uses smart contracts for secure transactions and promises to bring much-needed standardization to attract investors.

Moreover, announcements by countries to integrate carbon markets into national registries also suggest that trading and canceling carbon credits would become the standard in reducing emissions and combating the climate crisis.