European energy markets are experiencing more hours of negative prices – a trend that often accompanies the rapid expansion of renewable energy. However, this increase is the result of a combination of factors.

“While deploying more solar and wind energy is one of the key drivers, it is not the only one,” said Antonio Delgado Rigal, CEO of AleaSoft Energy Forecasting. pv magazine. “Demand also plays a crucial role.”

He said negative prices typically occur during the afternoon, when solar production is high, on windy days with strong wind output, or during periods of high hydropower production. These conditions often correspond to low demand, such as weekends, holidays or milder seasons such as spring.

“It is the combination of high renewable production and low demand that leads to negative prices,” he added. “The rapid increase in installed renewable energy capacity in Europe, together with falling electricity demand due to the Covid crisis in 2020 and the subsequent energy price crisis in 2022 and 2023, has led to an increase in the number of negative price hours in recent years has increased.”

Generators sometimes offer their energy at sub-zero prices to guarantee its sale on the market, leading to negative prices.

“This is possible thanks to the marginalist design of the electricity market, where offers are ranked in ascending order based on the price offered, and the lowest are matched first,” Delgado Rigal explains. “While it may seem counterintuitive, producers have reasons to offer at negative prices. One of these is that they receive a fixed payment for the production of energy, regardless of the market price, if they have one [power purchase agreement] or have been winners in an auction. In addition, some producers may have an inescapable obligation to a counterparty that purchases that energy. Another reason is that some generators, such as nuclear power plants, cannot easily reduce their production, as is the case in France and Spain, where nuclear power plants must continue to produce due to their technical characteristics.”

Delgado Rigal called for more storage capacity to prevent this phenomenon from happening more often. Batteries can absorb excess renewable energy during low demand and release it when needed.

He said the number of hours with negative prices will likely increase over the next two to three years. This is mainly due to the rapid expansion of renewable energy sources and slower-than-expected demand growth, which impacts decarbonization and emissions reduction goals.

“However, in the long term, hours of negative prices are not expected to pose a significant risk to project profitability,” he said. “While negative prices will continue to occur, they are not expected to be frequent or recurring enough to threaten the financial viability of renewable energy investments.”

To achieve this, key actions include implementing energy storage technologies, improving demand flexibility, increasing electrification in sectors such as industry, transport and heating, and scaling up the production of green hydrogen and are derivatives.

“This would allow renewables to remain competitive and profitable even in an environment where negative prices are occasionally recorded,” Delgado Rigal said.

Negative prices have historically occurred in markets such as Germany, where large renewable energy capacities are deployed. In contrast, markets such as the UK, which is heavily dependent on gas and coal, and France, which is dependent on nuclear energy, have experienced negative prices less often.

“Negative prices often occurred sporadically, especially during times of low demand, such as during the 2020 Covid crisis or the years following the 2008 financial crisis,” Delgado Rigal said. “In the case of the Spanish market, negative prices had only occurred in April this year and so far the lowest price was €2 ($2.21)/MWh. This is because in Spain [power purchase agreements] and auctions have non-payment clauses in the event of negative prices, which discourages the production of renewable energy sources at such times.”

In countries like Germany, renewable energy producers can still receive agreed payments even if market prices turn negative, provided negative prices do not last for more than three consecutive hours.

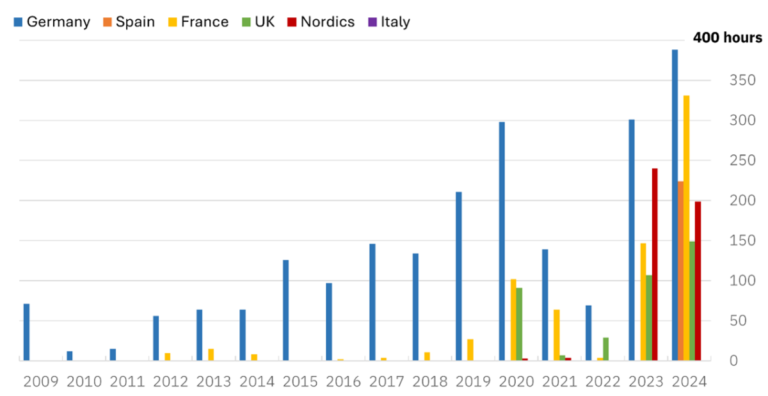

“From 2023 onwards, the number of hours with negative prices will increase significantly in almost all markets,” said Delgado Rigal. “The key factor is the rapid growth of solar energy and declining demand following the price crisis of 2022 and 2023. In most markets, the number of hours with negative prices so far in 2024 has already exceeded the number of hours recorded during the entirety of 2023 And then there are cases like the Italian market, where most of the demand is covered by gas-fired combined cycles and energy imports. In these markets, negative prices are very rare and virtually non-existent.”

In the future, markets that integrate and adapt their energy systems more effectively will be better protected against the risk of recurring negative prices.

“Markets with greater energy storage capacity, such as batteries, pumped hydro storage or green hydrogen storage capacity, will be able to store excess renewable energy during times of low demand and release it when needed,” said Delgado Rigal. “This will help reduce the frequency of negative prices because the energy does not have to be sold on the market at any price. Markets with more capacity in electrical interconnections with their neighbors will be able to export their excess production when domestic demand is low, avoiding system saturation and negative prices. This will make it possible to balance supply and demand, avoid energy waste and reduce price volatility.”

Green hydrogen production capacity could play a crucial role by using excess renewable electricity to produce hydrogen. This hydrogen can be stored and used as an energy source or raw material in industrial sectors, reducing the need to sell energy in times of negative prices.

“Markets that encourage greater flexibility in demand, through demand management programs or dynamic tariffs, will be able to adjust consumption based on the availability of renewable energy,” said Delgado Rigal. “This allows demand to respond better to supply, reducing the risk of negative prices. These elements will provide greater stability to the system and allow maximum use of renewable generation without causing market price distortions.”

He said negative prices, while not ideal, should not be seen as a problem requiring direct market intervention. Instead, they indicate temporary market inefficiencies, often due to a mismatch between renewable energy supply and demand. Intervening to prevent negative prices would disrupt the natural market signals and incentives necessary for efficient self-regulation.

“Rather than trying to avoid negative prices through restrictive regulations, it is better to use hedging and long-term contracts such as [power purchase agreements]” he said. “In this way, the price risk for both producers and consumers is limited, while the market always provides the right price signal. It is not a good idea to intervene directly in the markets to prevent negative prices, as these are an important market signal to stimulate innovation and investment in solutions such as storage and demand management.”

Delgado Rigal also said that negative prices are largely a reflection of the cannibalization currently happening in the renewable energy sector, especially PV.

“The same solar power plants compete with each other, causing prices to fall when production is plentiful,” he said, noting that negative prices, especially for the industrial sector, provide an opportunity to access energy at extremely competitive prices. “If industries can adapt and adjust their consumption to take advantage of these hours of oversupply, or if they move to markets where renewable energy is cheaper thanks to abundant installed capacity, they will be able to significantly reduce their energy costs. This flexibility will be crucial to benefit from the energy transition.”

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.