In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

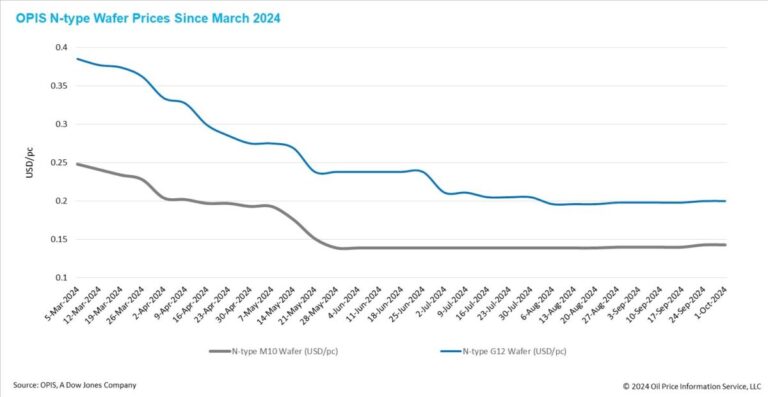

FOB Chinese waffle prices have remained stable across the board this week. Prices for mono PERC M10 and n-type M10 wafers remained stable at $0.145/pc and $0.143/pc, respectively. Similarly, prices for Mono PERC G12 and n-type G12 wafers remained unchanged at $0.211/pc and $0.200/pc, respectively, compared to the previous week.

The balance between supply and demand in the wafer market is improving as manufacturers have significantly reduced their business rates over the past month. According to the Silicon Industry of China Nonferrous Metals Industry Association, China’s wafer production in September was 44.31 GW, a month-on-month decline of 15.76%.

The slow pace of exploitation of wafer producers is likely to continue. During China’s Golden Week in early October, some waffle manufacturers reportedly scaled back production, from the usual three shifts of production staff per day to just one shift.

While the industry agrees that waffle prices have likely bottomed out and have been recovering intermittently, the challenge of raising prices comes with the difficulty of eliminating excess capacity. If prices rise, integrated manufacturers may increase their own wafer production and reduce external purchases, weakening demand for externally supplied wafers. In addition, smaller factories could take this opportunity to restart operations.

Another uncontrollable factor in clearing excess wafer capacity is weak downstream demand. China’s 14th Five-Year Plan aimed to achieve a combined solar and wind capacity of 1,200 GW by 2030, but this target was achieved in July this year, six years earlier. Insiders believe that future growth in solar installations could level off, with an expected annual growth rate of around 10% under optimistic scenarios.

On the global market, a recent hurricane in North Carolina hit a mining area producing high-purity quartz (HPQ). An insider reported that a major HPQ supplier temporarily halted operations last week due to power outages and infrastructure damage. While the full impact is still uncertain and considered manageable by some sources, concerns have already been raised. The disruption to the HPQ supply could drive up the cost of the wafers or reduce the quality of the wafers if lower quality quartz substitutes are used.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content