In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

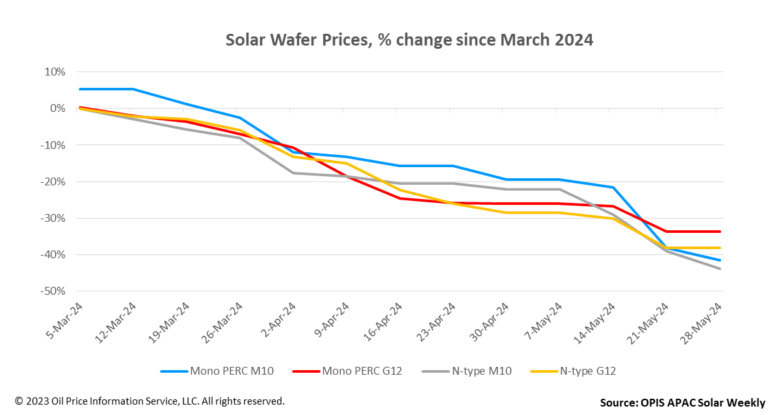

FOB prices in China for M10 wafers continued their downward trend this week. Prices for Mono PERC M10 and n-type M10 wafers decreased by 5.37% and 7.95% from week to week, reaching $0.141 per unit (pc) and $0.139/pc, respectively.

G12 wafer prices in FOB China remained relatively stable this week, with Mono PERC G12 and N-type G12 wafer prices flat at $0.236/piece and $0.238/piece, respectively.

According to OPIS market research, the average transaction prices of Mono PERC M10 and N-type M10 wafers in the Chinese domestic market have fallen to approximately CNY1.13 ($0.16)/pc and CNY1.12/pc, respectively. Even at this price, transaction volume remains minimal, an upstream source said. Another industry insider even cited a bid of CNY 1.05/piece for n-type M10 wafers, suggesting the possible direction of n-type wafer prices in the near future.

According to one market participant, the current sales price of wafers mainly deviates from production cost considerations, with the main emphasis on securing sales.

Wafer inventory remains high at more than 5 billion units, equivalent to about 40 GW and 20 days of production, according to multiple market sources. Against the backdrop of high wafer inventories, reports emerged this week that some manufacturers were cutting business rates. As a result, wafer producers’ overall business figures have fallen to between 50% and 60%, with monthly production expected to be between 55 and 62 GW.

Recent discussions have arisen about cell manufacturers stockpiling wafers, suggesting that a wafer price floor may have been reached. However, a mobile market source suspects that this could be a deliberate attempt by wafer manufacturers to spread disinformation. The source views this move as “unnecessary” and notes that “even if they hit a bottom, there is no basis for a price rebound.”

Due to shifts in international trade policy, orders for cells and modules exported from Southeast Asia to the US are expected to face hurdles in the near future. This development has sparked industry discussions about the digestion of wafers from Southeast Asia and the potential source of wafers for future cell production in the US.

“It is expected that until local cell production capacity is established in the US, the policy will not completely block the import of Southeast Asian cells. Consequently, the impact on Southeast Asian wafers is not expected to be too significant in the near future,” said a global polysilicon market source disclosed to OPIS at the China Polysilicon Development Forum (CPDF) held in Leshan on May 23 , Sichuan, China was held. and 24.

In the global market, market insiders have revealed that a vertically integrated manufacturer’s 3.3 GW first-phase wafer project in the US will be completed this year. The plant has already secured the necessary amount of polysilicon for its annual production capacity. In addition, other wafer manufacturers are exploring the feasibility of setting up factories outside Southeast Asia, such as in the United Arab Emirates, to deal with the complexities of the international trade environment, sources told OPIS at the CPDF.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired price data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.