The latest report from the International Energy Agency (IEA), which charts the future evolution of clean energy production, says the combined global market for PV, wind turbines, electric cars, batteries, electrolyzers and heat pumps will rise from $700 billion in 2023 to 700 billion dollars in 2023. more than 2 trillion dollars by 2035.

According to IEA forecasts, global solar panel production capacity will exceed 1.5 TW by 2035. The latest report, “Perspectives on energy technology 2024”, includes the production of solar energy, wind turbines, electric cars, batteries, electrolyzers and heat pumps.

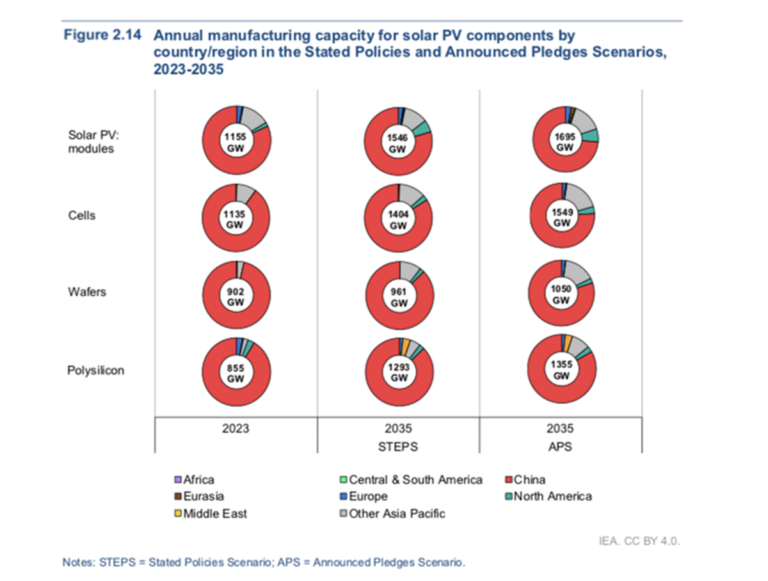

The report uses scenarios such as the Stated Policies Scenario (STEPS), which reflects the current policy landscape, and the Announced Pledges Scenario (APS), which assumes governments meet their climate targets, to predict the potential growth of these technologies.

The IEA said global solar panel production capacity could reach 1,546 GW by 2035 under STEPS, while capacity could rise to 1,695 GW under APS. In 2023, the global capacity was 1,115 GW.

China is expected to maintain a lead in solar energy production, but its market share may decline slightly as projects and policies in other regions drive production expansion, the IEA said.

U.S. solar panel production capacity is expected to reach 90 GW by 2030 under STEPS, increasing to just over 100 GW under APS. The IEA said U.S. demand for solar modules and polysilicon will be almost entirely met by domestic production by 2035, while demand for solar cells and wafers will still rely on imports.

The IEA said India’s solar panel manufacturing capacity under STEPS could reach around 80 GW, rising to around 120 GW under APS. In the European Union, the GSP scenario would support a target of meeting 40% of demand through domestic production.

In the long term, differences in fundamental costs in the global manufacturing market are likely to become increasingly important, the report said. The IEA said this could provide a strong competitive advantage for regions with low energy prices, including China, India, Southeast Asia and the Middle East.

The report predicts that global solar panel demand will grow from 460 GW in 2023 to 674 GW in 2035, at an average growth rate of 3% per year, to 724 GW in 2050 under STEPS. According to APS, global demand for solar panels is expected to reach 860 GW in 2035 and 894 GW in 2050.

China is forecast to remain the main growth driver of global demand, reaching approximately 415 GW by 2035 under both STEPS and APS. India and other emerging markets and developing economies (EDMEs) are expected to capture a growing share of the global market under both scenarios, reaching almost 25% in 2050 under STEPS and 35% under APS.

The IEA said average investment in the PV supply chain will fall in the coming years, from over $80 billion in 2023 to around $10 billion in the years 2024 to 2030, before falling even lower between 2031 and 2035. expects a decrease because “the current capacity is more than sufficient to cover a significant part of the deployment.” Most investments, the report added, will be needed in China, the United States, India and the European Union.

Based on current policy settings, the IEA said the combined global market for solar energy, wind turbines, electric cards, batteries, electrolyzers and heat pumps could rise from $700 billion in 2023 to more than $2 trillion in 2035 – close to value of the world crude oil market in recent years.

IEA Director Fatih Birol said that as countries try to define their role in the new energy economy, energy, industry and trade policies will all become more important and interconnected.

“Clean energy transitions offer major economic opportunities and countries are rightly trying to take advantage of them,” Birol said. “However, governments should strive to develop measures that also promote continued competition, innovation and cost savings, as well as progress towards their energy and climate goals.”

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content