BloombergNEF says the global solar industry will install 592 MW of modules this year, a 33% increase from 2023. The consultancy also lowered its estimate for polysilicon production in 2024 as manufacturers temporarily scale back production .

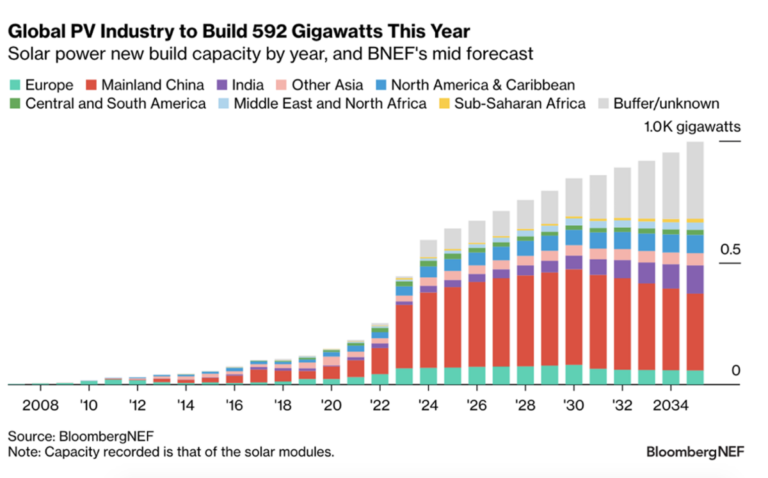

According to a new report from BloombergNEF, the global solar industry is on track to install 592 GW of modules this year, an increase of 33% from 2023. In its ‘3Q 2024 Global PV Market Outlook’, the company states that ‘low prices for modules will boost demand in new markets this year but hurt manufacturers, who are competing fiercely to maintain their market share.”

A quarter-on-quarter analysis shows a 1% increase in the world’s 28 largest markets. Pakistan, Saudi Arabia and India are leading the biggest developments, while Japan and South Africa are seeing notable declines. The most established solar energy markets continue to grow steadily.

The report predicts a steady annual increase in solar panel installations, reaching 996 GW by 2035. BloombergNEF also lowered its 2024 estimate for polysilicon production to 1.96 million tons – enough to produce 900 GW of modules.

Jenny Chase, BloombergNEF’s chief solar analyst, said pv magazine that the The main reason for the reduction in polysilicon production from the estimated annual production of 2.2 million tons in the second quarter of 2024 is “that manufacturers schedule maintenance or use other ways to temporarily reduce production, due to the low prices and oversupply.” The report states that polysilicon prices are currently $4.9/kg, which is below production costs for almost all manufacturers.

Meanwhile, module prices have fallen to $0.096/W, which is the lowest level ever, according to the report. BloombergNEF said most solar producers are expected to report losses this year and warned that some may not survive this cycle.

“Systemic overcapacity in the solar supply chain has led to continued price declines,” the report said. “Manufacturers are facing losses across all segments of the supply chain, from polysilicon to modules, and have responded with wage cuts, cost cuts, layoffs and even deferred payments to suppliers as they try to maintain production.”

BloombergNEF predicts a module price of less than $0.10/W for products based on tunnel oxide passivated contact (TOPCon) technology on the open market by the end of the year.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.