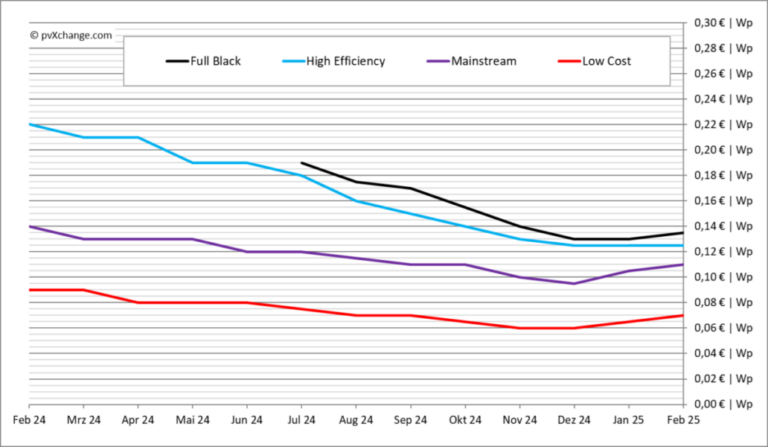

High efficient solar modules are becoming scarce, so that some retailers are requested to Stockpile pending rising prices, says Martin Schachinger, founder of PVXCHANGE.COM. He expects that the prices of the module will rise moderate but steadily until at least the beginning of the next quarter.

After they have stayed flat early in the year, the module prices started rising for the first time in more than two years. The increase affects all technological classes, including highly efficient modules, but the change in that category remains too small to register on price charts.

That will probably shift soon. Few discount modules remain on the market, because production of production causes an artificial shortage. High efficient modules become scarce, without immediate delivery in sight.

Some dealers are now in stock in response to the expected deficit. These modules will no longer be sold at bargain prices, but will be stopped and retracted to withstand the imminent food gap. As a result, the module prices will probably rise moderately but steadily until at least the beginning of the next quarter.

These prospects reflect delays in deliveries of major brands, with the fact that PV systems are not expected until April or May. Modules for large projects follow individual distribution rules, which means that their prices are less volatile due to longer planning and shipping times.

The impact of production treatments extends over the entire market, including modules mounted on the ground. Manufacturers share supply chains, so reduced output influences all modules. Some Tier-1 Chinese manufacturers reportedly did not produce any module this year, and decisions about restarting production after the Chinese New Year is not certain. Many suppliers still trust the stock of last year, but slow down new deliveries.

What does this mean for the PV market? Not necessarily bad news.

Overcapacity remains high, especially in China, but analysts expect the global demand for modules to rise, while growing slows down from 25% to 30% per year to around 8% to 12%. The production capacity is still much larger than the demand, projected with 1,400 GW against a forecast of 660 GW to 700 GW in 2025. Factory closures can help alleviate the delivery crossing, but they have continuous costs, which means that smaller manufacturers are probably forced from the market.

In Europe, political uncertainty and new regulations are the demand for PV to dampen and point to stagnation in large markets. Germany is expected to add only 15 GW this year, a decrease of 10% compared to 2024. In 2025, energy storage and flexible consumption will be central, powered by the Solar Peak Act. Installers who are unable to adapt will struggle against larger solution providers such as 1Comma5 and Enpal, who already offer AI-driven PV and storage systems and support Germany’s policy change.

Smaller installers still have options, because many manufacturers of inverters now offer open-system or turnkey solutions that help consumers to manage energy costs. With good storage and intelligent energy management systems, users can optimize dynamic electricity rates-on condition that network operators finally accelerate the long delayed smart meter rollout. The latest adjustments from Ernuble-Energien-Gesetz (EEG) also make the way paving for bidirectional EV tools, but car manufacturers must now deliver the necessary hardware.

In a future market with dynamic rates and bidirectional charging, PV systems are more than just add-ons they are essential for maximizing self-supply. However, module price alone becomes less relevant for the overall system economy. Reliability in the long term is more important because maintenance or replacement costs can roll out investment returns.

The rising module prices can encourage manufacturers to invest in higher quality raw materials, so that the quality loss that is seen during the recent phase reverses at a low price. Modules that were sold to Europe in bulk often missed the reliability of performance, in particular in top categories, unless buyers have concluded specific quality agreements. With the prices that are now higher, these problems can soon be solved, so that end customers can finally get the reliability they expect from their PV systems.

Image: pvxchange.com

About the author: Martin Schachinger has studied electrical engineering and has been active in the field of solar and renewable energy for almost 30 years. In 2004 he set up the online trading platform of PVXCHANGE.COM. The company has standard components in stock for new installations and solar modules and inverters that are no longer produced.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content