The International Energy Agency’s (IEA) Photovoltaic Power Systems Program (PVPS) says in its latest report that 2023 was a record-breaking but tumultuous year for solar energy development. It says the manufacturing industry is under pressure from an imbalance between supply and demand, with overcapacity causing prices to collapse.

According to the IEA-PVPS, the global solar sector is achieving record growth but is facing significant pressure, especially in the manufacturing sector.

His latest report states: “Trends in PV applications 2024”, that at the beginning of 2024, more than 1.6 TW of PV systems were operational worldwide, producing 2,136 TWh of electricity – equivalent to 8.3% of global electricity demand.

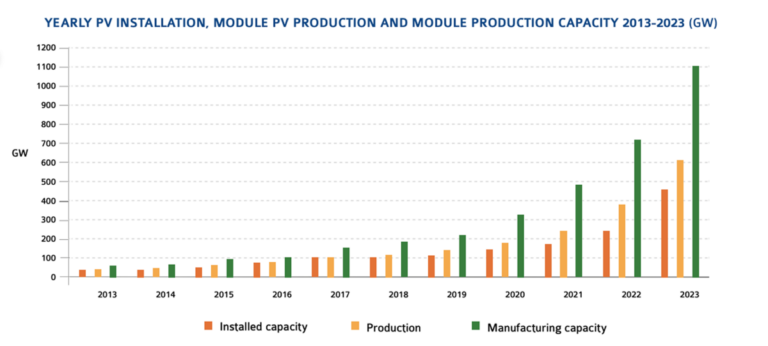

But despite a record year for solar energy in 2023, which saw 456 GW of new installations achieved, solar energy development in many countries has suffered setbacks and delays. The exception is China, which is now focusing solar energy development “at an unprecedented level” by growing its domestic market to absorb overcapacity in its own industry, IEA-PVPS said.

It explained that other countries have not been able to match China’s acceleration, leading to significant overcapacity in the PV manufacturing industry. According to IEA-PVPS figures, China was responsible for 92% of global polysilicon production last year, as well as 98% of wafer production, 91.8% of cell production and 84.6% of module production.

Overcapacity has led to a collapse in the price of PV components, especially modules, IEA-PVPS said. It said the lowest module price among reporting countries in 2023 was about $0.14/W, which is “significantly lower than anything ever seen before.” It says this is “a direct result of the large production volumes coming online in 2023, well above the market’s capacity to absorb.”

IEA-PVPS also noted that low prices have continued into 2024, falling below $0.10/W. It says this threatens the viability of the entire PV manufacturing industry and jeopardizes projects intended to create local jobs.

“This temporary imbalance between supply and demand in the industry has put enormous pressure on the manufacturing industry and is likely to lead to consolidation and possible bankruptcies,” said Gaëtan Masson, manager of IEA-PVPS Task 1. “The current (mid-2024) low prices may be considered unsustainable, but PV competitiveness was already guaranteed based on mid-2023 prices, and the prospects for rapid development in the coming years remain bright in many countries.”

IEA-PVPS said countries such as the United States and India, which were the third and fourth largest solar markets in 2023 after China and the European Union, could have achieved higher installation levels if several administrative, political and local issues, such as because weak networks or limited social acceptance had been resolved.

The number of countries accelerating the large-scale deployment of solar energy systems is increasing. By 2023, 36 countries installed at least 1 GW of solar energy, while 54 countries now boast a cumulative capacity of more than 1 GW.

Elsewhere in the report, IEA-PVPS said the global solar sector’s contribution to the global economy has accelerated significantly in recent years, with the sector now responsible for seven million jobs worldwide. The total enterprise value of the PV sector was $400 billion by 2023.

The trends report, now in its 29th edition, is part of this IEA-PVPS task 1that focuses on market and sector analysis.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.