New research from Denmark shows that PV-to-methanol facilities can achieve 30% lower levelized costs of methanol through involvement in reserve markets. The researchers examined the ability of a PV-to-methanol plant to contribute to the grid in frequency control reserves (FCR), automatic frequency restoration reserves (aFRR) and manual frequency restoration reserves (mFRR).

A group of researchers led by scientists from the Technical University of Denmark (DTU) have investigated how PV-to-methanol facilities can participate in reserve markets to minimize the levelized costs of methanol and have found that these facilities can deliver potential economic benefits.

In particular, the academics examined the ability of an actual PV-to-methanol plant to contribute to the grid in the form of frequency control reserves (FCR), automatic frequency restoration reserves (aFRR) and manual frequency restoration reserves (mFRR).

“To optimize the cost-effectiveness of power-to-X (PtX)-based fuel production, a proposal proposes to leverage the inherent flexibility of PtX plants to provide frequency reserves to the grid,” they explained. “An analysis of hybrid renewable energy system (HRES) technology and current reserve markets shows that the HRES is eligible for certification of frequency reserve facilities, which includes FCR, aFRR and mFRR, by the transmission system operator.”

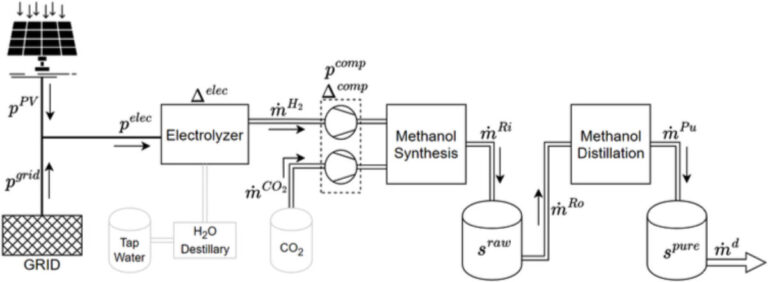

The analyzed PV-to-methanol plant can produce about 32,000 tons of e-methanol per year. It is powered by the electricity grid and a 300 MW PV plant connected to proton exchange membrane electrolyzers (PEM) with a capacity of 52.5 MW. The PEM unit has a minimum load of 5%.

“While existing studies mainly simulate short-term scenarios, this study expands the focus to a full year, shedding light on the dynamics of renewable energy integration and market governance over a longer period,” the research team said. “The comparison includes two scenarios: participation only in the day-ahead (DA) market and participation in both the DA and reserve (RE) markets for the years 2020 and 2021.”

The factory is located near the German border, in Kassø, South Jutland. According to the mathematical model, solar energy is responsible for 66% of the total energy used annually by the system. However, during the summer months, the PV capacity exceeds that of the power-to-X installation, resulting in a surplus of PV production, which can then be used for export to the grid and for reserve market participation.

“For both years, the aFRR market appears to be the main source of additional income, while participation in mFRR and FCR contributes to a lesser extent,” the team said. “In 2020, reserve market revenues total €4.82 million ($5.23 million), with FCR accounting for 16%, aFRR 79% and mFRR 5%.”

For the DA market alone, the model found a levelized cost of methanol (LCoM) of €1,508/ton in 2021 and €1,276/ton in 2020. For both the DA and RE markets, the model shows an LCoM of €1,059 /ton for 2021 and €1,117/ton for 2020. According to the researchers, these results are responsible for a reduction in LCoM of 30% for 2021 and 12% for 2020.

“The model efficiently allocates electrolyser capacity to maximize market returns, with the resulting LCoM values closely matching International Renewable Energy Agency (IRENA) estimates,” the academics concluded. “This underlines the economic benefits of HRES participation in reserve markets, pointing to the potential for improved sustainability of the renewable energy system through market engagement.”

Their findings were presented in “Cost minimization of a hybrid PV-to-methanol installation through participation in reserve markets: a Danish case study”, published in the International Journal of Hydrogen Energy. Academics from Denmark’s DTU and the Chinese University of Chinese Academy of Sciences conducted the research.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.