Agriculture is one of Brazil’s most important economic activities and is expected to produce BRL 2.46 trillion ($439 billion) worth of goods by 2024, according to estimates from the University of São’s Center for Advanced Studies in Applied Economics Paulo (USP). The academics estimate that agriculture will generate BRL1.65 trillion and livestock BRL801 billion, including machinery and service costs.

The Climate Observatory, a Brazilian NGO, estimates that 617 million tons of the total 2.3 billion gross tons of CO2 The equivalent of Brazil’s emissions in 2022 came from agriculture. Deforestation, the country’s largest source of emissions, with 1.12 billion tons of CO2 equivalent in 2022, is mainly the result of clearing land for new pastures and fields.

The figure of BRL 2.46 trillion fell from BRL 2.67 trillion in 2023 due to crop failures caused by climate change and the El Niño effect. Severe drought in Brazil’s midwest and unprecedented storms in the south hit the largest soy-producing regions.

In this context, solar irrigation increases agricultural productivity and reduces environmental impact. Leasing land for solar panels provides farmers with stable income, especially in areas with low or zero production, and public and private initiatives promote this model.

Policy tools

In July 2024, Brazil’s Ministry of Agriculture and Livestock allocated BRL508.59 billion to support agricultural projects. The RenovAgro credit line, a key part of the plan, can finance renewable systems and other practices that reduce greenhouse gas emissions.

“Photovoltaic technology is extremely versatile and can be used, for example, for pumping and irrigating water, cooling meat, milk and other products, controlling temperatures for poultry production, lighting, electric fences, telecommunications systems and monitoring property on the countryside. many other features,” says Ronaldo Koloszuk, president of Absolar, the Brazilian solar industry association.

Irrigation technology

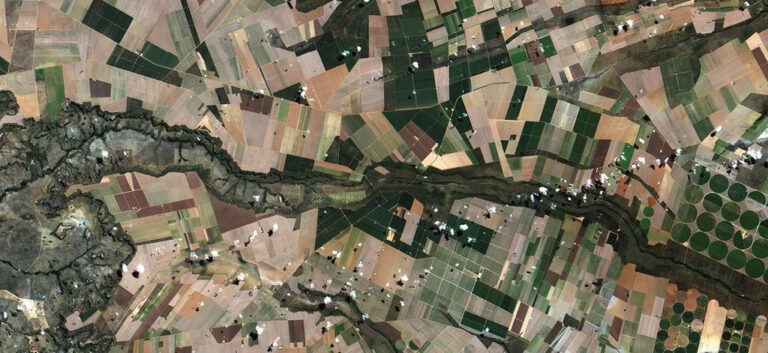

Irrigation technology is one of the most important methods to increase agricultural productivity and reduce climate impact on crops. The availability of electricity is one of the barriers limiting the expansion of irrigation technology, especially through the use of irrigation pivots, in which long sprinkler lines revolve around a central point.

Normative Resolution 1,000/2021, introduced by electricity regulator Aneel, introduced an electricity tariff that encourages night-time energy consumption for irrigation and aquaculture. To qualify, a consumer must have a connection installed solely for feeding the system responsible for pumping and distributing water.

To ensure that the use of water is in accordance with the conservation of the environment, it is necessary to be in possession of an environmental permit and the right to use water resources, or to have an exemption from such requirements .

The growth potential of irrigation centers in agricultural states is significant. US-based irrigation equipment manufacturer Lindsay Corp. says that the Brazilian state of Paraná, with almost 15 million hectares of agricultural land, has irrigated less than 2% of its agricultural land. In São Paulo, the state government wants to increase the size of its irrigated agricultural land by more than 2 million hectares. Currently, irrigation covers only 6% of São Paulo’s plantation area and the goal is to reach 15% by 2030. Mato Grosso now has 178,000 hectares under irrigation and could expand that to 3.9 million hectares.

Agricultural niche

Incentives such as low interest rates, longer payment terms and grace periods have prompted several solar companies to target Brazil’s agricultural sector. For example, solar equipment distributor Genyx launched a new business unit in 2023, with a dedicated agricultural team and a much more tailored approach to the sector.

“Companies want to sell over the phone, via WhatsApp,” says Bruno Catta Preta, director of institutional relations at Genyx. “We first go to the rural association and approach the sellers of other equipment and inputs. Producers don’t want PowerPoint in their email; they want to drink coffee and talk face to face. They are also not afraid of investments of BRL 700,000 or BRL 800,000, because they are used to spending money on expensive equipment such as pivots, trucks and harvesters.”

Catta Preta explained that irrigation pivots, for example, are expensive pieces of equipment that utilities often find difficult to keep connected. In addition, the poor quality of the electricity transmission network that reaches rural properties via the grid provides an incentive to use not only solar systems but also batteries.

“Distribution lines in the rural segment are long and almost always consist of a single line,” says Silvio Robusti, senior product marketing manager at Chinese inverter manufacturer Growatt. “There are few connections and they are sensitive to large fluctuations because they cover large distances and have a low consumer density per kilometer. Maintenance is also more complex, electricity quality is poorer than in major urban centers and significant electrical outages are common. In some cases, these properties can remain in the dark for up to a day and a half.”

Growatt supplied inverters for a 24 kW off-grid solar project installed on a farm in the municipality of Tatuí, in the interior of São Paulo state. It allowed the drilling of an artesian well for access to drinking water, as well as the construction of two houses on the property.

“In the beginning, there was no basic infrastructure such as water and electricity, making it unfeasible to build two houses on the property for the family to live in,” says Oscar Makoto Kojima, the off-grid engineer responsible for the project. “The customer also made a comparison of the connection to the electricity grid of the energy distribution company on site, but the costs would have been too high and the process too time-consuming. He then opted for an off-grid PV system integrated with batteries.” The location has four 9.6 kWh Dyness lithium batteries and 54 JinkoSolar modules, each with a power of 440 W.

In the northeastern state of Bahia, cotton producer Sementec Group’s Dom Perignon farm doubled its soybean harvest with a solar-powered irrigation system and reduced diesel consumption by 70%. The project was installed by Loop Energia and is fed by eight artesian wells, seven central irrigation points and three storage basins with a total capacity of 600 million liters. It is served by a private, 21 km long, 34.5 kV medium voltage network.

The off-grid system includes 1.2 MW of solar capacity with more than 2,000 JA Solar bifacial modules, each with a power of 545 W. It also features nine PHB inverters and five diesel generators – three with a capacity of 700 kW and two with a capacity of 550 kW. capacity each.

With more than 900 hectares of soy plantations, the farm uses sunlight to increase productivity and reduce production costs, said Luvânio Lopes, CEO of Loop Energia. The daily diesel consumption of 4,000 liters has fallen to 1,000 liters, which means a monthly saving of BRL 500,000. Smart grid technology has made it possible to increase soybean production from between 40 and 60 bags per hectare to more than 100 bags per hectare per crop.

State programs

In September 2023, the state government of Ceará approved the Renda do Sol project, which supports the implementation of PV systems for small farmers and low-income families across the state.

“In the future, we want the state of Ceará and the city halls to buy the energy,” said Governor Elmano de Freitas. “This is very important for our development. To do this, we want to educate these families and make it possible for them to get financing for their solar power plants.”

According to the project plan, two pilots will initially be set up in the municipalities of Jaguaribara and Tamboril, where more than 160 families are involved in the production of vegetables, fruits and dairy products. It is expected that the monthly income of these families will increase by more than 50% with the additional resources generated by the program.

In December 2023, the Minas Gerais state government approved the Minas Gerais Rural Renewable Energy Program, which provides tax incentives for agricultural producers, including family farmers and agroecological users of renewable energy.

The Brazilian states also provide specific financing lines for the sector. For example, the Paraná Renewable Energy (RenovaPR) program financed 462 small-scale solar generation projects in the first quarter of 2024 alone, amounting to BRL 44.5 million.

Paulista’s Sustainable Rural Development Credit Line released BRL 10.3 million in 2023 to 109 producers in 52 municipalities in the state of São Paulo for renewable energy activities. In 2022, BRL 13.6 million will be made available to 115 producers in 69 municipalities.

Agrivoltaic pilots

A partnership between energy company Cemig, Minas Gerais Agricultural Research Company and the Telecommunications Research and Development Center will bring together solar energy and arable farming on the same land, increasing the value of land use and enabling the development of innovative business models. The total investment is approximately BRL 10.5 million and the research will be carried out for 30 months.

“We will conduct a full assessment of the agrivoltaic system tailor-made for Minas Gerais, involving technical, regulatory and economic-financial aspects from the perspective of the rural producer, the energy distributor and the supplier of the integrated system solution,” said the commercial manager of the telecom research organization, Carlos Alberto Previdelli.

Sunfarming, a German company specializing in 1 MW systems that optimize the use of light for solar energy generation and plant cultivation, aims to develop 4 GW of agrivoltaic generation capacity in four Brazilian states. In Pará, the company wants to develop as much as 1 GW, starting in Belterra, where it can install up to 30 MW of sites in combination with land reforestation. The company is also developing projects in Rio Grande do Sul, Rio de Janeiro and Ceará.

The Federal University of Santa Catarina’s Strategic Solar Energy Research Group has installed a 100 kW agrivoltaic system on its campus with funding from Spanish petrochemical company Repsol, through the R&D program of Brazil’s National Oil and Gas Agency. At that location there are photovoltaic panels developed in Brazil by the Chinese battery manufacturer BYD, with a view to applications in the agricultural sector and architecture.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content