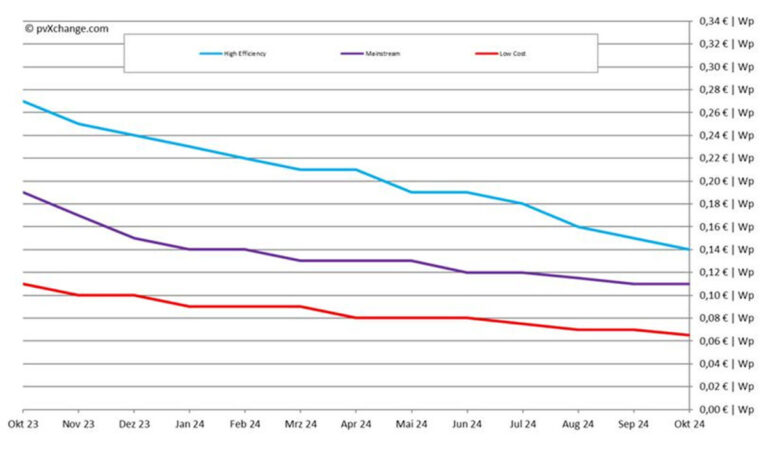

Martin Schachinger, the founder of pvXchange.com, reports that prices of tunnel oxide passivated contact (TOPCon) solar panels in Germany have fallen by an average of €0.010 ($0.0109)/W this month. Demand remains particularly weak in the residential sector, while complex authorization processes also pose a challenge for the commercial and industrial (C&I) and land-based segments.

Germany’s PV industry is struggling, with company bankruptcies piling up, reflecting a trend seen across all sectors. According to Deutsche WirtschaftsnachrichtenBankruptcies reached a peak not seen since 2010 in the third quarter of 2024, mainly due to self-induced problems and continued price declines.

This month, price drops mainly affected TOPCon modules in the higher performance classes, which fell by an average of €0.010/W, while prices for other module classes remained largely unchanged. Many suppliers are still under pressure and are even devaluing popular brands just to boost sales.

However, the past six to nine months show that this strategy is not necessarily working. Despite lower prices for components and turnkey systems, demand and sales figures have not increased accordingly.

There is still a strong reluctance to buy, especially in the residential segment, due to uncertainty about long-term economic conditions and individual incomes. Meanwhile, the cost of living continues to rise despite weaker inflation and increasing approval times from governments and authorities.

Recent interest rate cuts have failed to improve the investment climate. New installations in Germany and Europe appear to be stagnating at the levels of recent months. While the growing C&I segment has partially offset the decline in large systems and small government-subsidized systems, it has not yet offset the decline.

If we look at why the number of PV installations is decreasing, even for large roof and ground systems, even though the situation should have improved and bureaucratic hurdles should have been reduced, we can see the discrepancy between expectations and reality. Simplifying the rules is not enough if there are not enough staff to process the flow of project applications. For example, the time between submitting an application to the grid operator and receiving network approval has increased significantly instead of shorter in many regions. In addition, if the capacities in the low and medium voltage grid are exhausted and additional transformers or even substations have to be built, a major project can be postponed indefinitely.

And now we’re getting to the point where the survival of companies is in jeopardy. Especially in medium to large projects, the planning lead time is often enormous and personnel and sometimes materials must be pre-financed. However, the risk all too often lies with the project developer, because with current business models banks cannot do much beyond the legally guaranteed compensation. They need planning certainty, which is rarely provided, neither in the construction of the system nor in the subsequent sale of the energy it generates. The sword of Damocles of the temporary curtailment of the photovoltaic system now hangs over everything. If periods of negative electricity prices continue to increase in the future, there is a risk of economic damage.

The decline in PV installations, even for large rooftop and ground-mounted systems, highlights the gap between expectations and reality. Simplified rules are not enough if there are not enough staff to process the flow of project requests. In many regions, the time between applying to network administrators and receiving approval has increased. When the capacity of the low and medium voltage network is exhausted and new transformers or substations are needed, projects can be delayed indefinitely.

Companies now face existential risks. For medium to large projects, planning lead times are enormous and pre-financing of personnel and materials is common. However, project developers often bear the risk because banks demand planning certainty, which is rarely available during construction or energy sales. The possibility of temporary curtailment of the photovoltaic system threatens further economic damage, especially if periods of negative electricity prices increase.

The market’s recent rapid growth is now reversing, as companies that grew too quickly are struggling. The PV industry has always moved in waves, with booms followed by busts. The boom of 2022 and 2023 saw installations and prices rise, but now prices are correcting sharply, with expectations of a more modest growth trend returning.

This market consolidation mirrors what took place in early 2010. Companies with too high expectations fail because they have failed to remain flexible and adapt to changing circumstances. Companies must prioritize flexibility and invest in qualified personnel to manage increasing market complexity, rather than chasing every deal or focusing on short-term opportunities with little competition.

The number of bankruptcies in the photovoltaic market is increasing. Planners and installers are struggling with slow order inflow, investor hesitations and delays that are causing fixed costs to skyrocket. Wholesalers are burdened by excess inventory, while competition between suppliers – especially across borders – is becoming self-destructive. This wave of consolidation is likely to impact some producers, including those in China.

However, the upside of market consolidation is that stronger, more innovative companies will survive. Once the market stabilizes, communications and installation quality should improve. It is time to send positive signals to the market and the public to stimulate investments, restore confidence in future technologies and improve the order situation.

Price points differentiated by technology (as of October 15, 2024):

About the author: Martin Schachinger studied electrical engineering and has been active in the field of photovoltaics and renewable energy for almost 30 years. In 2004, he founded the online trading platform pvXchange.com. The company has standard components in stock for new installations and solar panels and inverters that are no longer produced.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content