Martin Schachinger, founder of pvXchange.com, said PV module prices will depend on national and international demand trends in the coming months, with outcomes ranging from increases to stagnation or further declines. Almost anything is possible, but nothing is certain.

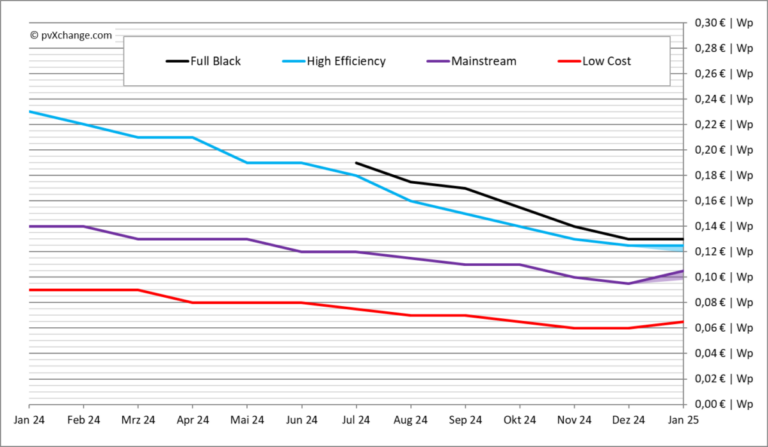

First of all, the good news: at the beginning of this year, module prices for high-efficiency products and other typologies remained stable. Even modules with an all-black appearance, which were reintroduced to the price index in January, see minimal price movement.

The upward trends in the lower price categories shown in the chart and barometer below result in part from updated typological classifications. Technological advances have shifted the boundary between high-efficiency and regular modules to 22.5%.

Now the bad news: as predicted in December 2024, product availability is deteriorating, especially for high-end PV modules. These modules, often reserved for large-scale projects or selected customers, remain in short supply.

Free inventory usually only arises when projects are postponed or canceled. Short-term access to certain inverters and storage systems is also problematic, forcing suppliers to propose alternatives. Post-holiday logistics challenges and a delayed restart of production at some manufacturers are exacerbating the situation. Chinese manufacturers in particular, in their attempts to combat destructive competition and overproduction within Europe, have created artificial shortages.

The year-end price crash in 2024 added to the complexity. In November and December, suppliers sold warehouse inventory at rock-bottom prices to clean up balance sheets, saturating the market with cheap inventory. With the first quarter generally quiet, demand for new goods remains weak, especially in Germany. Here, uncertainty surrounding potential government changes and the global implications of Donald Trump’s US re-election have stalled momentum.

The trajectory of module prices – whether they rise, stagnate or fall – largely depends on national and international demand in the coming months. Almost any scenario is possible, with no apparent certainty.

Changes in the module price index further complicate the picture. Modules with powers of 440 W and 575 W, which were considered rare and expensive six months ago, have now become standard products. The efficiency threshold for high-efficiency modules now starts at 22.5% or specific powers such as 450 W, 585 W and 700 W, depending on the size. However, manufacturers’ data sheets often exclude the frame area when reporting efficiency, leading to discrepancies. Suppliers typically charge more for higher performance classes, even if the production technology remains the same.

This reclassification has changed the prices. For example, January’s price for regular modules includes several performance classes previously classified as high efficiency. The regular index now reflects fewer low-cost modules, creating uncertainty visible in the shading of the accompanying graph. Using previous calculation methods, the regular price increase appears less dramatic, while prices for high-efficiency products have fallen moderately instead of stagnating.

All-black modules, which have been reintroduced into the price index after a hiatus since April 2022, show a slight price premium. Historically, these modules have had no price difference compared to black and white products. However, customer demand for aesthetics in residential installations has led to a price difference of a few euro cents per watt peak. For glass-to-glass modules, which are primarily manufactured on two sides, these premiums stem from the appearance achieved by printing on the back of glass, rather than the production costs.

Customers’ willingness to pay more for black modules may reflect the meticulous cell sorting required for a uniform appearance, although quality issues remain. The longevity of this premium remains unclear, but market observers continue to monitor price developments and engage manufacturers in addressing product quality issues.

Image: pvXchange

About the author: Martin Schachinger studied electrical engineering and has been active in the field of photovoltaics and renewable energy for almost 30 years. In 2004, he founded the online trading platform pvXchange.com. The company has standard components in stock for new installations and solar panels and inverters that are no longer produced.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content