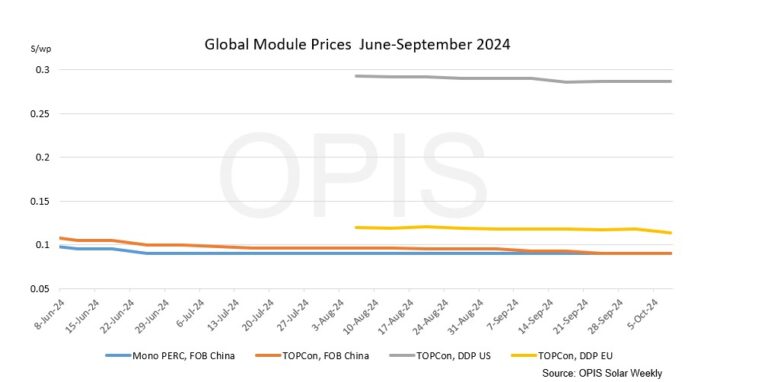

In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

FOB China: The Chinese Module Marker (CMM), the OPIS benchmark rating for TOPCon modules from China, was assessed at $0.090/W Free-On-Board (FOB) China, steady amid unchanged market fundamentals. Although the Chinese market reopened on Tuesday after the Golden Week holiday from October 1 to 7, trading activity remained subdued, with most market players expecting buying activity to pick up towards the end of the week.

Tradeable indications of $0.085-0.09/W FOB China were heard from the top 10 module vendors. Prices were expected to weaken in the coming weeks as module sellers began clearing inventories in October and rushed to secure final sales orders before the end of the year. October operating rates were expected to remain high throughout this period, a market source said. China could produce about 50 GW of modules in October, up from about 49 GW in September, the source added.

DDP Europe: TOPCon module prices decreased slightly week after week. OPIS estimated the average price at €0.104 ($0.113)/W, with indications still ranging between a low of €0.090/W and a high of €0.122/W. According to market participants, the DDP Eastern Europe TOPCon price would range between €0.090/W and €0.130/W. European sources reported TOPCon module prices for panels ‘Made in Europe’, between €0.20/W and €0.30/W.

Freight rates for the China/East Asia-Northern Europe ocean route were $5,074 per forty-foot equivalent unit (FEU). This equates to $0.0120/W, stable from week to week.

DDP US: The spot price for TOPCon modules DDP US remained flat this week at $0.287/W, with new year indications showing a slight increase to $0.297/W and $0.300/W in Q2 2025. The market continues to watch for policy news this fall, as new anti-dumping tariffs and proposed Section 301 tariffs on Chinese polysilicon and wafers could push prices higher.

A major North American solar developer said the proposed Section 301 tariffs on Chinese polysilicon and wafers could have a greater impact than the 50% tariff suggests as they would apply to both early steps in the supply chain and would join a litany of other applicable charges. The U.S. Trade Representative will comment on the matter through October 22.

The same source suggested that a 15 cent premium could be applied to domestic modules for the residential and commercial and industrial (C&I) sectors, while the utilities market may only sustain a 2 to 3 cent increase versus the import. The domestic content bonus will have a much higher added value for smaller projects, where the capital investments represent a higher percentage of the total costs, the source said.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content