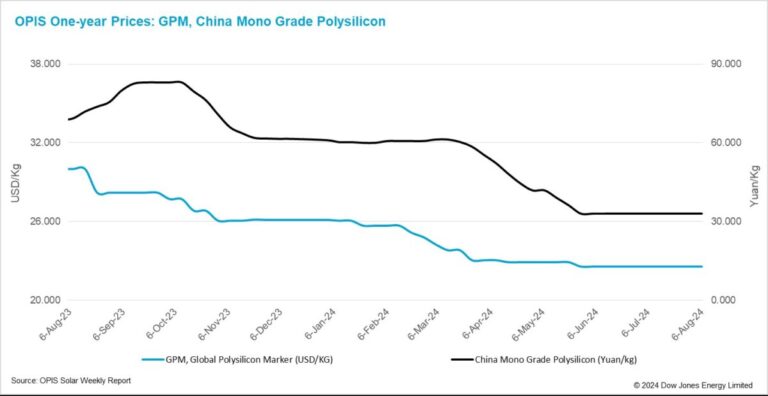

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was valued at $22,567/kg this week, reflecting stable market fundamentals.

Industry insiders in the global polysilicon market are currently rattled by news of a delay in preliminary ruling results from US investigations into imported cells and modules from four Southeast Asian countries.

According to a source, the deadline for the countervailing duty investigation, originally expected around July 18, has been postponed to September 30. The preliminary results of the anti-dumping investigation, initially expected in early October, are now expected to be postponed by a week, with the possibility of further extension until the last week of November.

Other sources agreed, with one noting that “being postponed until November is a high probability event.” It is highly likely that the US will wait until after the 2024 presidential election to release the specific results of the tariffs, the source added.

Another industry insider noted that the uncertainty surrounding large integrated manufacturers exporting modules to the US has prompted them to consider all possible ways to postpone their monthly purchases of global polysilicon committed to suppliers under long-term contracts during this period .

As a result, uncertainty about the activities of these large companies has also increased. “Given that the high gross margins of US module prices are currently the only significant source of potential profitability for supply chain manufacturers, they cannot afford to exit this market despite increasing trade barriers,” said an industry insider. The source added that more module manufacturers are reportedly delivering small module orders by making a deposit with US Customs during this period.

The global polysilicon market is poised to endure another two to three months of extended ‘winter chill’, a market observer concluded, noting that minimal price fluctuations are expected during this period due to subdued market activities.

One market observer offered a long-term perspective, suggesting that with the support of U.S. trade policy, global polysilicon demand should remain stable in the coming years. The next major factor likely to impact global polysilicon prices will be changes in the supply-demand dynamics between global polysilicon production and newly established production capacities outside China and the four Southeast Asian countries – a shift that may only become significant after a few years become.

China Mono Grade, OPIS’ assessment of mono-grade polysilicon prices in the country, remained stable this week at CNY33/kg ($4.60/kg), marking the tenth straight week of stability. China Mono Premium, OPIS’ price assessment for mono-grade polysilicon used for drawing N-type blocks, is reported at CNY39/kg ($5.44/kg). Sources indicate that Chinese polysilicon manufacturers are still struggling with continued production cuts and ongoing cash losses.

According to an upstream source, a major Chinese polysilicon producer with an annual capacity of 300,000 tons has only 13,000 tons planned for August. Similarly, another leading manufacturer of similar scale plans to produce 8,000 tonnes in August.

Recent market consensus suggests that polysilicon prices have bottomed out and are unlikely to fall further, leading to reports that wafer companies and traders are starting to stockpile polysilicon.

According to one market participant, wafer companies are increasing their polysilicon bids, and some with stable cash flows have expressed intentions to stockpile, although no concrete actions have yet been observed.

“A slight increase in supply from some polysilicon manufacturers has already been observed this week, although this increase has not yet affected actual transaction prices,” the source added.

Spot and futures traders have also increased their inquiries about polysilicon prices. Multiple sources told OPIS that China’s polysilicon will be listed on the stock exchange as a futures commodity in October. This development could prompt some traders to stockpile and build, potentially pushing polysilicon prices higher.

Nevertheless, according to a market survey by OPIS, there are still some industry insiders who are skeptical that listing polysilicon as a futures product will have a major positive impact on price growth.

“Given the current supply-and-demand scenario, I believe that listing polysilicon as a futures item will not result in a major price increase as the difficulty in driving up polysilicon prices is coupled with the challenge of reducing polysilicon inventories,” said a market source. commented. “Right now, the polysilicon inventory of 200,000 to 300,000 tons is huge, and it is unlikely that it would all be hoarded by dealers; Not to mention that polysilicon production is still ongoing.”

Another market source offered a different perspective, noting that the success of listing polysilicon as a futures commodity also depends on support from major polysilicon producers. If current low prices persist, these leading producers could potentially push smaller competitors out of the market. However, listing polysilicon as a futures commodity could absorb excess production capacity, potentially leading to a price rebound and providing a lifeline to smaller producers – a scenario that major producers are currently reluctant to support.

In the early stages of listing a product as a futures item, market operations are often underdeveloped, one market veteran noted, adding that this is especially true for polysilicon, a commodity with only a few market participants and easily manipulated prices. “Given the current inactivity in the polysilicon market, it may not be the ideal time for a futures commodity launch, and so a major price shift is not forecast,” the source concluded.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.