In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

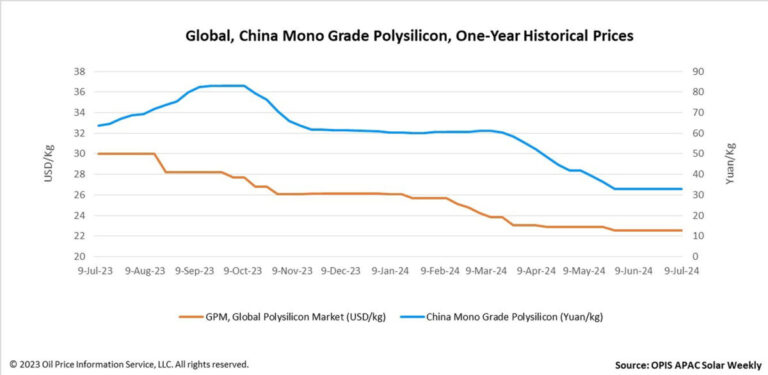

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was valued at $22,567/kg this week, unchanged from the previous week, on buy-sell indications.

A source familiar with the global polysilicon market noted that spot polysilicon has been largely unsold for two months, while lower-quality materials are underperforming.

However, the global polysilicon suppliers are reporting no production reduction so far, and customers who have long-term agreements with the suppliers are still under some pressure and have purchased goods at relatively stable prices. “Signing a long-term agreement is intended to protect the interests of both parties. Shifting all risk to one party to avoid risk entirely is a practice that misses the spirit of a contract,” said a supplier source.

According to a China-based source, a Chinese wafer manufacturer, which maintains a low operating rate of 30% domestically, is sending wafer cutting equipment to Laos and may consider adding ingot capacity there in the future. This development points to potential new sales channels for global polysilicon.

Due to reduced production of solar products in four Southeast Asian countries, current production of ingots, which require polysilicon globally, can only consume less than 1,500 tons of these materials per month, the source said. The source also noted that the production capacity of newly built block factories outside these countries is insufficient to fully stimulate global polysilicon demand.

“We believe that production capacity of blocks outside China and the four Southeast Asian countries will flourish in the coming years, introducing new factors that will influence global polysilicon prices,” said a market observer. However, the source also noted that US trade policy will remain a crucial determinant of global polysilicon price trends over the next two years.

China Mono Grade, OPIS’ assessment of polysilicon prices in the country, remained stable this week at CNY33 ($4.54)/kg, marking the sixth consecutive week of stability.

According to a market source, major polysilicon manufacturers halting price cuts have helped stabilize regular market prices. The source added: “There is a high probability that polysilicon prices will stabilize at this current low in the near future.”

According to an upstream source, a major manufacturer with strong financial backing and a fast business pace is actively ramping up its new annual polysilicon production capacity of 200,000 tons in Yunnan. In addition, their new 200,000 tonne polysilicon plant in Inner Mongolia is currently under construction and is expected to be operational in the fourth quarter of this year.

“However, we can expect some obstacles to the progress of this Inner Mongolia project due to the current market downturn,” said a market veteran.

Another market observer noted that despite lower production costs for fluidized bed reactor (FBR) granular polysilicon, manufacturers are currently unable to maintain high operating speeds due to the product’s market share limitations. “There are two FBR granular polysilicon manufacturers in China engaged in production and sales, while another manufacturer operates a research and development pilot production line,” the source added.

One market participant concluded that based on current business figures, an effective reduction of polysilicon inventories by the end of the year appears to be a challenge. Further declines in polysilicon production are expected for the second half of the year.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content