In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

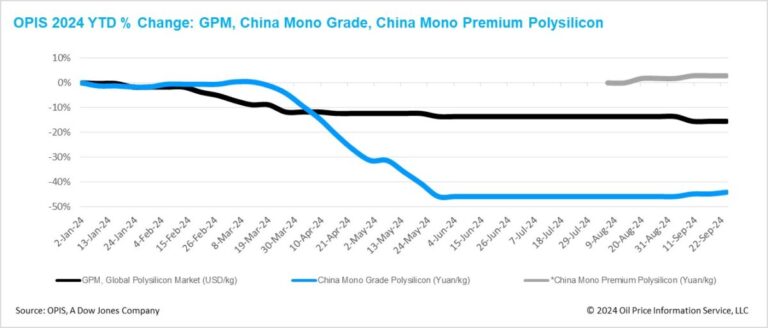

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was valued at $22,068/kg this week, unchanged from the previous week, on buy-sell indications.

The long-awaited preliminary ruling from the American investigation into solar cells and modules imported from four Southeast Asian countries has been officially postponed until November 27 at the latest. The deadline for the final rulings remains 75 days after the preliminary ruling, although an extension is possible.

The uncertainty over tariffs during this period has been described as ‘dangerous’ for global polysilicon suppliers. Reports show that suppliers are relying on long-term contracts to maintain price stability and offset financial losses from the first half of the year.

Accordingly, reports indicate rising purchasing volumes and reduced pressure on price negotiations from major global polysilicon buyers, who had previously halted spot purchases and deferred monthly deliveries under long-term contracts. Insiders interpret this as a response to increased legal pressure from suppliers to enforce contract compliance.

Another policy update, while not directly related to global polysilicon capacity, could potentially impact the future layout of global polysilicon capacity. Starting on September 23, the US Trade Representative opened a docket to gather feedback on proposed 50% Section 301 tariffs on polysilicon and wafers from China, closing the comment window on October 22.

While this will have minimal impact on current international trade patterns in the solar energy sector, continued trade barriers could further encourage the growth of polysilicon and wafer production outside of China, potentially changing global supply and demand dynamics for polysilicon.

China Polysilicon: China Mono Grade, OPIS’ assessment of mono-grade polysilicon prices in the country, remained stable this week at CNY33.625 ($4.80)/kg. China Mono Premium, OPIS’ price assessment for mono-grade polysilicon used for the production of N-type ingots, also remained stable at CNY 40.125/kg, unchanged from the previous week.

Market insiders generally agree that polysilicon prices in China have bottomed out and are now expected to see a slow, periodic rebound. However, these increases are driven more by commercial strategies than by supply-demand dynamics. Large producers could limit their financial losses, while less competitive producers could manage to extend their survival during these potential price increases.

The process of clearing excess capacity in the polysilicon segment is progressing slowly. Sources indicate that polysilicon production for September is expected to be around 130,000 tonnes to 140,000 tonnes, while estimated wafer production for the month suggests polysilicon demand of less than 100,000 tonnes. In addition, a major manufacturer is expected to bring new production capacity online in the fourth quarter.

Another challenge in clearing excess capacity is the likelihood that polysilicon will be officially listed as a futures commodity in October or November. Reports indicate that some traders have begun building warehouses to store goods for futures trading; However, there is little evidence that major producers or buyers are actively participating in this development.

The current excess supply of polysilicon has merely shifted from manufacturers to buyers, and achieving a healthy balance between supply and demand in China will take quite some time.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content