New U.S. incentives are supporting solar manufacturers and encouraging domestic build-out of the earlier stages of the solar supply chain.

The US Inflation Reduction Act of 2022 sets out the question supply-side incentives to encourage solar energy production in the United States in the form of production tax credits for manufacturers and investment tax credits for developers using domestic content.

Although these incentives have led to a rush of investments Among major global solar component suppliers, a large portion of investment is focused on the final parts of the solar supply chain. Now these incentives are moving further up the supply chain as the final rules for the Advanced Manufacturing Investment Credit (CHIPS ITC) have been released by the The United States Department of the Treasury and the Internal Revenue Service.

The Treasury Department said the CHIPS ITC is “generally equal to 25% of the basis of each qualified property that is part of an eligible taxpayer’s advanced manufacturing facility if the qualified property is in use after December 31, 2022 is taken, and relates to construction work taking place after the entry into force of the CHIPS and Science Act on 9 August 2022.”

Treasury Secretary Janet L. Yellen said the Biden-Harris administration’s economic plan focuses on bringing semiconductor manufacturing back to the United States and promoting innovation in this important sector.

“Semiconductors are essential to ensuring a stable supply of low-cost consumer goods and our investments continue to strengthen those supply chains, create good-paying jobs and safeguard our national security,” Yellen said.

According to the Solar Energy Industries Association (SEIA), the Treasury Department’s final regulations confirm that Section 48D applies to advanced manufacturing facilities and equipment that produce semiconductors, including the cutting, etching and bonding of the semiconductor-grade polysilicon used in PV modules is used.

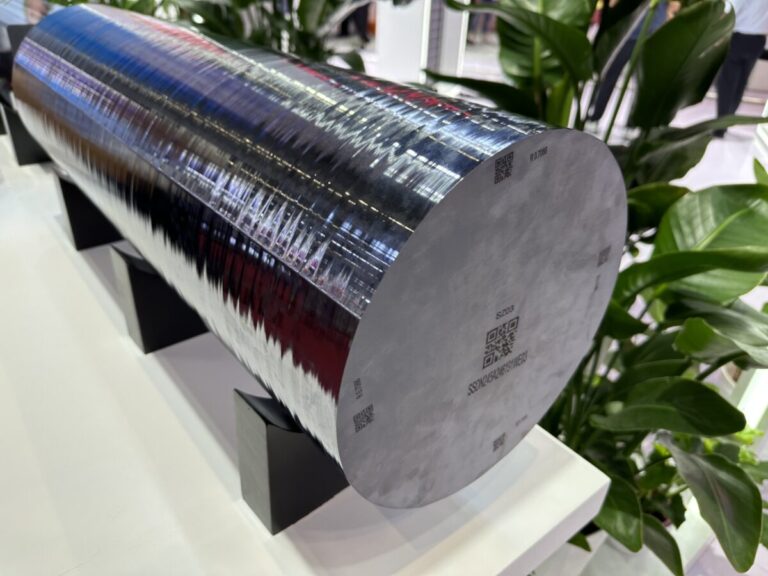

The news is welcome as the U.S. solar industry is trying to build a complete solar supply chain, but has not yet produced enough blocks and wafers to match planned cell and module capacity. SEIA notes that this has been the case since the adoption of the IRA 21 GW of wafer announcements and 10 GW of blocks, but only 3.3 GW of blocks and wafer capacity is under construction.

“The Treasury Department’s final rules will create new opportunities for solar manufacturers and encourage upstream development of the solar supply chain,” said Abigail Ross Hopper, president and CEO of SEIA.

Hopper pointed out that the supply chain remains a challenge in the United States, and that the lack of ingot and wafer production “represents a critical gap in the solar supply chain… Over the past two years, SEIA has urged the government to all the tools it has to support the production of blocks and wafers. We commend the Treasury Department for its thoughtful approach to industrial policy, which is helping to revitalize our communities with good-paying manufacturing jobs and increase our energy independence. This is a win-win for businesses and our economy and will continue America’s manufacturing renaissance for years to come.”

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.