The National Energy System Operator (NESO) has released the provisional T-4 capacity market auction results for delivery in 2028/2029.

The T-4 auction was closed at 11.30 am yesterday (11 March) and 43.1 GW was obtained in 669 capacity market units (CMUs). The auction was released for a price of £ 60/kW/year, at the all times of last year all times high clearing price of £ 65/kW/year.

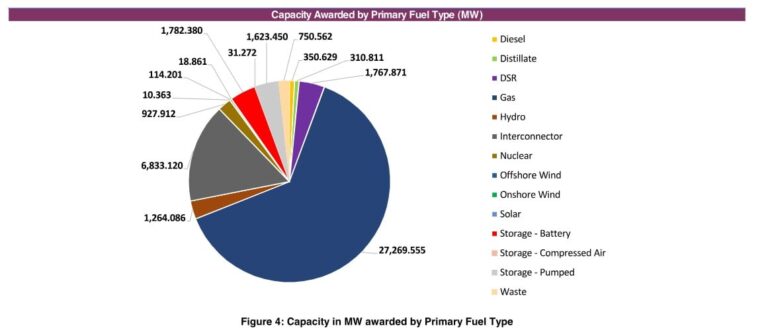

About 18.861 MW of capacity was awarded for solar generators, in 12 market units, while 111 Battery Energy Storage System (Bess) CMUs received a total of 1,782 GW capacity. Bess represents 16.59% of all total capacity granted in this auction. Pumped storage was awarded 3.77% of the total capacity granted in this T-4 round, at 1,623 GW over eight cmus. In the meantime, 17 Bess CMUs, who represent 182 MW capacity, left the market in this auction round.

Of the existing generating CMUs for energy storage activa, 21 MW capacity was awarded to 1 hour of assets, 4.4 MW was awarded to 2 hours of assets, 2.23 GW was awarded to a 12-hour pump pumping project of Drax over two CMUs, while 1.4 GW was allocated to a 9-hour durn-storage.

For new Build generation CMUs, 0.785 MW capacity was obtained for 1 hour of assets, 80.7 MW was obtained for 1.5 hours of assets, while 781 MW-in a total of 1.82% of all sold capacities for assets of 2 hours. Longer storage projects for the duration make an increasing dent in capacity market auctions, with a total of 404 MW capacity protected for 4-hour endurance projects, 189 MW protected for 5-hour endurance projects, 31 MW protected for projects of 6 hours and almost 240 MW protected for 8-hour endurance projects.

Spotlight on Fidra Energy

One of the biggest successes in this year’s T-4 auction came for Fidra Energy, who won 15-year prizes for his 1.4 GW Thorpe Marsh and 500 MW West Burton C BESS projects. Both projects are expected to become operational in 2027; Once operational, the Thorpe Marsh project will be the largest battery project in the UK.

Chris Elder, Chief Executive Officer of Fidra Energy, said: “The capacity market auction is an important part of the energy market of the VK and the income it offers, renewable generation and storage companies offer the confidence to invest in the British market. Saving a record-breaking capacity market price for new battery energy storage projects is a proud moment for us and proof of the strength of the British BESS market. “

Walid Mouawad, director and co-head of energy transition at Institutional Investor Eig, who offers financing for Fidra Energy, added: “The success of Fidra in the capacity market auction is proof of the growing role of large-scale battery storage in the energy transition of the VK.

“These projects will offer the grid critical flexibility and ensure that a stable and reliable food expands the renewable generation. It is proud to support the development of these transforming assets, which strengthens our dedication to promote the future of the UK Clean Energy. “