High interest rates, excess inventory in warehouses and falling parts prices have created a perfect storm for solar distributors since October 2023. Frank Jessel, CEO of BayWa re Solar Trade, explains how the industry can embrace true digitalization to better navigate this volatility.

From pv magazine 24/10

Normalized solar demand after June 2023, following previous peak years, meant solar equipment distributors faced high inventory levels as prices fell.

While the solar industry is expected to grow 7.31% annually through 2029, module prices have continued to decline. New ways must be found to deal with fluctuating prices and inventories.

BayWa re’s Solar Trade team has sold more than 10 GW of modules and inverters in 2023. But we must also ask ourselves what the market looks like for the second half of 2024 and what lessons have we learned from these rapidly falling prices?

Moving parts

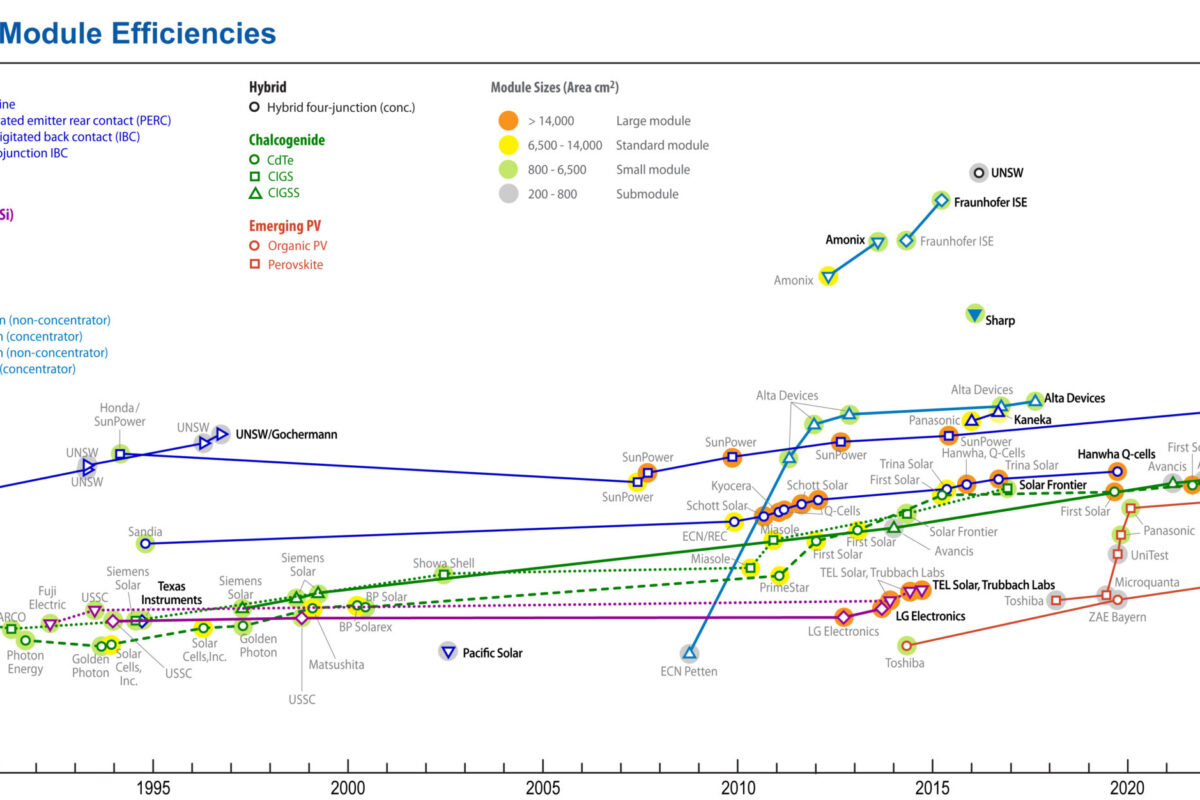

Predicting the development of module prices is a difficult task for wholesalers. Different solar cell and module technologies mean there are multiple price fluctuations that need to be managed and monitored. For example, negatively doped ‘n-type’ solar panels have become more popular due to their longer lifespan and resistance to light-induced degradation, compared to the previous generation of positively doped ‘p-type’ products. As a result, prices for N-type solar panels have stabilized at a higher level.

P-type modules have a lower price. Companies are trying to reduce excess inventory in the market, leading to distress sales. This poses a challenge when prices can hardly be reduced further if profits need to be made. For example, now that module prices have fallen by up to 50%, this means we have to sell twice as much to make the same gross profit.

Prices for inverters and energy storage systems have now started to fall. Due to excessive demand, some installers built up their inventory when inverters were scarce. Here too, distributors will have to wait patiently until these inventories are reduced. Only then will the normal rhythm of the market return. Inverter manufacturers will make offers to boost sales, including cashback and promotional offers, but the real market opportunity will only become apparent when installers are ready to buy again.

Companies would be wise to look for ways to manage their inventories – and therefore their capital – more efficiently. Digitization is one method.

Efficiency gains

In solar energy distribution, any process that can be made digital should be. Compared to the automotive industry, our sector has much more room for improvement. In a survey conducted by professional services firm EY, approximately 89% of energy professionals cited skills gaps as the top challenge for accelerating digital technology adoption. It was encouraging that the European Union launched the Large-scale Skills Partnership in December 2023 to help tackle this problem, but more efforts will be needed to unlock true digitalisation.

The kind of digitalization needed goes far beyond e-commerce. It affects all our internal processes and our connections with suppliers. For example, if orders and deliveries are automated, we can use our warehouses – and therefore our capital – much more efficiently. Manufacturers, in turn, can plan their production better. Selling more goods requires more hands, but digitalization can ensure that those hands do high-level work and that we hire people for optimal impact.

At BayWa re Solar Trade, more than half of all transactions will be processed digitally by 2023. In Switzerland this figure was above 80%, which is the benchmark for us internally. I expect this percentage to increase in the future and that our Swiss distribution company will digitally map approximately 90% of its internal business processes in the areas of sales, processing and planning. This is critical because it frees up the sales team to focus on more important tasks, such as maintaining customer relationships, selling new products, and exploring promising future markets. This last strategy is crucial as more and more regions worldwide become interested in PV.

Ultimately, digitalization not only benefits workflows, but also business results. Investments in this area allow us to reduce our supply of solar panels to just 60 days. This means that we fully convert our module warehouses six times a year, allowing us to offset any price drops and make optimal use of capital. We can only achieve this high level of efficiency through a combination of first-class talent and investments in digitalization.

Optimistic view

There is no denying that high interest rates and falling component prices are having a significant impact on global markets, hitting distributors of different sizes in different ways. A solid digital foundation can help organizations remain agile amid global market challenges and continue to meet demand without major changes to the structure of their business model.

The market recovery hoped for in the second half of 2024 has not yet materialized, but with flexibility, smart problem solving and the deployment of new technology, the challenges of 2024 and the “perfect storm” of solar pricing issues can be overcome overcome. and paves the way for a robust start to an optimistic 2025.

About the author: Frank Jesselbased in Tübingen, Germany, became CEO of BayWa re Solar Trade Holding in 2024, after serving as director of the division for eight years. He has been working at BayWa re for almost twenty years.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content