In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

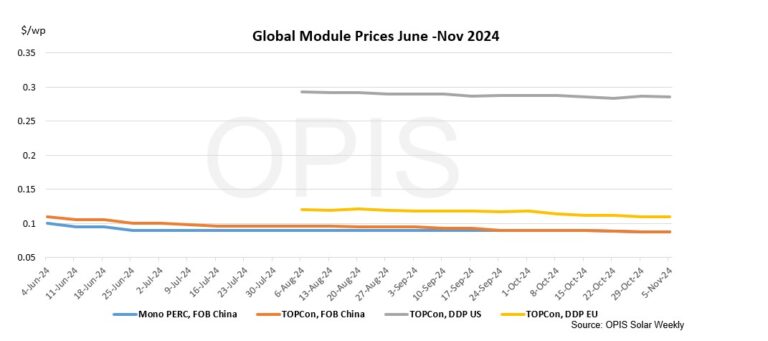

FOB China: The Chinese Module Marker (CMM), the OPIS benchmark rating for TOPCon modules from China, was steady at $0.087/W Free-On-Board (FOB) China, with price guidance between $0.085-0.095/W on an FOB basis.

Spot prices have fallen in recent weeks as manufacturers push to clear ‘old stock’ before the end of the year. According to a module buyer from Southeast Asia, several manufacturers are clearing their inventories before launching new module specifications for 2025. The average module price in October was $0.089/W, down 4.3% month over month, according to OPIS data.

“We expect prices for delivery in 2025 to become even lower as demand remains weak and inventory levels remain high,” a Tier 1 module seller told OPIS. The seller noted that declining demand for upstream solar cells could put further pressure on cell prices or at least prevent a near-term increase.

DDP Europe: Prices for TOPCon modules have fallen slightly, while overproduction of Asian modules remains high and European demand remains flat. OPIS estimated the average price at €0.101/W, a decrease of 0.98%, with indications ranging between a low of €0.080/W and a high of €0.120/W.

Freight rates for the China/East Asia-Northern Europe ocean route fell another 1% to $3,489 per forty-foot equivalent unit (FEU). This corresponds to $0.0083/W.

Freight rates for Asia-Northern Europe and the Mediterranean closed 30% lower in October than a month ago and have bottomed out, according to market observers.

DDP US: Prices have fallen slightly this week, with OPIS assessing the spot price for utility-scale TOPCon modules DPP US at $0.285/W, while past indications show the price slightly higher in Q1 2025 at $0.296/W and Mono PERC modules for the same delivery time at $0.284/W.

Sources say additional guidance on the domestic content bonus is expected by the end of the year. A utility-scale deal that assembled TOPCon modules with U.S.-made cells (manufactured with imported wafers) closed for $0.45/W with delivery of the modules in June or July 2025.

Last week, the agency adjusted the CVD rate for Jinko’s subsidiaries in Malaysia from 3.47% to 9.92%, and the “all others” rate from 9.13% to 12.32%, after issuing a “ministerial error” in his calculations. Following new allegations of subsidy from petitioners, the DOC is now also investigating the “cross-border” supply of silver paste and solar glass in Southeast Asia.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content