In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

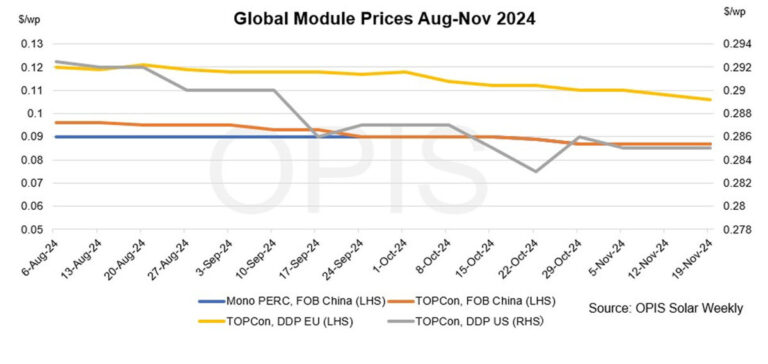

FOB China: The Chinese Module Marker (CMM), the OPIS benchmark rating for TOPCon modules from China, was steady at $0.087/W Free-On-Board (FOB) China, with price guidance between $0.085-0.095/W.

Several Tier 1 manufacturers have increased their offer prices following news of the reduction of the export tax credit for photovoltaic products from 13% to 9%, effective December 1. The affected products include monocrystalline silicon wafers with a diameter greater than 6 inches (15.24 cm) and photovoltaic cells, both assembled and disassembled into modules.

A top five Chinese manufacturer told OPIS that the lower discounts have led to contract renegotiations, although the full impact is still being assessed. Meanwhile, another industry source suggested that a cut in discounts is unlikely to alleviate China’s oversupply problem as manufacturers could pass on the extra costs to buyers.

In other policy updates, the Brazilian government has increased import duties on out-of-quota photovoltaic cells assembled into modules from 9.6% to 25% for certain companies. However, the rate within the quota will remain at 0% until June 30, 2025.

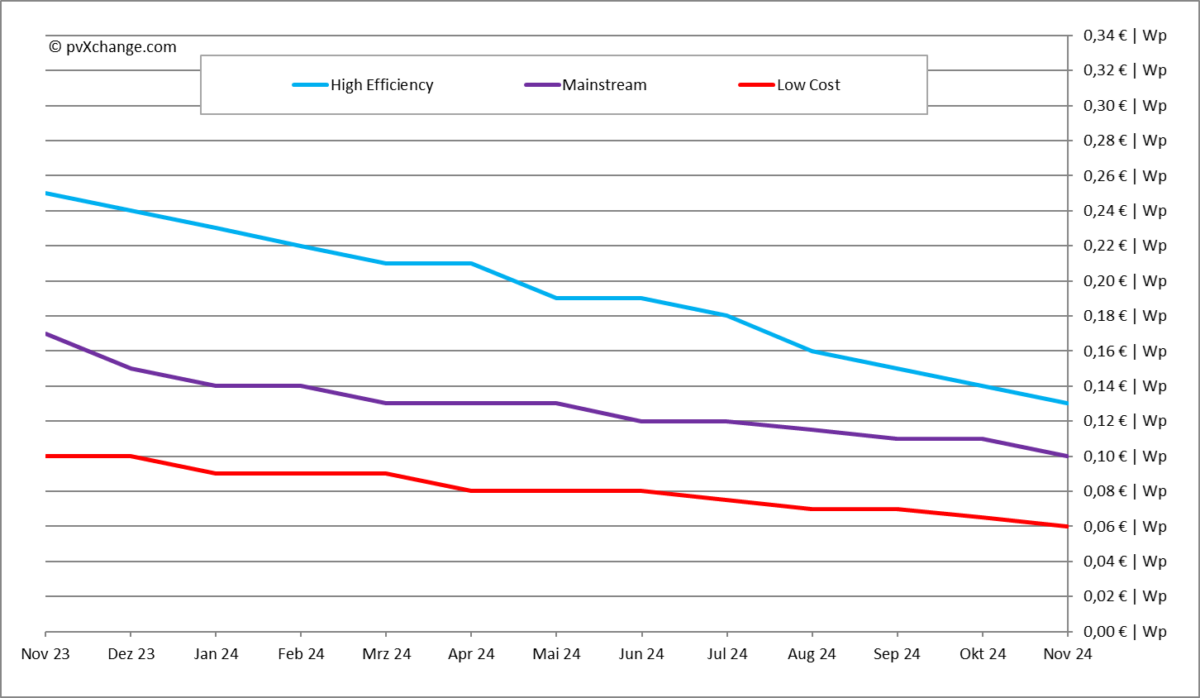

DDP Europe: TOPCon module prices decreased by 0.99%, with average values of €0.100/W and ranging between a low of €0.080/W and a high of €0.115/W for Tier 1 panels.

According to sources, prices from sellers who want to ‘rapidly reduce their inventories’ have reached a new low of €0.055/wp, and even exceeded the threshold of €0.06/wp.

Freight rates published by Drewry for the China/East Asia-Northern Europe route rose 2% this week to $4,043 per forty-foot equivalent unit (FEU). This corresponds to $0.0095/W.

DDP US: Prices are stable week on week, with OPIS assessing the spot price for utility-scale TOPCon modules DPP US at $0.285/W, while past indications show the price in the first quarter of 2025 to be slightly higher at $0.296/W and Mono PERC modules for the same delivery time for $0.284/W.

While the industry continues to absorb news of Donald Trump’s victory and its implications for future US energy policy, the import market is largely quiet. A key developer source said the spot price for utility-scale TOPCon modules continues to hover around $0.22-0.23/W for delivery from Indonesia and Laos, $0.25-0.26/W from India and $0.28-0 .30/W from Vietnam, Malaysia, Cambodia and India. Thailand.

An installer source said prices for residential Mono PERC modules assembled in the US with imported cells range from the high $0.20/W to mid $0.30/W. The source is currently evaluating a deal to acquire U.S. modules from a Tier 1 manufacturer by 2025 at a price of around $0.20/W.

The same source said they continue to see bargain prices for residential modules from Southeast Asia with prices in the high teens to low $0.20/W as manufacturers continue to try to sell off their inventory, adding that many of the lower priced goods are saddled could be subject to tariff risks. until the December 3 usage deadline.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content