In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

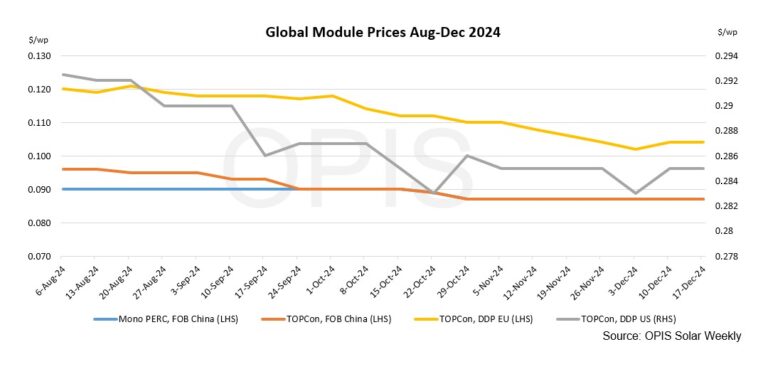

FOB China: The Chinese Module Marker (CMM), the OPIS benchmark rating for TOPCon modules from China, remained stable this week at $0.087/W Free-On-Board (FOB) China, with price indications between $0.083-0.095/W.

The module market continues to stagnate as the industry digests the impact of the recently signed “self-regulation agreement” by more than 30 Chinese solar companies, which aims to stabilize prices by controlling supply.

“Most module manufacturers are now likely to be running at 50-70% operating speed, compared to 80% last year. Weak demand continues to drive lower prices,” said a producer.

Despite these efforts, prices show little sign of recovery. A top five module manufacturer told OPIS that “strong selling pressure” and the need to clear old inventories are preventing any meaningful price increase at least through the first half of 2025. Although manufacturers are encouraged to operate at reduced capacity in the coming months , Market sentiment indicates that high inventory levels and slower sales may continue to keep prices low.

DDP Europe: TOPCon module prices increased by another 1.00%. OPIS estimated the average price at €0.099 ($0.102)/W, with indications ranging from a low of €0.075/W to a high of €0.115/W for Tier 1 panels.

According to sources, sluggish European demand for modules and the severe sell-off in recent months have increased downward pressure on prices. However, they expect that there could be a slight increase in DDP Europe panel values by the end of December.

Freight rates published by Freightos for the China/East Asia-Northern Europe ocean route fell 5.13% to $5,051 per forty-foot equivalent unit (FEU). This corresponds to $0.00126/W.

DDP US: Prices are stable this week, with OPIS continuing to rate the spot price for utility-scale TOPCon modules DPP US at $0.285/W. Future indications show that the price for delivery in the first quarter of 2025 will be $0.293/W and Mono PERC modules for the same delivery period will be $0.282/W.

Developers continue to rush to stash module inventory before the new year to secure their projects’ 2024 eligibility for the ITC, fearing changes to the incentive under the new Trump administration. One source noted that any company placing orders in the coming weeks should also receive delivery within three and a half months. A distributor source said he is moving inventory quickly, but said if a change to the ITC is made next year, developers should have time until the new tax law takes effect — possibly later in the year — to determine eligibility secure their projects before 2025.

Price increases related to the DOC’s interim anti-dumping determination in late November continue to dominate market conversations. A distributor source told OPIS that their customer received approximately $0.41/W for utility-scale TOPCon modules in the first quarter from a supplier affected by a high cash deposit rate.

While it is widely expected that non-subject companies will also raise prices to take advantage of the situation, some sources are skeptical. One major developer said there is sufficient operational capacity outside the four countries involved – and in the US – to meet around 40 GW of annual demand. And since most major suppliers have already made plans to open cell factories outside the region, the pain will likely be short-lived, he said. One distributor told OPIS he had seen a price increase of a few cents from Indonesia and Laos, but given prices were hovering in the high teens and low 0.20s before preliminary determinations, it didn’t register much.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content