In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

In the Chinese marketThe majority of OPIS module sellers surveyed said the TOPCon FOB China market was calm and prices were stable, although there were some buyers in the market who talked down prices. Market talk of TOPCon prices below $0.09/W FOB China circulated the market, with one buyer pointing out that there were offers of TOPCon class A loads rated at 580-585 W, with load sizes above 10 MW being offered for $0.081. -0.086/W. However, sellers surveyed by OPIS said no transactions have taken place at this level.

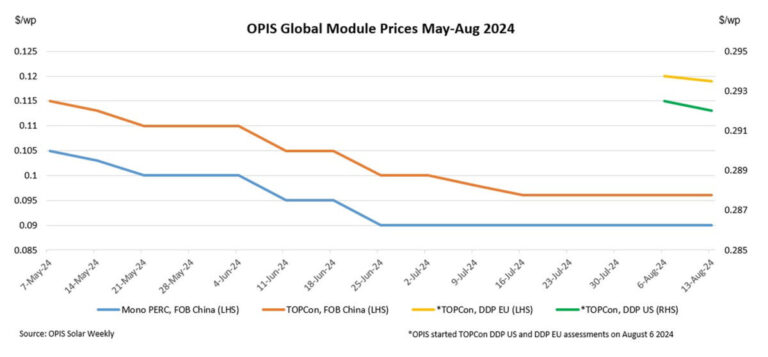

Most market discussions were still at $0.095-0.10/W FOB China. The Chinese Module Marker (CMM), the OPIS benchmark rating for TOPCon modules from China, was assessed at $0.096/W, unchanged from the previous week, while prices for Mono PERC modules were assessed stable from week to week at $0.090/W.

Bearish sentiment prevailed in China’s domestic market as recent large-scale public tenders, such as China Coal Group’s 4 GW tender, had attracted low bids of CNY 0.7134 ($0.100)/W for N-type modules and CNY 0 .7104/W for P modules. type of modules with many market participants expecting module prices to drop to the CNY0.70/W level in the coming weeks, an industry source said. Mono PERC module prices were estimated at CNY0.777/W, stable from the previous week, while TOPCon module prices were assessed unchanged from week to week at CNY0.801/W.

In the European marketOPIS rated the TOPCon modules delivered in Europe this week lower at €0.109 ($0.12)/W, with indications ranging from €0.100/W to €0.120/W. While delivered prices have fallen in recent weeks due to a seasonal break, a market source noted that August freight rates are still hovering at high levels compared to previous months.

According to OPIS data, freight rates from China to Rotterdam in August are approximately $7,000 to $8,000 per forty-foot equivalent unit (FEU), approximately $0.0189/W to $0.0192/W, which is 30% higher compared to June. According to a European trade source, the supply of TOPCon modules until the second quarter of 2025 was approximately €0.100/W to €0.110/W, depending on the project size.

In the American market, spot prices for US-delivered, duty-paid (DDP) TOPCon modules fell to $0.291/W this week, with indications of $0.260/W to $0.320/W, while prices for first quarter 2025 delivery average $0.311/W ranging between $0.280/W and $0.350/W. OPIS estimated US mono PERC Q4 delivery module prices at $0.249/W, with indications between $0.200/W and $0.295/W, while 2025 delivery loads were around $0.27-0.34/W.

A major US buyer said prices of TOPCon modules from India and Southeast Asia, which will ship this year, have recently fallen. Another North American source noted that concerns among developers are increasing as fall approaches, especially about increased rate risk from Southeast Asia. Trade officials significantly expanded the scope of AD/CVD investigations this spring, increasing the likelihood that anti-market behavior will be found in the four target countries. The White House has yet to clarify whether there will be technical waivers or grace periods.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired price data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content