In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

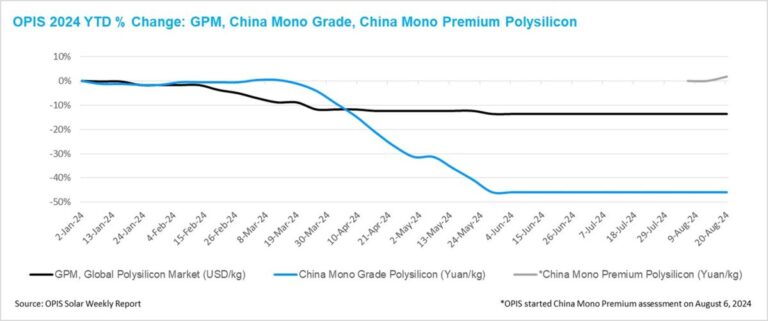

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was valued at $22,567/kg this week. This is unchanged from the previous week, as the fundamentals of this market segment remain largely stable for now.

Wafer factories in Southeast Asia have reportedly ramped up operations recently, with the aim of diverting these wafers to countries in the region beyond the four countries currently under investigation by the US, where they are processed into cells and modules intended for sales in the US market.

This trend has not led to changes in global polysilicon transaction prices. A Southeast Asian wafer manufacturer said it prefers to buy polysilicon from traceable regions in China to reduce costs. Furthermore, current global supplies of polysilicon, built up from a sluggish spot market, are sufficient to meet the slight increase in demand resulting from higher wafer production rates in Southeast Asia.

The fire caused by a pipe explosion at a global polysilicon factory last week has attracted a lot of attention in the market. However, market participants agree that the incident will have a limited impact on the plant’s production capacity and is unlikely to affect global polysilicon prices.

This is partly because the manufacturer is holding excess inventory after a customer postponed some regular monthly orders under a long-term purchasing agreement, a market source said. In addition, ongoing uncertainty surrounding U.S. investigations into imported cells and modules from four Southeast Asian countries continues to subdue global polysilicon demand, further minimizing the potential impact on prices.

China Mono Grade, the OPIS rating for mono-grade polysilicon prices, remained stable this week at CNY33 ($4.62)/kg, marking twelve consecutive weeks of stability. Meanwhile, China Mono Premium, OPIS’ price assessment for mono-grade polysilicon used in drawing N-type ingots, rose 1.79% from last week to CNY39.7 ($5.56)/kg.

The rise in prices of polysilicon used in drawing N-type ingots has been attributed partly to a few wafer mills replenishing their polysilicon supplies after depletion, and partly to futures and spot traders accumulating polysilicon in preparation for its possible listing of it as a futures item.

Major polysilicon giants, with their cost advantages and control over much of the market supply, are increasingly demonstrating strong pricing power in the Chinese market. While smaller companies produce at limited production rates, their regular customers now turn to these large factories for spot purchases, further strengthening the giants’ influence on prices.

With the dry season approaching in two months in Sichuan and Yunnan – regions that rely on hydropower and are home to many polysilicon factories – rising electricity costs are expected to drive up production costs. This will likely make it even more difficult for smaller, shuttered polysilicon companies to resume operations, increasing the pricing power of the big producers.

One market observer suggested that polysilicon giants could continue to raise their prices, to a potential level of around CNY50 ($7.01)/kg, slightly above their production costs. However, this level remains well below the cost threshold for smaller producers and is unlikely to stimulate the reopening of closed small factories.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content