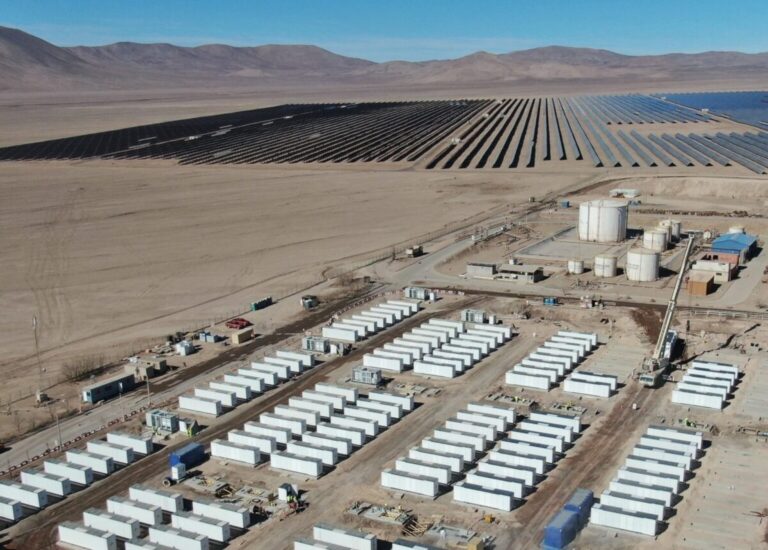

The Tamaya BESS will have 152 battery containers from Sungrow

Image: Engie

By ESS news

Battery and cell makers have had a tough 2024 so far, with declining margins and revenues due to slower-than-expected global sales of electric vehicles (EVs), driving down volumes.

However, BloombergNEF (BNEF) reports that the stationary storage market is up 61% and prices for turnkey systems are down 43% from 2023, part of driving that deployment. In April, this figure was at a record low of $115/kWh for two-hour energy storage systems.

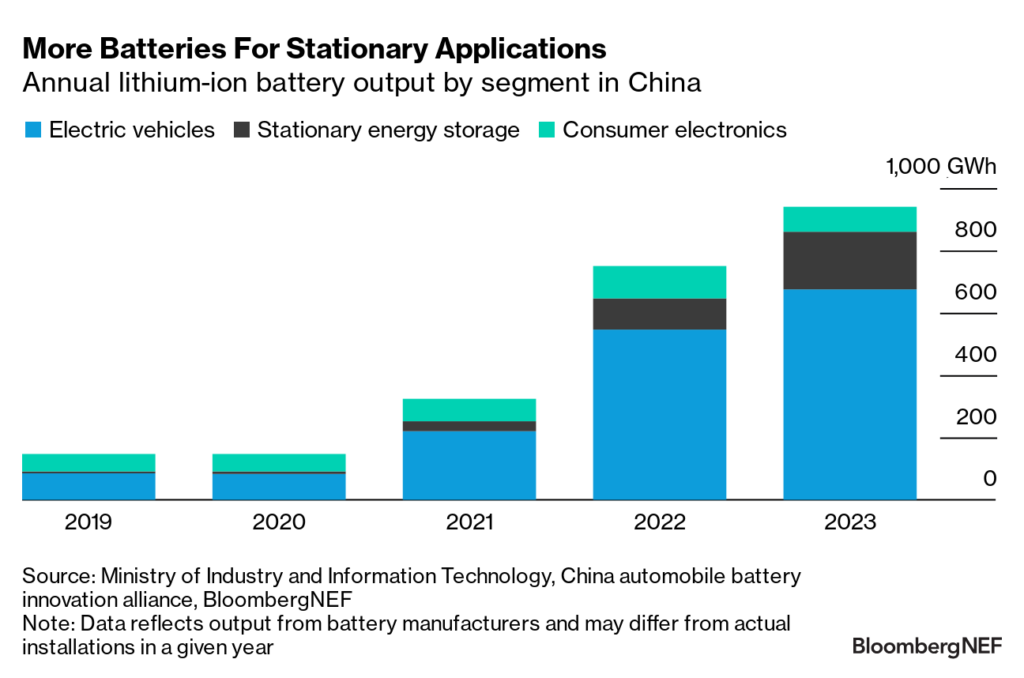

By looking at the annual production of lithium-ion batteries from Chinese manufacturers and assigning them an application, stationary energy storage has overtaken consumer electronics as the second largest application for battery production. The global market for stationary energy storage will almost triple by 2023.

Even combined, they were both far behind electric vehicles. However, BNEF points out that the ratio of demand for EV batteries to demand for stationary batteries has fallen from 15 to 1 to 6 to 1 over the past four years:

However, growth in the segment is much faster than EV battery growth, from a smaller base, and forecast demand shows the segment continues to grow rapidly. This is partly due to mandates in China for co-location with solar and wind energy for storage, plus the US Inflation Reduction Act, and measures being introduced in Europe, Japan and Latin America, among others. Germany and Italy are leaders in the housing market.

In chemicals, BNEF expects NMC to have a market share of only about 1% in 2030 as cheaper and potentially safer LFP chemicals take market share.

To read further, visit our ESS news website.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content