The US energy storage market saw significant growth in the second quarter, with the network-scale segment leading the way with deployed capacity of 2,773 MW and 9,982 MWh.

According to the latest report from the American Clean Power Association (ACP) and Wood MackenzieUS Energy Storage Monitor” According to the report, every segment of the market saw growth in the second quarter over year-ago totals, with the community and commercial sector (CCI) up 61% to 87 MWh and residential up 12% to 423 MWh. A total of 3,011 MW and 10,492 MWh were deployed in the market, the second highest quarter ever after the fourth quarter of 2023, with 13,437 MWh.

California, Arizona and Texas accounted for 85% of installations.

“This quarter showed tremendous growth compared to year-ago levels and the grid-scale segment remains the key driver,” said Vanessa Witte, senior analyst with Wood Mackenzie’s energy storage team. “The community also performed strongly. And while the housing market did grow, it was still a somewhat sluggish quarter as rapid growth in California faltered, combined with low installations in Hawaii and Puerto Rico, which continue to be impacted by stimulus changes.”

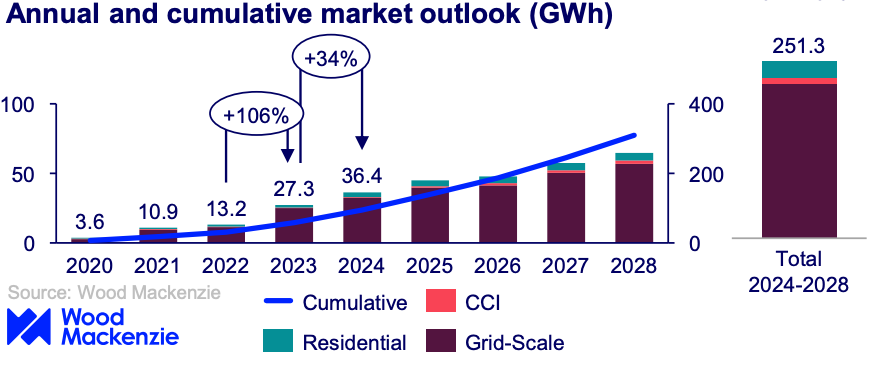

According to Wood Mackenzie’s five-year outlook for the US energy storage market, total US storage deployment will grow 42% between 2023 and 2024, but capacity additions will level off as deployment increases, with an average annual growth rate of 7.6% between 2025 and 2028. Across all segments, the industry is expected to deploy 12.8 GW/36.9 GWh in 2024.

The grid-scale segment is expected to grow 32% year-on-year, with 11 GW/32.7 GWh deployed by year-end, and 62 GW cumulatively between 2024 and 2028. Over the next five years, 12 GW of distributed storage is used. The residential segment will account for 80% of distributed electricity capacity installations, with 10 GW of storage capacity between 2024 and 2028. The CCI segment is expected to install 2.5 GW of storage between 2024 and 2028, a modest reduction from previous forecasts.

“Growth levels off in 2025 and 2026 as project capacity is shifted to later years of the forecast, largely due to early-stage development issues,” Witte said. “The CCI segment continues to experience high growth barriers, including the complexity of developing these projects and the limited availability of financial value streams.”