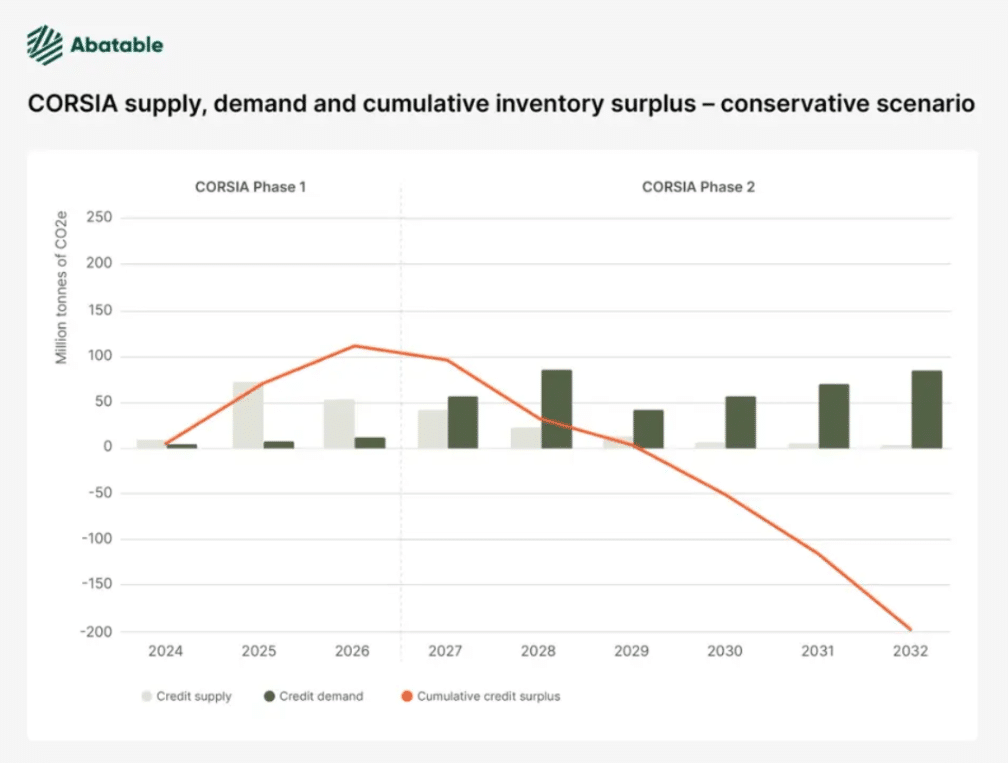

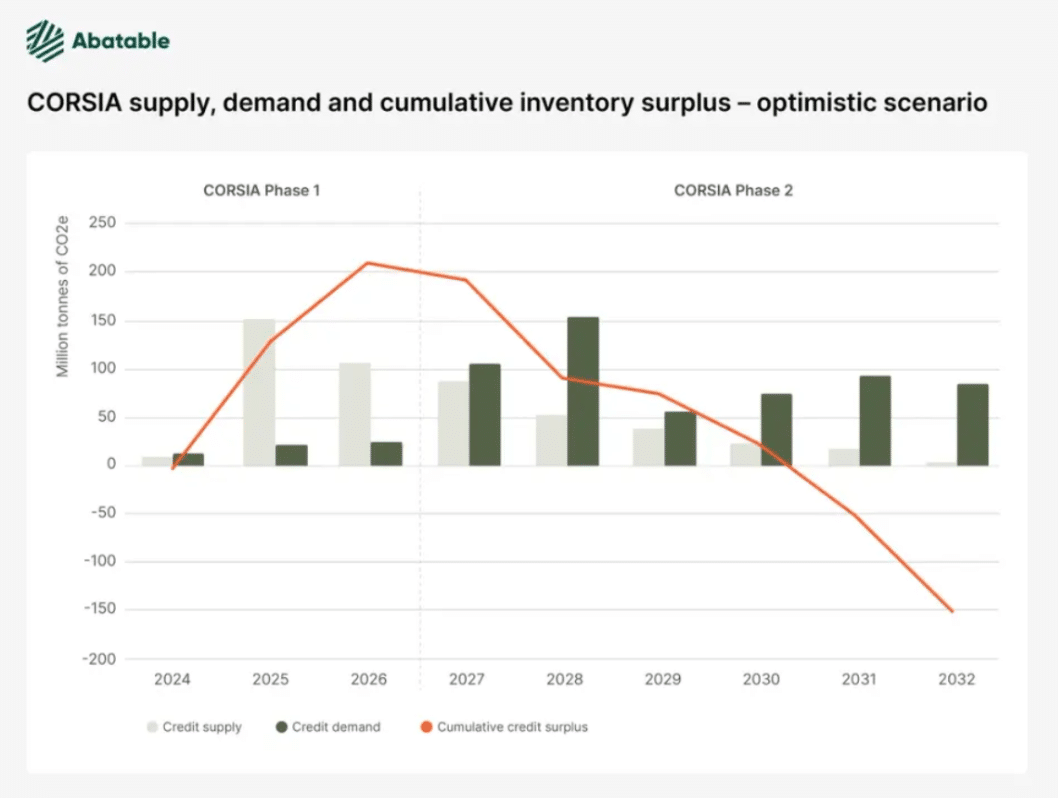

According to an analysis by Abatable, the surplus of CORSIA-eligible carbon credits is expected to turn negative by 2030 unless new supplies become available.

Currently, the aviation sector contributes approximately 3% of global emissions. As a sector that is difficult to decarbonise, it is exploring immediate, low-carbon technology solutions such as sustainable aviation fuel (SAF) and electrification. However, these solutions face cost and technology hurdles and it will take some time before they become widespread.

The challenge of decarbonizing aviation

To limit emissions in the meantime, the International Civil Aviation Organization (ICAO) launched the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) in 2016. CORSIA aims to offset any growth in aviation emissions above 85% of 2019 levels.

CORSIA entered its first phase in January this year, after a pilot period from 2021 to 2023. Phase 1, which runs from 2024 to 2026, is voluntary for participating states, while phase 2 will be mandatory from 2027.

- To comply, airlines can purchase SAF, improve fleet efficiency or purchase CORSIA-eligible carbon credits.

However, the rollout was a challenge. In March, major carbon credit issuers Verra, Gold Standard and Climate Action Reserve (CAR) were only conditionally approved by the ICAO Technical Advisory Organization. This status will be reviewed in September following a resubmission process completed in April 2024.

Currently, CORSIA Phase 1 credits can only be obtained through the American Carbon Registry (ACR) and ART TREES standards. Additionally, CORSIA credits require letters of authorization from host countries, further limiting supply.

Currently, the only recent issuance eligible for the scheme is 7.1 million Guyana ART credits. The decision of the ICAO Technical Advisory Body shows that this limited supply situation may continue into 2024.

Demand will exceed supply in 2030

Abatable’s analysis shows that, under current market conditions and without new supply, demand for CORSIA credits will exceed supply in 2030. In phase 2 of the program, demand is expected to exceed supply between 2029 and 2030.

In a conservative scenario, CORSIA demand will only exceed 100 million credits after 2034. However, supply will peak in 2025 and can only meet demand until 2029. Without new projects, demand in Phase 2 could exceed supply by 14x.

In an optimistic scenario, aviation emissions will return to 85% of 2019 levels this year, with CORSIA demand exceeding 100 million carbon credits in 2027. Supply, supported by projects likely to undergo corresponding adjustments, will meet demand until 2030. Without new projects, demand in Phase 2 could be 7x greater than supply.

Abatable’s projections include existing projects that are expected to meet the Integrity Council for the Voluntary Carbon Market’s Core Carbon Principles and are likely to receive corresponding adjustments. Supply from Verra, Gold Standard and CAR is expected from 2025.

CORSIA’s design aligns with Article 6 of the Paris Agreement, which allows countries to trade emissions reductions to meet Nationally Determined Contributions (NDCs). Corresponding adjustments ensure accurate progress toward NDCs and avoid double counting. These adjustments are necessary for CORSIA credits, allowing them to be transferred internationally.

However, delays in the implementation of Article 6 mechanisms may impact CORSIA. While details are being developed, projects that receive letters of authorization may be listed on voluntary market registers as Article 6 compliant. Biennial UN reports will confirm national accounting and the application of corresponding adjustments.

A key challenge is liability for the revocation of authorized credits. The ICAO technical advisory body suggests that proponents of standards or projects should accept liability, while standards argue that this should lie with the withdrawing country. COP29 decisions could impact this issue and potentially cause even more delays.

Market reaction and developments

The market is responding to these developments. New commercial structures and carbon insurance products are being developed to reduce risks and encourage trading activity. These products are intended to give market participants confidence and increase liquidity, especially given the current market uncertainties.

So, what’s next for this development in CORSIA carbon credits?

Verra, Gold Standard and CAR have resubmitted their applications, and the Technical Advisory Board will review them again in September 2024. If they fail, new sources of supply will be delayed until 2025, beyond current projections.

To alleviate supply issues, standards must move toward adoption while building capacity to help countries develop market infrastructure and governance for authorizing credits with associated adjustments. Large CORSIA participants could invest in upstream projects, although this would require market insight and time to generate a credit flow and make the necessary adjustments.

Airlines will not be required to purchase credits until Phase 1 is completed in January 2028. However, some airlines may purchase and withdraw credits in advance, based on expected liabilities based on historical emissions data. The final emissions reports and audits will be completed in 2027, showing that the total credits are needed, leading to an increase in the number of credits.

The availability of credits beyond 2027 will depend on decisions by ICAO, Article 6 negotiators and governments, as well as the emergence of new sources of supply. The measures taken in the meantime will be crucial to ensure there are enough carbon credits to meet future demand.

The future of the CORSIA carbon credit market depends on increasing the supply of eligible credits. Abatable’s analysis underlines the need for new projects and corresponding adjustments to meet rising demand by 2030. In the meantime, in pursuing low-carbon technologies, the aviation sector must rely on carbon offsets.