Pexapark, a Swiss renewable intelligence provider, says that Corporate Power Purchase Agreements (PPAs) rose in 2024 on the market for renewable energy renewal of Europe, despite a decrease in the total contracted volumes.

Pexapark said in a new report that business PPAs rose in Europe last year, with an increase of 14% on an annual basis of long -term contracts, despite a general decrease in contracted volumes.

Buyers from the company have revealed this growth, which contributed to an increase of 26% in deal activities, according to the research agency established in Switzerland. It said that the PPA activity of companies became a record high, signed with 316 long-term contracts.

The total contracted volumes, however, fell by 11% compared to 2023, largely as a result of a 59% decrease on PPAs on an utility scale. Volumes of companies fell with a marginal 1%, Pexapark said.

Although the goals of the net-noise remain an important motivation of demand, market risks such as price volatility, competition from contracts for difference (CFD) schedules and higher costs are weighted on the appetite of the business risk. Despite these challenges, the market showed resilience, embracing innovative deal structures such as PPAs with mixed technology and battery storage agreements to adapt, according to Pexapark.

In 2024, Pexapark registered a total of 15.2 GW in announced volumes, which represents a decrease of 11% compared to 2023. The most important trend that influenced the total volumes, was the cap in listed utilities, a decrease of 59% years year. According to Pexapark, the disclosure of company collection decreased by only 1%by only 1%.

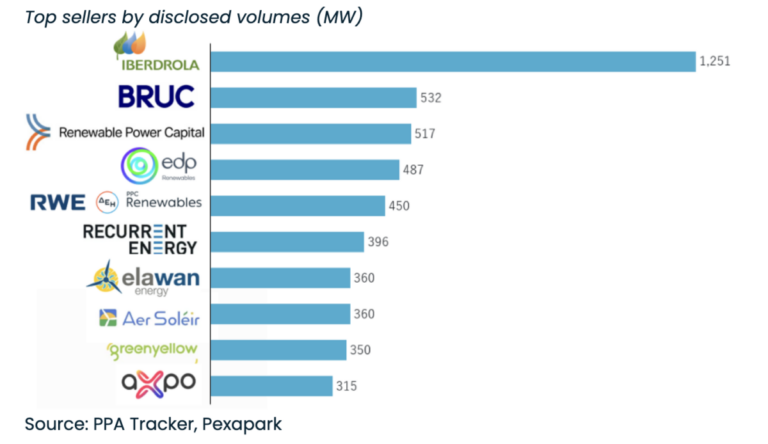

The research agency said that Spain led the European market with 4.66 GW of contracted volume. It was followed by Germany, which registered the highest number of deals, with 48 transactions of a total of 2.04 GW. Iberdrola maintained his position as the best seller, while Amazon was at the top of the list of company buyers with 1.5 GW in six deals.

“In 2024, the PPA market proved the ability to innovate with the new reality of the penetration of increased renewable energy sources, because the challenges of negative prices and cannibalization have forced a reconsideration of traditional approaches,” said Pexapark Cooo Luca Pedretti. “Multi-technology PPAs for firmer profiles, multi-buyer models and innovation in energy storage abnormalities signals strong resilience. By adapting to these new realities, the industry can overcome obstacles and continue the energy transition. “

Last week Pexapark said that it registered 27 European PPAs for 2.09 GW capacity in December 2024, making it the second most -looking month of the calendar year. The month saw an increase of 105% in the revealed volumes and an increase of 50% in deals compared to November 2024.

Earlier this month, Spain announced 820 MW of energy storage projects for applications in the fourth quarter of 2024, including several Van Iberdrola.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.