A Nexamp project in New Jersey.

The American community market of the United States has installed a record -breaking 1.7 GWDC of capacity in 2024, an increase of 35% compared to 2023, according to a New report Released by Wood Mackenzie in collaboration with the Coalition for Community Solar Access (CCSA). With policy uncertainty at both national and national level, however, long -term growth is in balance.

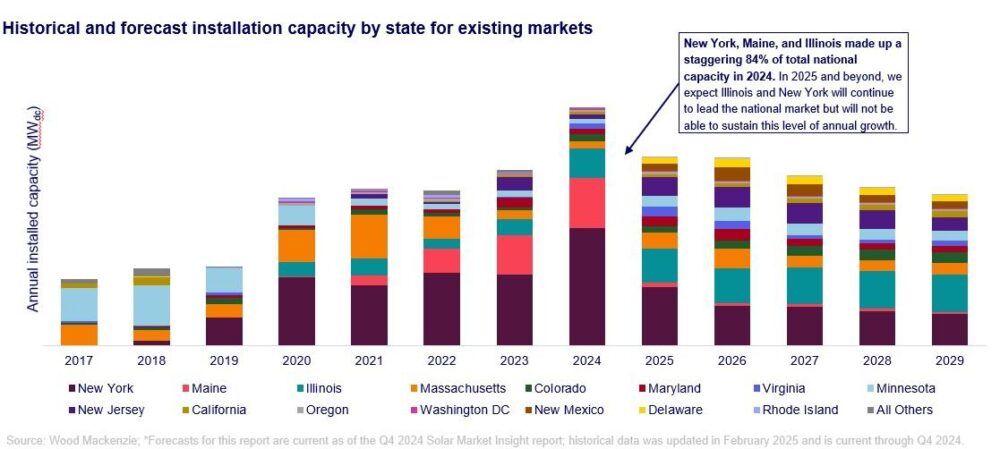

According to the reportLast year’s growth was led by New York, Maine and Illinois. All three States break annual archives and accounted for 83% of the national volumes. Cumulative Community -Zonne -installations now a total of 8.6 GWDC.

“We saw an impressive activity in 2024, which resulted in our strongest year so far for community growth,” said Caitlin Connelly, research analyst and main author of the report. “Despite impressive 2024 installation volumes, however, the top state markets are quickly saturated and will not be able to maintain the same levels of growth in the long term. In addition, emerging markets are slow to rise and limit the program size caps the potential for growth in these states to compensate for falls in larger markets. “

As a result, in the basic case of Wood Mackenzie, the national community growth of the community will contract an average of 8% to 2029 annually, with more than 15 GW being the highlightDC from cumulative community -Zonne -Zonne -Energy installed. Depending on how the policy changes and reforming the interconnection develops, the growth views could, however, vary greatly.

“Although the new American administration has fueled an extreme amount of uncertainty in the American solar sector, material actions have so far resulted in minimal changes in our basic preview,” Connelly said. “In a low case that represents an extremely downward scenario, our five -year prospects, however, contract 40% compared to the basicase. On the other hand, the matters such as usual at the federal level and the rapid improvement of state policy and interconnection -conditions in a high case outlook 37% higher than the basic case. “

Potential new state markets

A boost area can come from new state markets that have proposed legislation for community programs for the community. In the past year, the legislation in Pennsylvania, Ohio, Missouri, Iowa, Georgia, Washington and Wisconsin has progressed beyond ever, which indicates strong two -part support and the potential for new market expansion. Community Solar is also included in important energy plans of the state, such as those of Pennsylvania Lightning Energy PlanStrengthening its value to legislators and supervisors. If everything comes by, new markets for solar energy -state markets in 2029 can stimulate at least 16% by at least 16%.

“While the opposition continues to exist in setting up a new legislative community setup for communities, developers develop their business models and explore new ways for the development of the community,” Substelly said. “These sources are well positioned to play a crucial role in supporting resilience of the network and the increased demand for electricity, since they can be used quickly, can be scaled quickly and can be built with storage in the vicinity of the customer tax. “

LMI customers can expand

Community solar capacity that serve directly with a low to moderate income (LMI) subscribers is concentrated in New York and Massachusetts. The two states combined include 49% of the 1 GWDC of LMI-Serving Community Solar, which emphasizes the constant dependence on state and federal stimuli to increase LMI capacity. In total, LMI subscribers make up 14% of the total community capacity used by the community.

Stricter LMI subscriber requirements in emerging state markets will result in LMI capacity that forms almost 18% of the total community capacity of the community in 2026. Federal uncertainty with regard to the LMI communities Adder and solar energy for all financing could possibly limit the long-term growth of LMI capacity.

Developer and assets -owner signs remain very consolidated

The top five community installers of the community insured 19% of the market in 2024, against 25% in 2023. The competitive landscape for power owners is considerably more exclusive, more dominant and region -specific than that of community installation in the community. The top 10 of the owners of solar energy cases ensured 54% of the capacity installed in 2024 and 40% of the cumulative capacity. Top owners include Nexamp, AES Clean Energy and Nautilus Solar.

“The record-breaking growth of Community Solar in 2024 is a clear sign that the demand for affordable, distributed energy is stronger than ever,” said Jeff Cramer, CCSA president and CEO. “This record growth comes at a time when the demand from the customer and the network to community zoning has never been higher. Barriers to meet this question – such as interconnection tracing and policy romply, however, dozens of gigawatts of new local electricity, dozens of billions of dollars in investments and millions of customers on the sidelines. With the increasing Bipartisan Momentum to take on these challenges, the potential for continuous record growth remains strong. “

News item from Wood Mackenzie