According to the latest report from Wooden Mackenzie and the Coalition for Community Solar Access (CCSA).

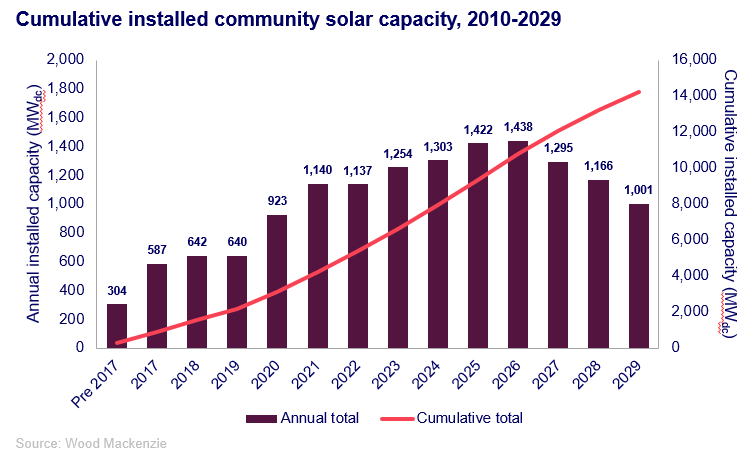

The cumulative solar installations in the national community will reach 14 GW by the same year.

Program pipelines remain strong in mature state markets for now. Wood Mackenzie predicts the national community solar market will grow by an average of 5% per year through 2026 and then shrink by an average of 11% through 2029. Expanded program capacity and the creation of new state markets have the potential to drive further growth beyond 2026.

In a bull case forecast scenario, Wood Mackenzie’s five-year outlook in existing markets increases by 21% compared to the base case, while in a bear case there is a decline of 20%. Alternative scenarios do not take into account the creation of new state markets.

Wood Mackenzie estimates that the introduction of proposed legislation in Ohio, Pennsylvania, Michigan and Wisconsin and four additional potential state markets would result in an increase of at least 17% over the base case. When considering a bull case forecast scenario for existing markets and the successful passage of legislation in all potential markets, the cumulative national outlook reaches 17.1 GW by 2029.

According to the report, 3.6 GW of community solar is expected to serve low- to moderate-income subscribers by 2029. As of the first quarter of this year, Wood Mackenzie estimates that 829 MW of community solar will directly serve LMI subscribers.

“The U.S. community solar market has tripled in size since 2020, but growth has begun to slow in existing state markets,” said Caitlin Connolly, senior research analyst at Wood Mackenzie and lead author of the report.

“Additionally, the May 2024 decision on solar in California resulted in a significant 14% reduction in Wood Mackenzie’s national five-year outlook. Without a major market entrant like California, the long-term growth of community solar will largely depend on the passage of legislation to enable new state markets.”

Additionally, the three largest subscriber management companies manage 56% of total community solar subscribers and 71% of LMI subscribers. LMI subscribers remain the most expensive to acquire, with costs averaging $113 per kilowatt, 27% higher than the average cost for non-LMI residential subscribers. Developers can save costs by outsourcing subscriber acquisition and management to third-party companies, the report said.