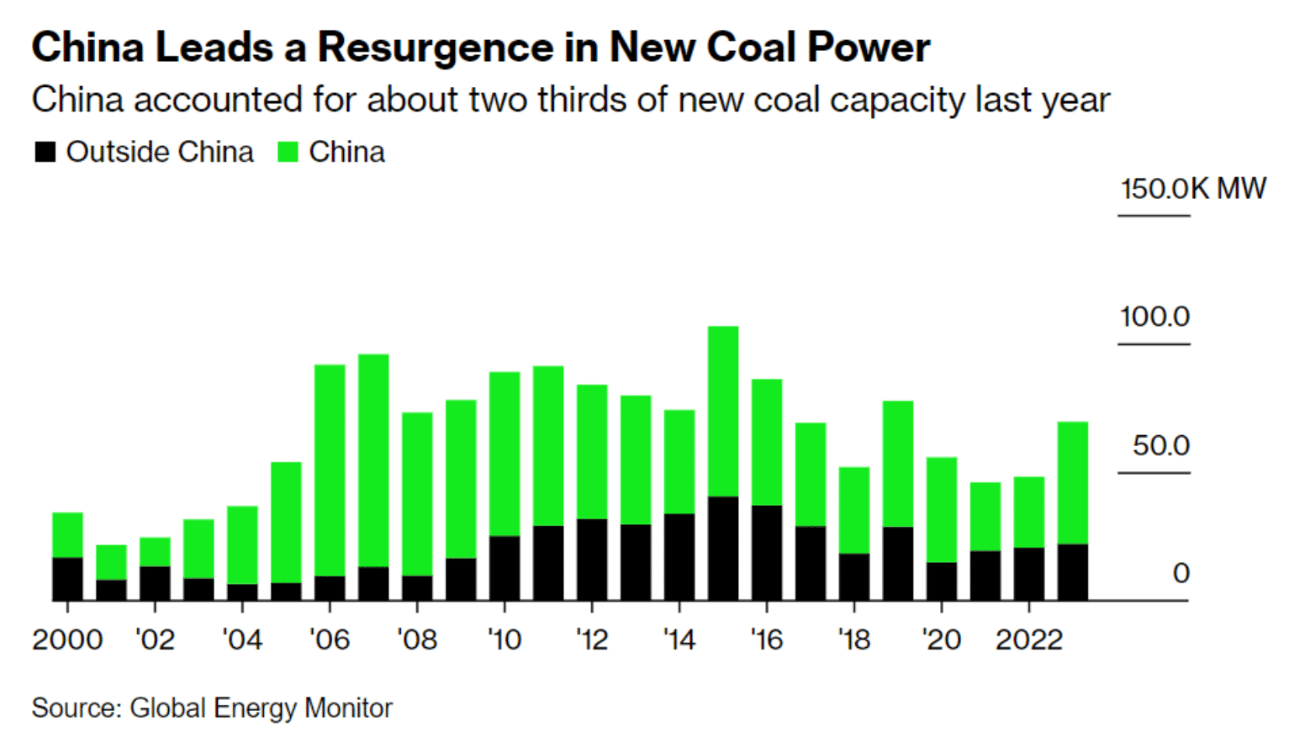

China has set in motion a major development for the global energy landscape and has presided over a massive increase in coal energy capacity, pushing the world total to a record high in 2020, according to a new report from the Global Energy Monitor. This increase was mainly driven by new factories in China, which accounted for about two-thirds of the expansion, with Indonesia and India following closely.

The current state of coal consumption

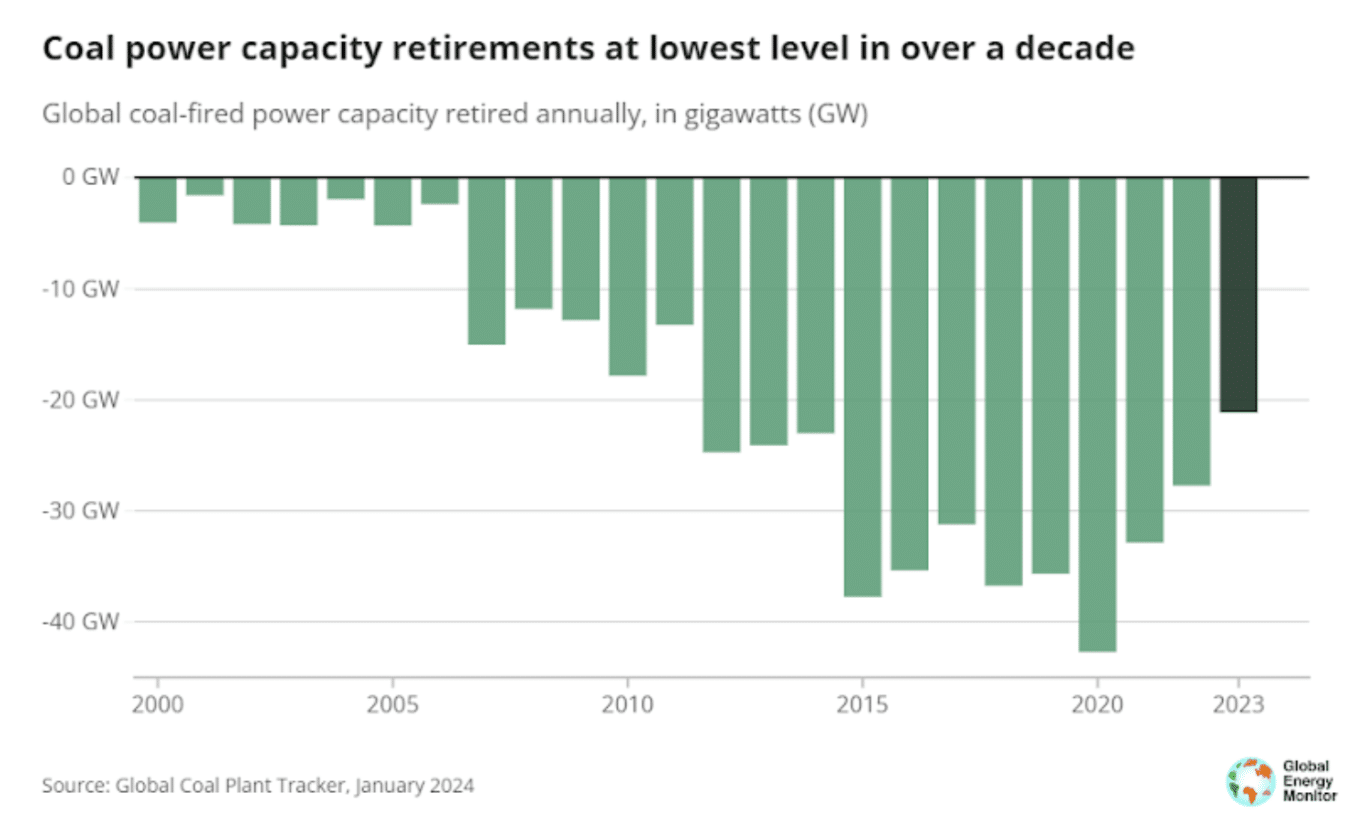

The coal fleet grew by 2% to 2,130 gigawatts, a notable increase driven by a decline in the number of retirees worldwide. This trend has been particularly prominent in China, where the country started building 70 gigawatts of new coal-fired power stations in 2020. That is almost 20 times more than in the rest of the world combined.

The reportentitled “Global Coal Plant Tracker 2021: The world’s 1000 largest coal-fired power stations”, emphasizes the important role that China plays in the global coal market.

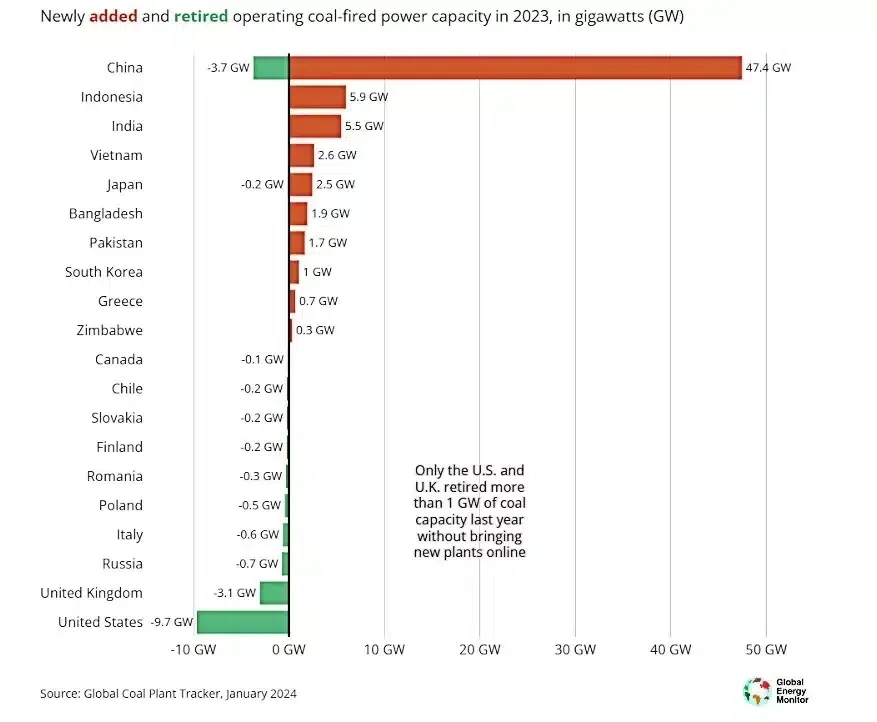

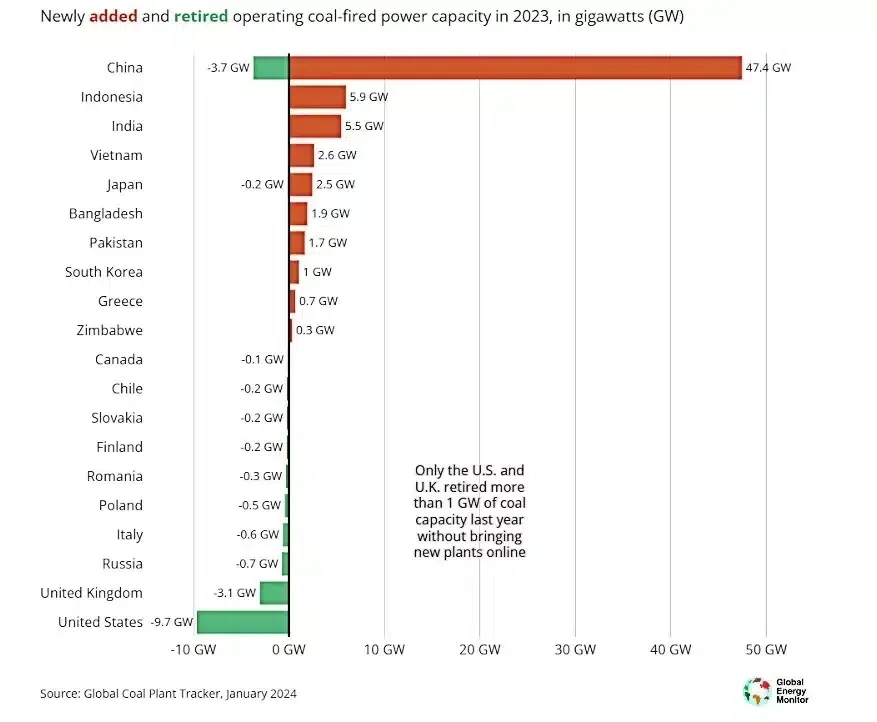

The aggressive expansion of the country’s coal-fired power plants is in stark contrast to the trend of decommissioning coal-fired power plants in many developed countries, such as the United States and the European Union.

The increase in coal energy capacity has significant implications for global energy markets and climate policy initiatives.

According to the Global Energy Monitor, in 2023 about as many countries will have opened new coal-fired power stations as closed units. Yet overall, more capacity is being added than withdrawn.

Here are 8 key points from the coal report:

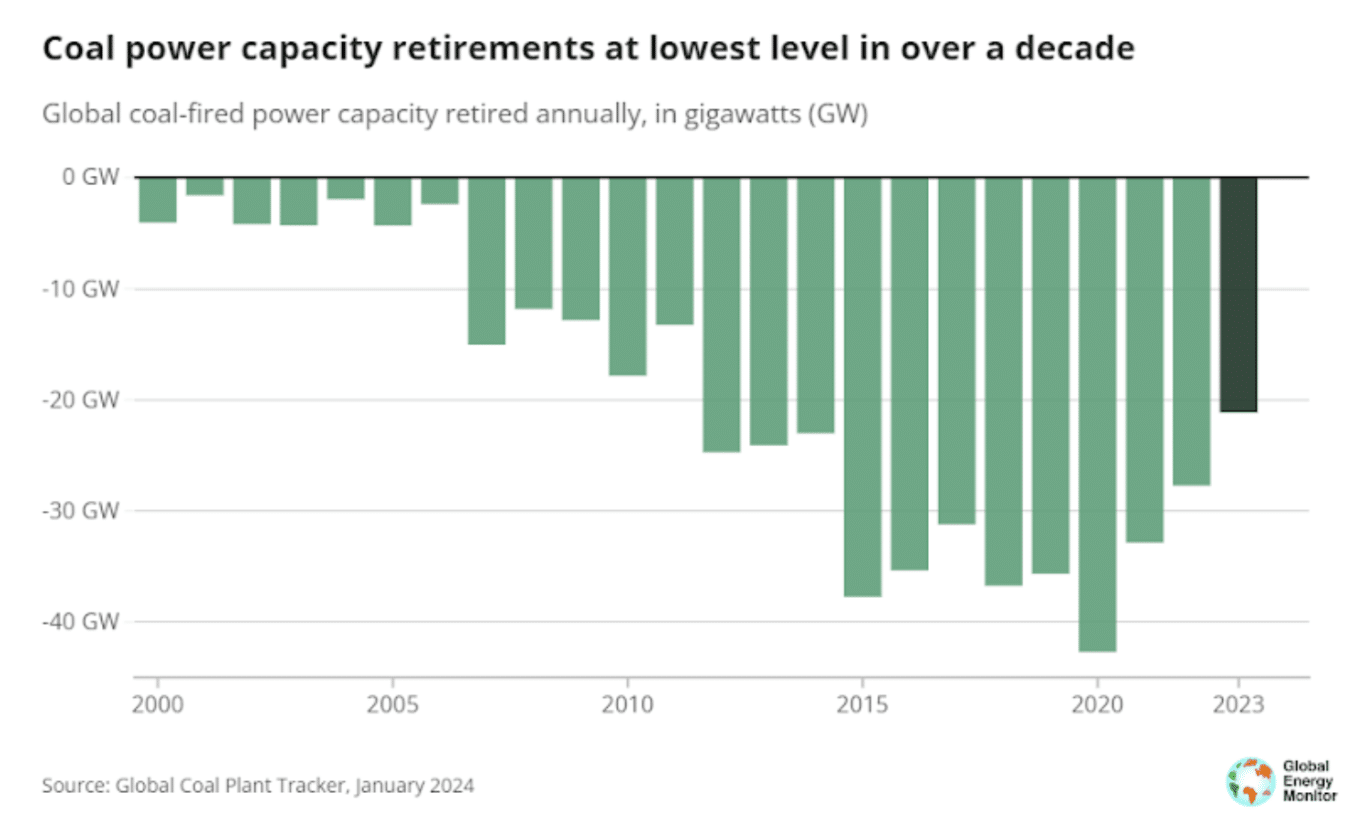

- Global operational coal capacity grew by 2% in 2023with China accounting for two-thirds of the new additions. However, this accelerated growth in coal capacity may be short-lived as the low 2023 pension rates, which have contributed to coal’s rise, are expected to accelerate in the coming years. USA and Europewhich compensates for the blip.

- The increased capacity additions will also be tempered if China takes immediate action to ensure it meets its target of closing 30 gigawatts (GW) of coal capacity by 2025. Countries where coal-fired power stations are being retired must do so more quickly, and countries with plans for new coal-fired power stations must ensure they are never built.

- Otherwise, it will be difficult to achieve the goals of the Paris Agreement and reap the benefits of a rapid transition to clean energy. Coal’s fortunes this year are an anomaly, as all signs indicate that this accelerated expansion will change course.

RELEVANT: Global team develops world’s first ‘Coal-to-Clean’ Carbon Credit Program

- Data for the report comes from GEM’s Global Coal Plant Tracker, an online database updated biannually that identifies and maps every known coal-fired generating unit and every new unit proposed since January 1, 2010 (30 MW and larger) brings. This data serves as a vital international reference point used by organizations including the IPCC, IEA and the UN.

- According to the IEA, global coal demand is expected to decline by 2.3% in 2026 compared to 2023 levels. And that’s even without stronger clean energy and climate policies. This decline is driven by the major expansion of renewable energy capacity that will come online in the three years to 2026.

- More than half of global renewable capacity expansion is expected to take place in China, which currently accounts for more than half of global coal demand. As a result, China’s coal demand is expected to decline in 2024 and stagnate in 2026.

- The shift in coal demand and production to Asia is accelerating; China, India and Southeast Asia are expected to account for three-quarters of global consumption by 2023, compared to only about a quarter in 1990. Consumption in Southeast Asia is expected to increase. exceed those of the US and the EU in 2023.

- It is expected that the three largest coal producers in the world – Indonesia, China and India – will also do this breaking production records in 2023, pushing global production to a new high. However, to reduce emissions at a pace consistent with the goals of the Paris Agreement, relentless coal consumption would have to fall much faster.

China’s crucial role and the shift in coal’s global leadership

The growth of China’s coal capacity underlines China’s focus on meeting energy needs for economic and industrial expansion, despite global efforts to reduce greenhouse gas emissions. The trade-off between increasing coal capacity and the shift to cleaner energy will significantly impact the global energy scenario.

The role of China and other key players in this process will be critical in determining the pace and scope of the shift to a more sustainable energy future.

The report further highlights a significant shift in global leadership on coal policy, especially within the G7 and G20 countries. The G7 countries, which accounted for 23% of global coal capacity in 2015, have reduced their share to 15% by 2023.

The reduction is underlined by the completion of new units in Japan. This marks the end of coal construction within the G7, although proposals still exist in Japan and the US

Meanwhile, the G20 countries own 92% of global coal capacity, with Brazil, the current G20 chairman, witnessing a decline in pre-construction capacity, leaving only two projects in Latin America.

This geographic shift in coal policy and projects underlines a broader global trend to reduce dependence on coal. Moreover, it will be significant consequences for international energy markets and climate policy initiatives.

Coal-fired power plant proposals and retirements

The dynamics of coal plant proposals and retirements provide a nuanced view of the future of the global coal industry. In 2023, while 69.5 GW of coal energy capacity was added, only 21.1 GW was retired, leading to a net increase in global coal capacity.

This trend is particularly pronounced outside China, where new proposals totaled 20.9 GW, led by countries such as India, Kazakhstan and Indonesia.

Despite a general trend towards dismantling, these developments certainly point to a complex global landscape regions continue to explore new coal projects.

This ongoing activity suggests that while global momentum is toward reducing dependence on coal, achieving this goal will require joint efforts from all countries, especially those with significant new proposals..