In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

FOB Chinese market

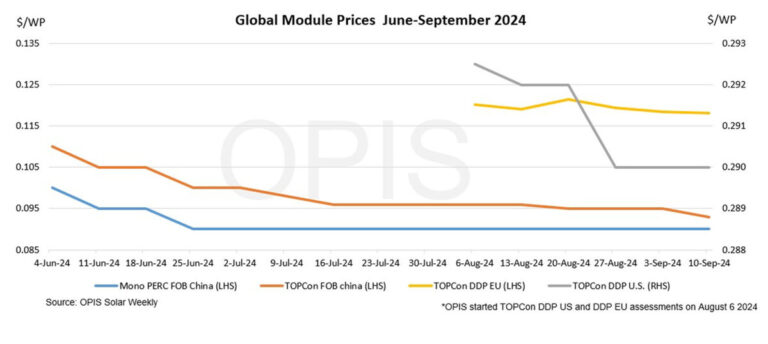

The Chinese Module Marker (CMM), the OPIS benchmark rating for TOPCon modules from China, was assessed at $0.093/W Free-On-Board (FOB) China, down $0.002/W week over week due to the hearing buying and selling indications. The majority of tradable indications were heard at $0.090-0.095/W FOB China. There were also TOPCon offers for $0.085-0.088/W from the Top 10 module manufacturers circulating in the market.

Market sentiment was bearish. Despite price pressure from the upstream polysilicon and wafer segment, overcapacity would limit any possible price increase in the cell and module segment, an industry source said. Domestic prices of mono-grade polysilicon from China rose 1.89% week-on-week to CNY33.625 ($4.74)/kg, while mono PERC M10 wafers rose 2.13% to CNY0 in the same period ,144/piece. Amid intense competition among module sellers and pressure to clear inventories, module prices would continue to weaken towards the end of the year, the source added.

The price difference between Mono PERC and TOPCon modules has narrowed due to the reduced supply of Mono PERC modules and the lower production costs of TOPCcon modules. Prices of Mono PERC and TOPCon modules are expected to converge in the coming weeks, an industry source said. OPIS estimated Mono PERC module prices in the week through Tuesday at $0.09/W FOB China.

Europe

In Europe, TOPCon module prices remained stable at €0.107 ($0.118)/W, despite a wider range of indications ranging from a low of €0.090/W to a high of €0.122/W. On the freight side, freight rates for Asia and Northern Europe fell another 2% to $7,770 per forty-foot equivalent unit (FEU). This corresponds to $0.0184/W.

Market sources do not expect DDP EU prices to change in the near future. Currently, there is abundant production capacity and every manufacturer wants to deliver even at extremely low margins, market players said.

In terms of European policy, the European Commission presented its long-awaited competitiveness report on September 9. The report calls for a radical change in industrial policy with increased defensive trade measures and an accelerated legislative process by ending individual countries’ veto powers during council votes.

United States

The spot price for US-delivered, duty-paid (DDP) TOPCon modules remained unchanged week over week. The spot price of the TOPCon module was immediately estimated at $0.290/W, and delivery in the first quarter of 2025 remained at $0.301/W. Mono-PERC delivery in the first quarter was estimated flat at $0.291/W, and delivery loads in the second and third quarters of 2025 were unchanged at $0.294/W.

On the policy front, U.S. trade officials have again delayed announcing their final decisions in the event of tariff increases under Article 301, which would double tariffs on Chinese solar cells to 50%, a move seen by some as largely symbolic. as the vast majority of imported solar products now come from Vietnam, Malaysia, Thailand and Cambodia. Customs and Border Protection has increased its arrests of shipments, and not just from Indian manufacturers trying to penetrate the U.S. market. Maxeon reported last week that all its shipments from Mexico to the US have been halted since July, with no clear timing for their release.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content