In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

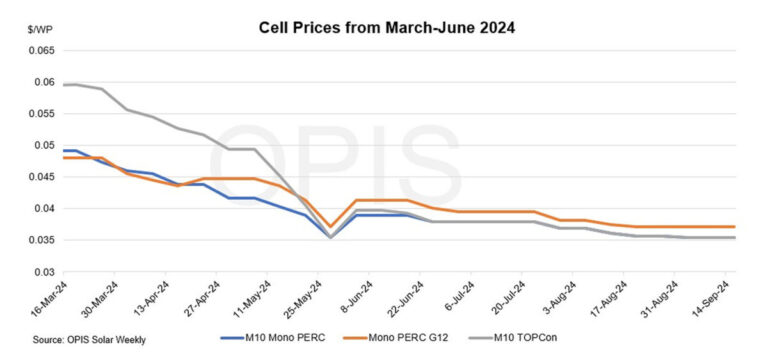

Cell prices were considered stable in the week through Tuesday as the Chinese market remained closed from September 15 to 17 for the Mid-Autumn Festival. Prices for FOB China Mono PERC M10 cells and TOPCon M10 cells remained stable at $0.0354/W, while prices for FOB China Mono PERC G12 cells were assessed unchanged from week to week at $0.0372/W on default of trading activity.

Demand was sluggish as market participants were sidelined by the holidays. Recent price declines in the mobile segment, amid uncertainty about when this downward trend would end, also dampened sentiment. Prices for M10 PERC cells have fallen 21.68% since January this year, while prices for M10 TOPCon cells have fallen 39.4% in the same period through Tuesday, OPIS data shows.

A further reduction in cell prices would result in cell manufacturers closing their production lines because current cell prices were below production costs. On the other hand, some market participants expect a slight increase in cell prices after the holidays as cell makers have been considering price hikes in recent weeks amid slight gains in the upstream wafer segment.

Prices were stable in the domestic Chinese market. Mono PERC M10 and TOPCon M10 were assessed unchanged from week to week at CNY 0.290 ($0.041)/W, while Mono PERC G12 prices remained flat at CNY 0.300/W from the previous week.

China exported about 4.65 GW of solar cells in July, most of which went to India, an industry source said.

Outside China, India’s Ministry of New and Renewable Energy (MNRE) is seeking feedback on draft guidelines for an approved model and manufacturer list (ALMM) specifically for solar cells, with a target of implementation by April 1, 2026, according to a memorandum issued September 7.

The memorandum stated that all projects under the purview of ALMM must source their photovoltaic modules from models and manufacturers included in the ALMM List-I for solar PV modules. These modules in turn must use solar PV cells from models and manufacturers in the ALMM List-II for solar PV cells.

US trade officials on Friday set new Section 301 tariffs of 50% on cells, whether assembled in modules or not, from China. These will come into effect on September 27. More interestingly, in the same message, the USTR proposed that the same tariff would apply to polysilicon and wafers from China. This would push Chinese companies to completely rethink their supply chains. The proposal on polysilicon and wafers will be subject to a public comment period, the details of which will be communicated separately.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content