In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

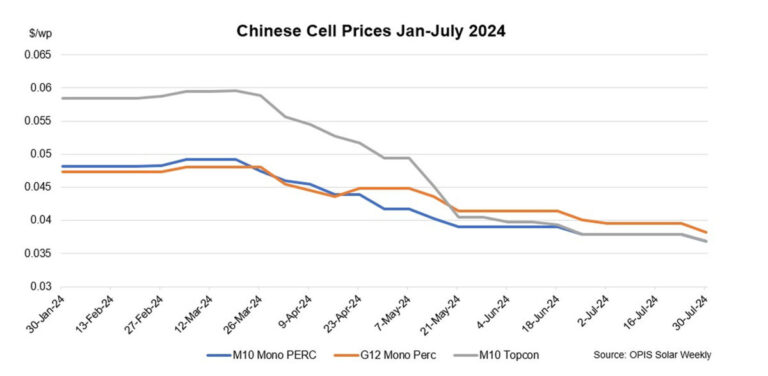

Prices in the Chinese mobile market were assessed lower from week to week due to buy-sell indications. Prices for FOB China Mono PERC M10 cells and TOPCon M10 cells were down 3.29% week-on-week at $0.0369/WW, while prices for FOB China Mono PERC G12 cells were down 3.29 % lower were rated at $0.0382/W.

Market activity remained quiet as the majority of market participants remained on the sidelines and adopted a wait-and-see attitude. While prices had already bottomed out, falling 59-63% year-on-year on July 30, expectations of further price declines kept most buyers away from the market, according to OPIS data.

In the domestic market, some sellers had lowered the prices of Mono PERC M10 and TOPCon M10 to CNY 0.29 ($0.040)/W, while others kept prices stable at CNY 0.30/W. The prices of Mono PERC M10 and TOPCon M10 cells were estimated at CNY 0.298/W, down 2.3% week on week. Mono PERC G12 prices were 3.1% lower at CNY0.308/W.

China produced a total of 310 GW of cells in the first half of 2024, up 37.8% year-on-year, despite attempts by cell manufacturers to reduce cell production in June and July in an effort to limit market oversupply.

Although cell exports rose 26.2% to 142.16 GW over the same period, sales prices achieved were much lower compared to a year ago, resulting in tighter margins for cell makers, an industry source said. The sector is experiencing a phase of persistent low prices across the solar value chain and if this continues for a long time, the sector could be heading towards consolidation faster than expected.

Meanwhile, cell manufacturers continue to reduce production in an attempt to restore the balance between supply and demand in the market. China’s cell production is expected to reach 49-51 GW in July, up from 53 GW in June, according to the Silicon Industry of China Nonferrous Metals Industry Association.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired price data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content