In a new weekly update for PV -MagazineOpis, a Dow Jones company, offers a quick look at the most important trends in the global PV industry.

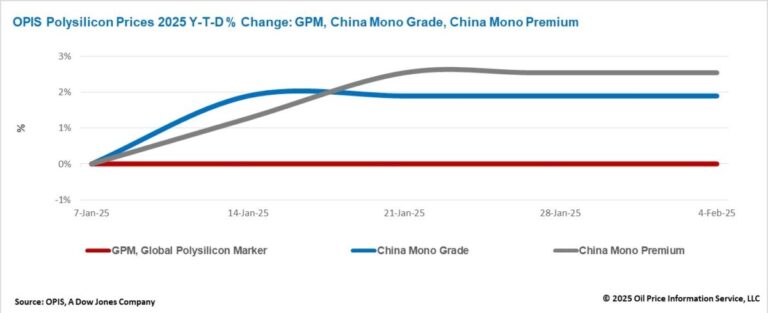

The Global Polysilicon Marker (GPM), the OPIS -Benchmark for Polysilicon outside China, was rated this week at $ 20,360/kg, or $ 0.046/W, unchanged from the previous week of unchanged market fundamentals.

The global polysilicon market remains modest, without significant shifts in supply or supply. WAFER production speeds in Southeast Asia, the primary import market, show no signs of growth and uncertainty about international trade policy suggests that a short-term repair in the worldwide demand of Polysilicon is unlikely.

The stakeholders in this market are closely referring to potentially American trade policy that can promote non-Chinese products, thereby strengthening the global demand for polysilicium, because the profitability of global polysilicon manufacturers is complicated to the evolving landscape of international trade policy.

This trend gradually unfolds. On 1 February, US President Donald Trump announced a rate increase of 10% on all exports from China, which will take effect on 4 February. This policy relates to solar products throughout the supply chain. Although it does not directly stimulate the demand for global polysilicon, it indicates an increasing limitation of products containing Chinese content, which could ultimately support the global demand of Polysilicon.

The China Mono Grade, the assessment of opis for polysilicon prices of mono-quality in the country, remained stable this week on CNY 33.625 ($ 4.61)/kg, equal to CNY 0.076/W. Likewise, the China Mono Premium, the price assessment of OPIS for mono-grade polysilicon used for the N-type Ingot production, stable on CNY 40.375/KG, or CNY 0.091/W. Both prices remained unchanged compared to the last week because of the closure of the Chinese market for the New Year’s holidays of the Moon.

In January, the China Mono Premium price rose three consecutive weeks prior to the New Year’s Eve holidays, with market discussions that focus on two important concerns: the duration of low company rates at Polysilicon producers and the sustainability of the price rebound observed before the holiday.

Most Chinese polysilicon producers continued to work with reduced rates. Apart from a FBR manufacturer of a detailed polysilicon, which maintained a company interest of 70% as a result of a relatively low stock pressure, Siemens operated polysilicon manufacturers with an average percentage of 30% to 40%.

However, some market participants warned that the recent price rebound could cause misleading signals, so that manufacturers may resolve production prematurely, which could shorten the duration of the price repair.

According to data from the China Non -Ferrous Metals Industry Association (CSIA), the Chinese Input of Polysilicon in 2024 in 2024 was 39,800 MT, while the export reached 40,000 MT, which was marked the first time in history that the import has exceeded. This growth of the export of polysilicon was reportedly partially powered by the continuous input of certain modules made from traceability-compliant Chinese polysilicon on the American market.

If this trade flow continues, the participants in industry expect that the Chinese Polysilicon export will continue to grow over the next two years, in particular because the production capacity of the new Wafer will be announced in regions such as India, Indonesia and the Central East.

Opis, a Dow Jones company, offers energy prices, news, data and analysis of gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmental products. It acquired price determination of data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content